The Insider Review | June 2022

A monthly summary of notable insider trading activities from Verity’s Director of Research.

In Brief

- Insider sentiment was very positive in May; will it continue in June?

- Discussing “Data Pillars” this week.

- Media highlights: insider buying and selling.

Macro: Next Few Weeks Will Be Extremely Important

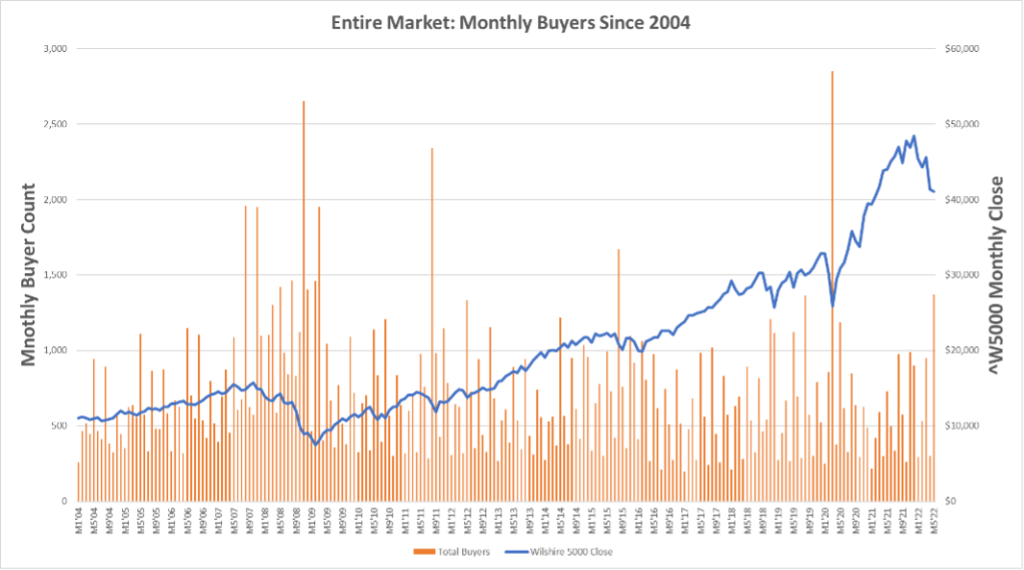

May 2022 has gone down in the books as one of the most positive months for insider sentiment on record, a sign that many U.S. insiders believe stocks are oversold and undervalued.

The breadth of buying didn’t compare to other periods when the market fell sharply and insiders rushed in to buy. (See: November 2008 False Bottom, March 2009 Great Financial Crisis Bottom, August 2011 U.S. Debt Downgrade Bottom, March 2020 Pandemic Bottom.) But we’re seeing very encouraging behavior.

Right now, the conviction isn’t as strong as when insiders as a group made incredibly well-timed bottom calls in the past. So the next few weeks ahead of end-of-quarter trading window closures will be extremely important.

May 2022 By the Numbers

Sourced from VerityData | InsiderScore, which reaches back to January 2004.

Getting Granular

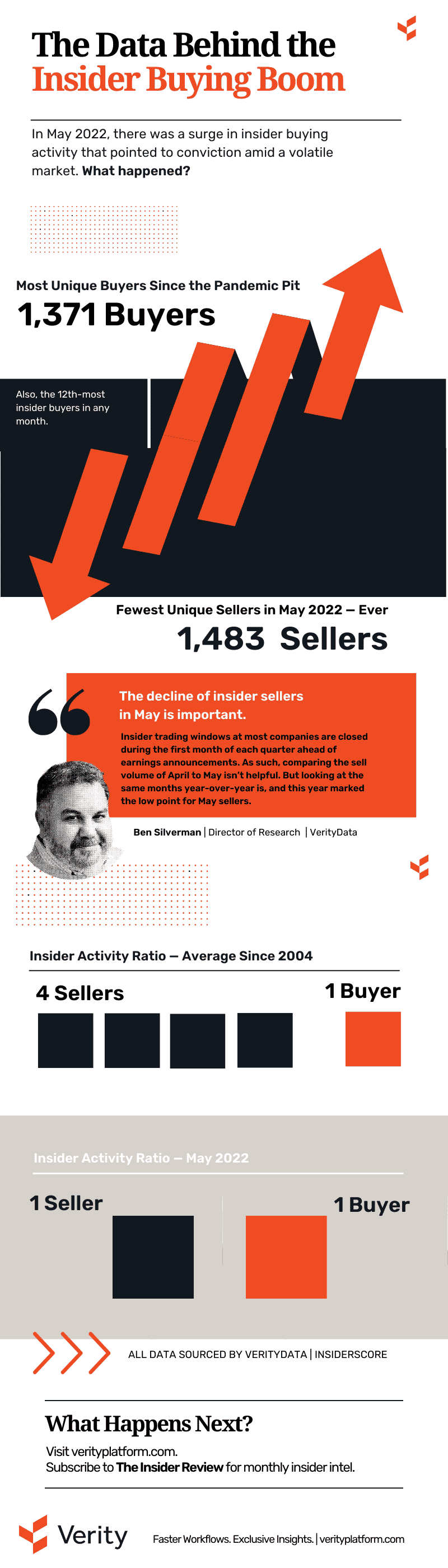

- 1,371 unique insider buyers: The 12th most any month and the most since the Pandemic Pit of March 2020.

- 1.08-to-1.0 sellers-to-buyers ratio: The 8th best ratio and the best since March 2020. The average ratio since January 2004 is 3.56-to-1.0. Buyers have only outnumbered sellers seven times.

- 1,483 unique sellers: The fewest number of unique sellers in May ever. This is important because there’s a seasonal aspect to insider buying and selling related to insider trading windows at most companies being closed during the first month of each quarter ahead of earnings announcements. As such, comparing the sell volume of April to May isn’t helpful. But looking at the same months year-over-year is, and this year marked the low point for May sellers. The second least active May for sellers was in 2009, as the market was in the initial stages of a recovery from the Great Financial Crisis low.

- 607 buyers at Russell 2000 companies: The 3rd most ever behind the 652 buyers in August 2011 and the 1,388 in March 2020.

- 1.01-to-1.0 sellers-to-buyer ratio in the Russell 2000: The 10th best ratio ever and best since March 2020. There were only nine more sellers than buyer in May.

- 68 buyers at S&P 500 companies: The 20th most ever and the highest number since March 2020.

- 5.79-to-1.0 sellers-to-buyer ratio in the S&P 500: The 17th best ratio ever. This compares to the average ratio of 16.20-to-1.0 since January 2004.

Data Spotlight: Data Pillars

I’m excited to be part of a panel discussion on data pillars and how fund managers can leverage data to improve alpha generation. Join the conversation with us on June 8 by registering here for free.

Among the topics that we will discuss:

- Data integrity — addressing key challenges surrounding data cleansing and potential avenues to acquiring third party data to complement existing data sets.

- Data structures — how to can fund managers structure data to create greater efficiency; parsed and visualized, to provide focus.

- How can data support the decision-making process? How can data be used to develop and influence investment ideas??

Insider Buying & Selling in the Media

The media took notice of what insiders were doing in May and we weighed in with data commentary. I spoke to CNBC’s Fast Money mid-month to discuss the then emerging insider buying trend and as the month was closing, CNBC’s Robert Frank highlighted VerityData in his report for Squawk Box. Meanwhile, MarketWatch’s Nathan Vardi used our SPAC and IPO databases cross-referenced with our insider selling data for this piece on the wave of insider selling that accompanied high-profile and now-busted tech IPOs from 2021.

About the Data

Data included in this report is sourced by VerityData’s comprehensive databases of insider trades, buybacks, at-the-market offerings, management changes, institutional investor disclosures, and more.

For access, request a free trial of VerityData >>

For data inquiries relevant to this report, contact Ben Silverman.

Outperformance Starts Here

See how Verity accelerates winning investment decisions for the world's leading asset managers.

Request a Demo