Who We Serve

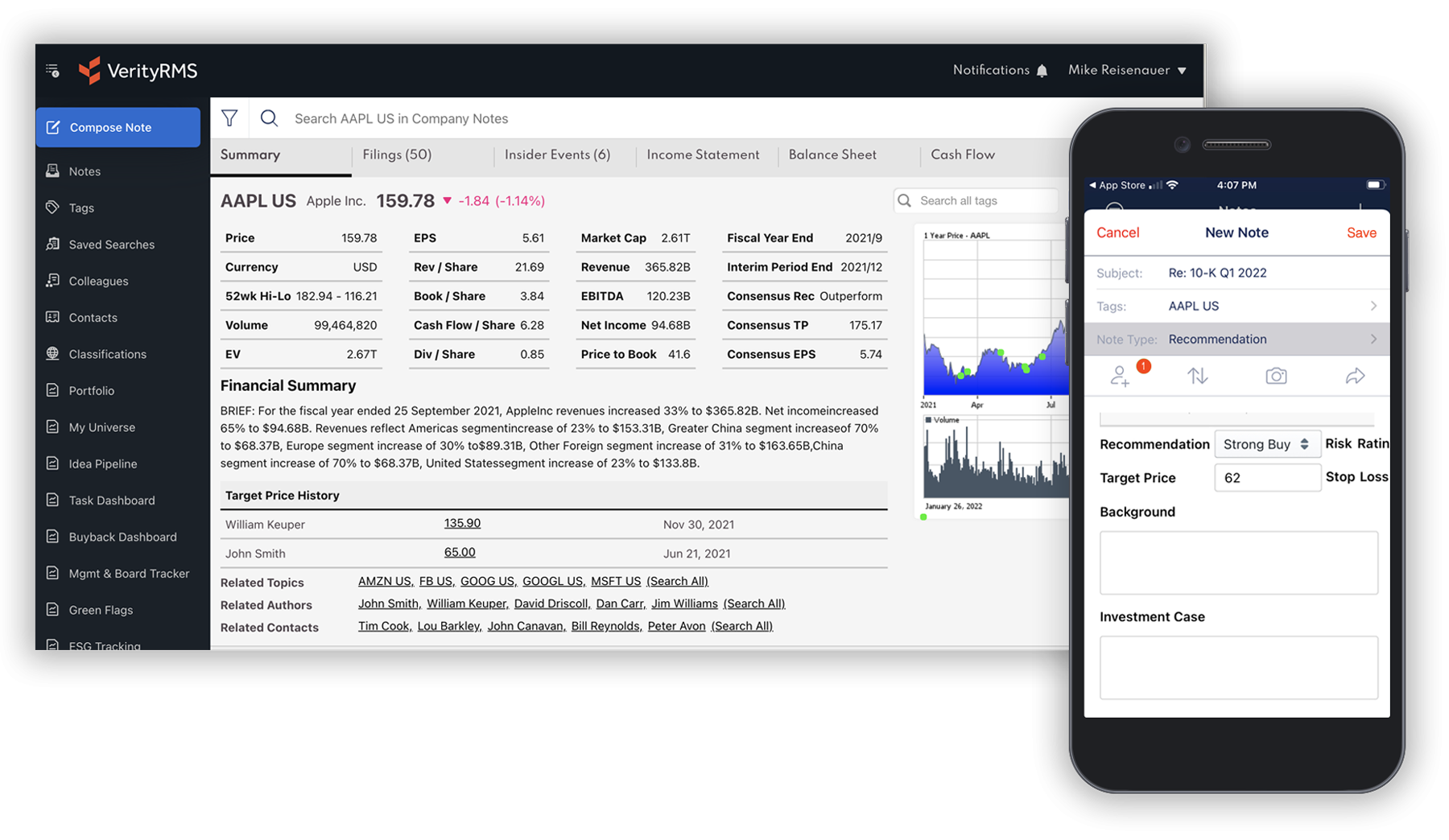

Verity helps direct investment firms reduce inefficiency and risk with high-performance investment software and data. From startups to global multi-strategy funds. Whether public equity, fixed income, private equity, or a hybrid model.

Public Equity

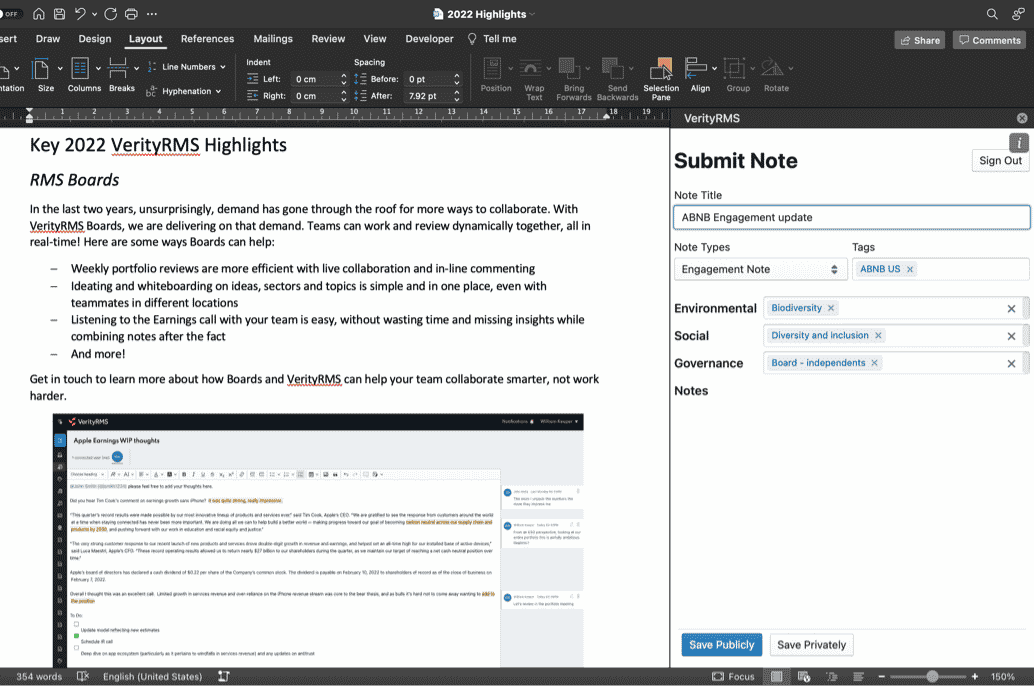

Investment research teams at the world's leading asset managers rely on the full-suite of Verity solutions to improve productivity and accelerate fund performance.

Products: VerityRMS, VerityESG, VerityData

-

Generate differentiated ideas

-

Monitor portfolios

-

Speed research workflows

-

Automate compliance & reporting

-

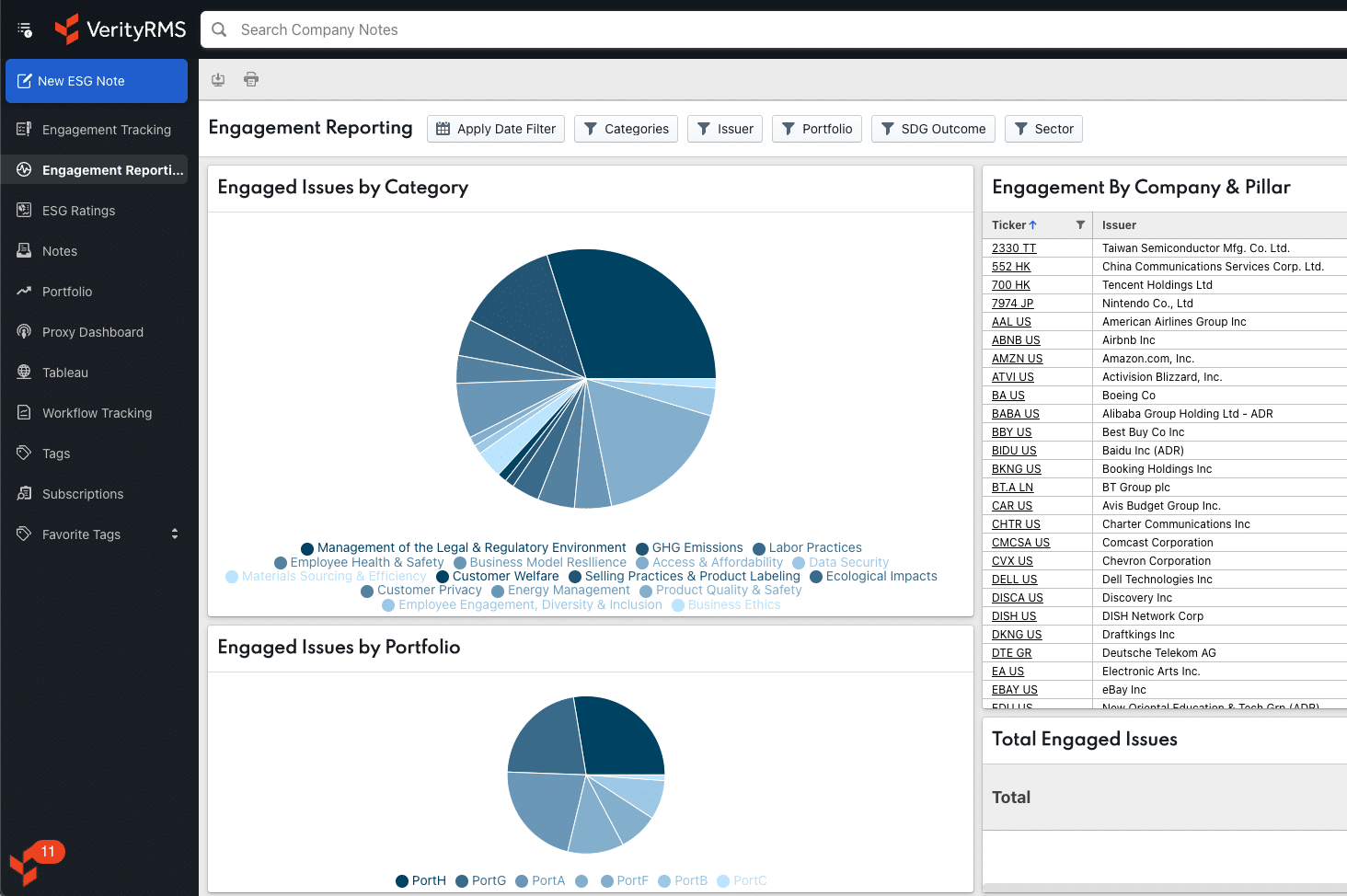

Track ESG engagements

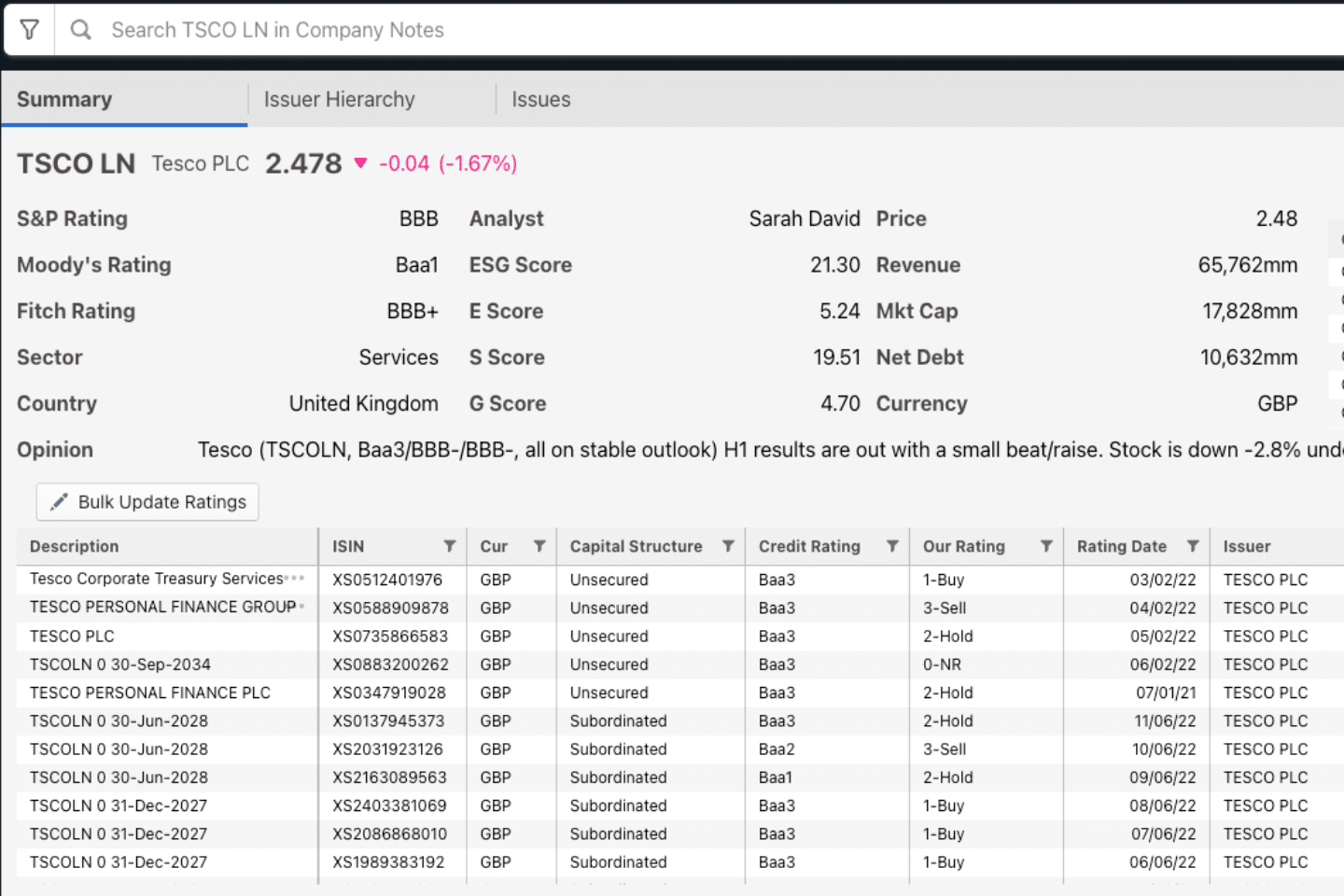

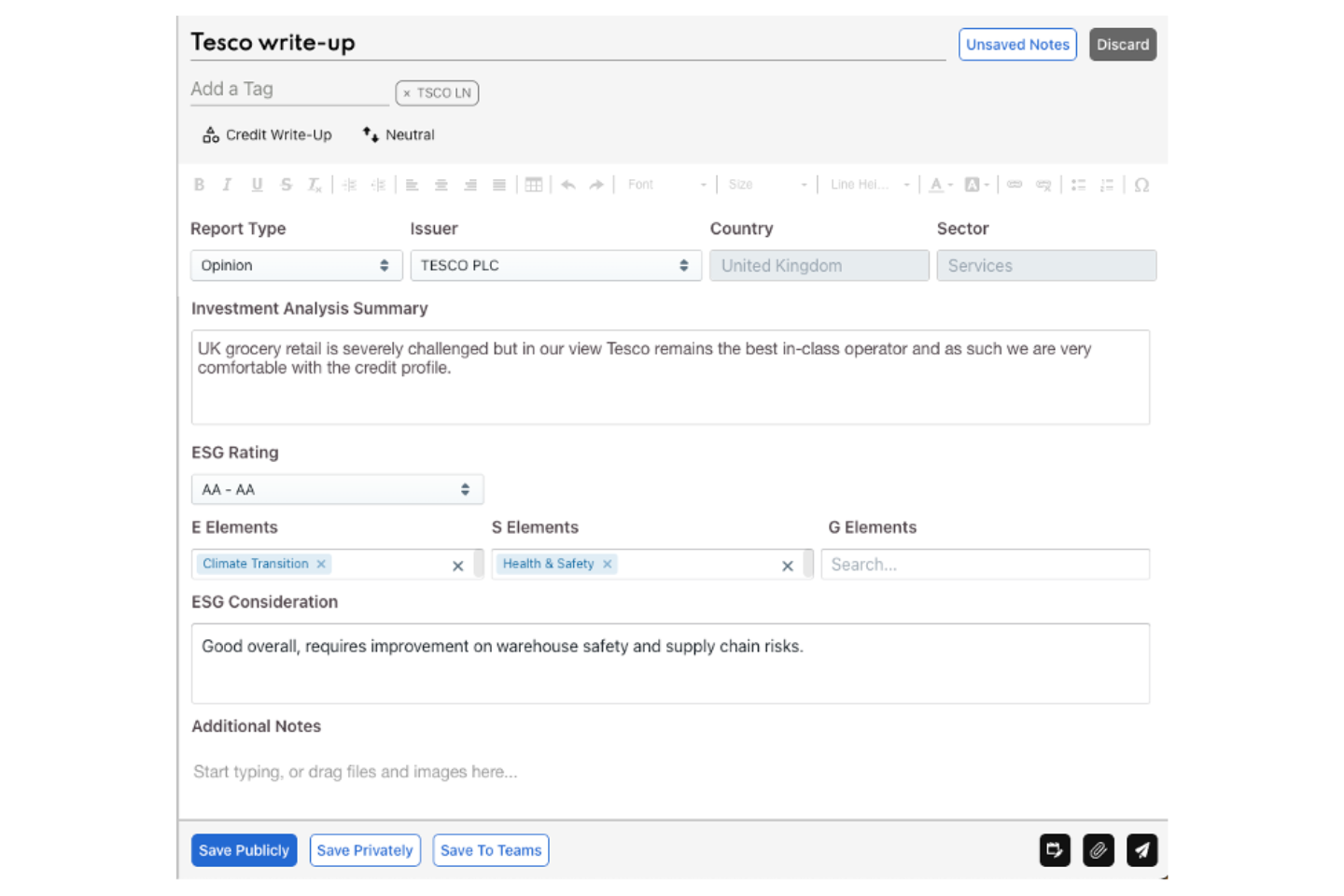

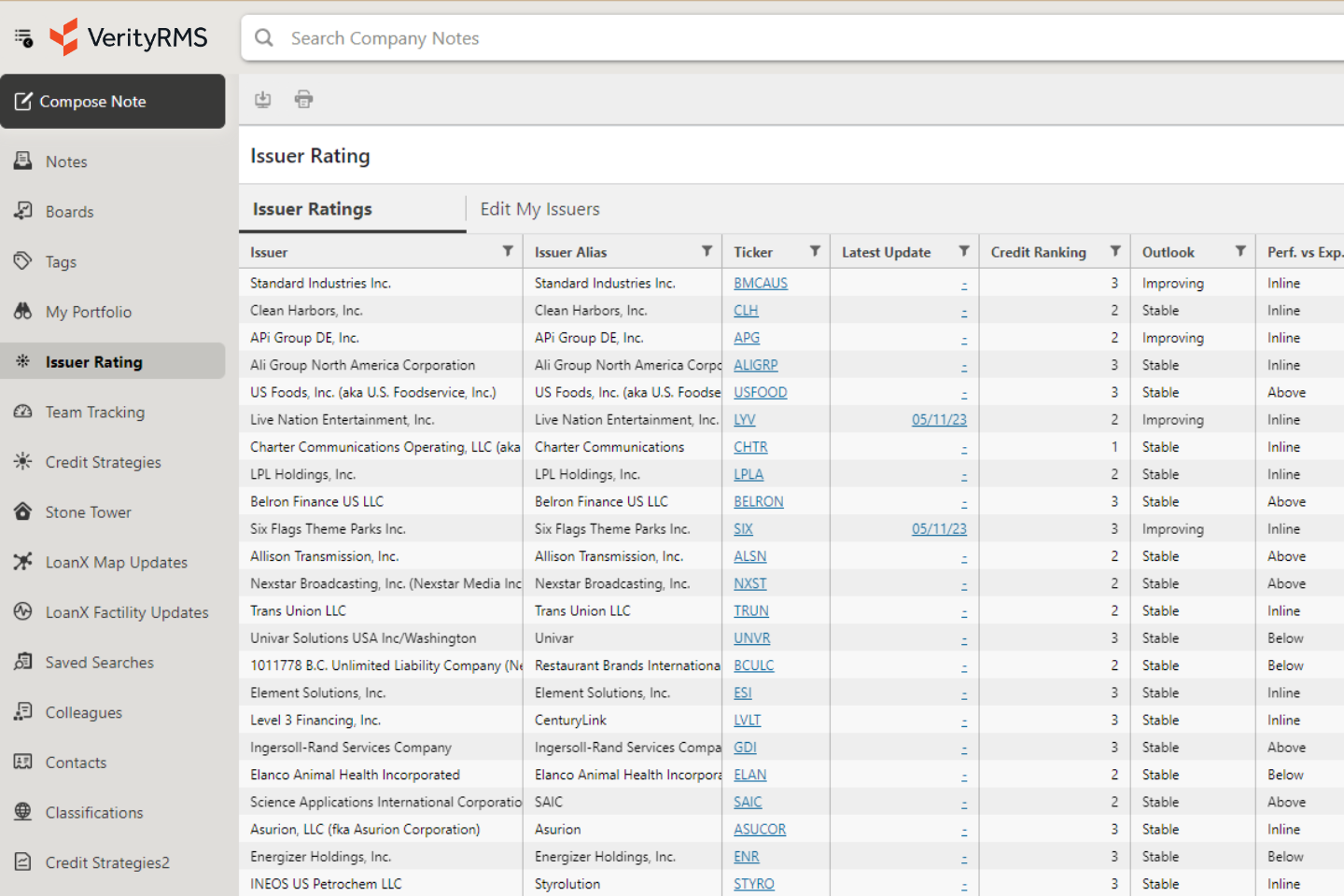

Fixed Income

Fixed income funds accelerate decision-making when credit analysts & portfolio managers can author, visualize, and report on investment research across complex issuer hierarchies.

Products: VerityRMS for Fixed Income

-

Visualize pipeline & portfolio

-

Organize by issuer hierarchies

-

Automate reporting & compliance

-

Search & find content quickly

-

Centralize & secure research

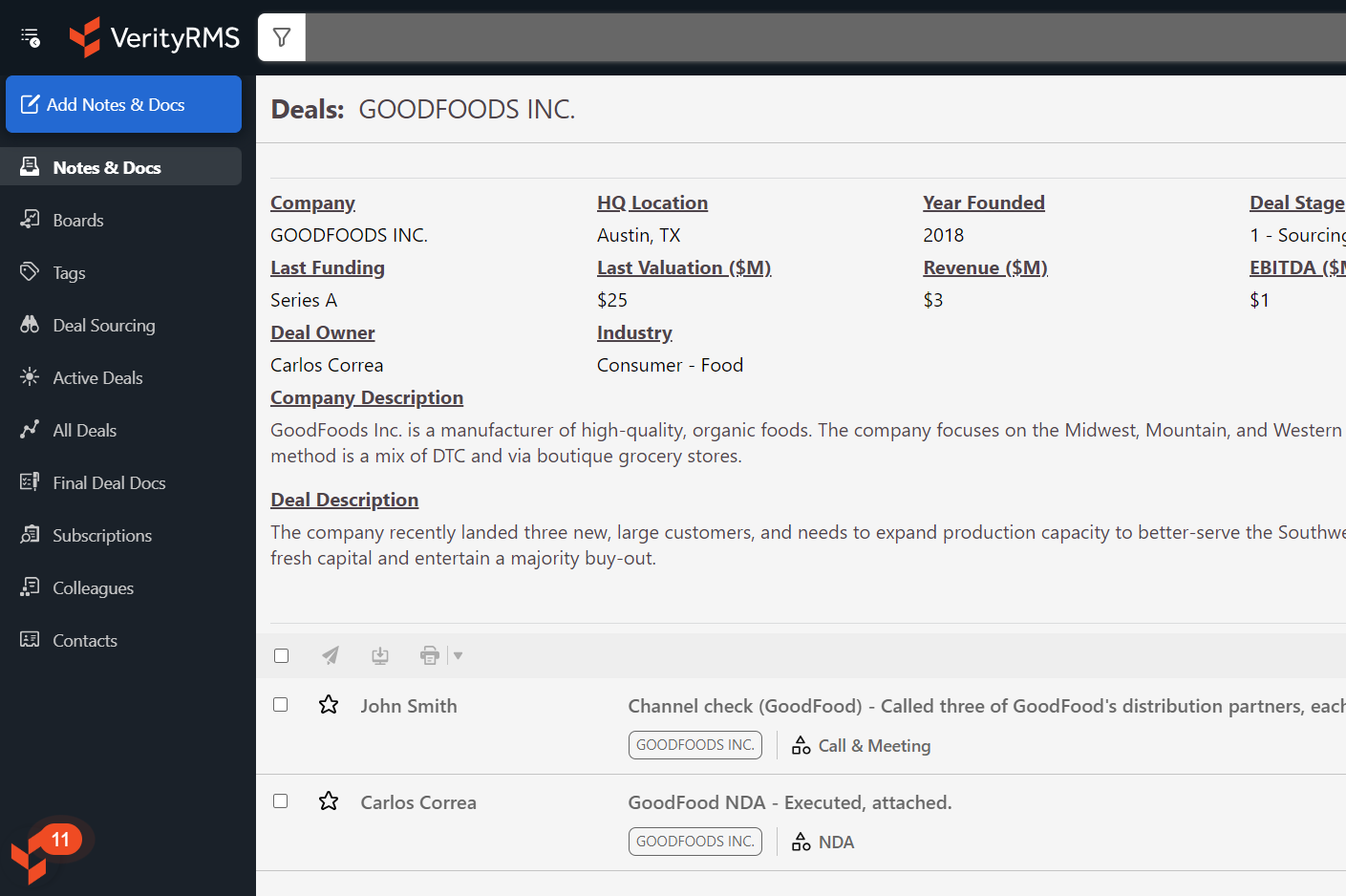

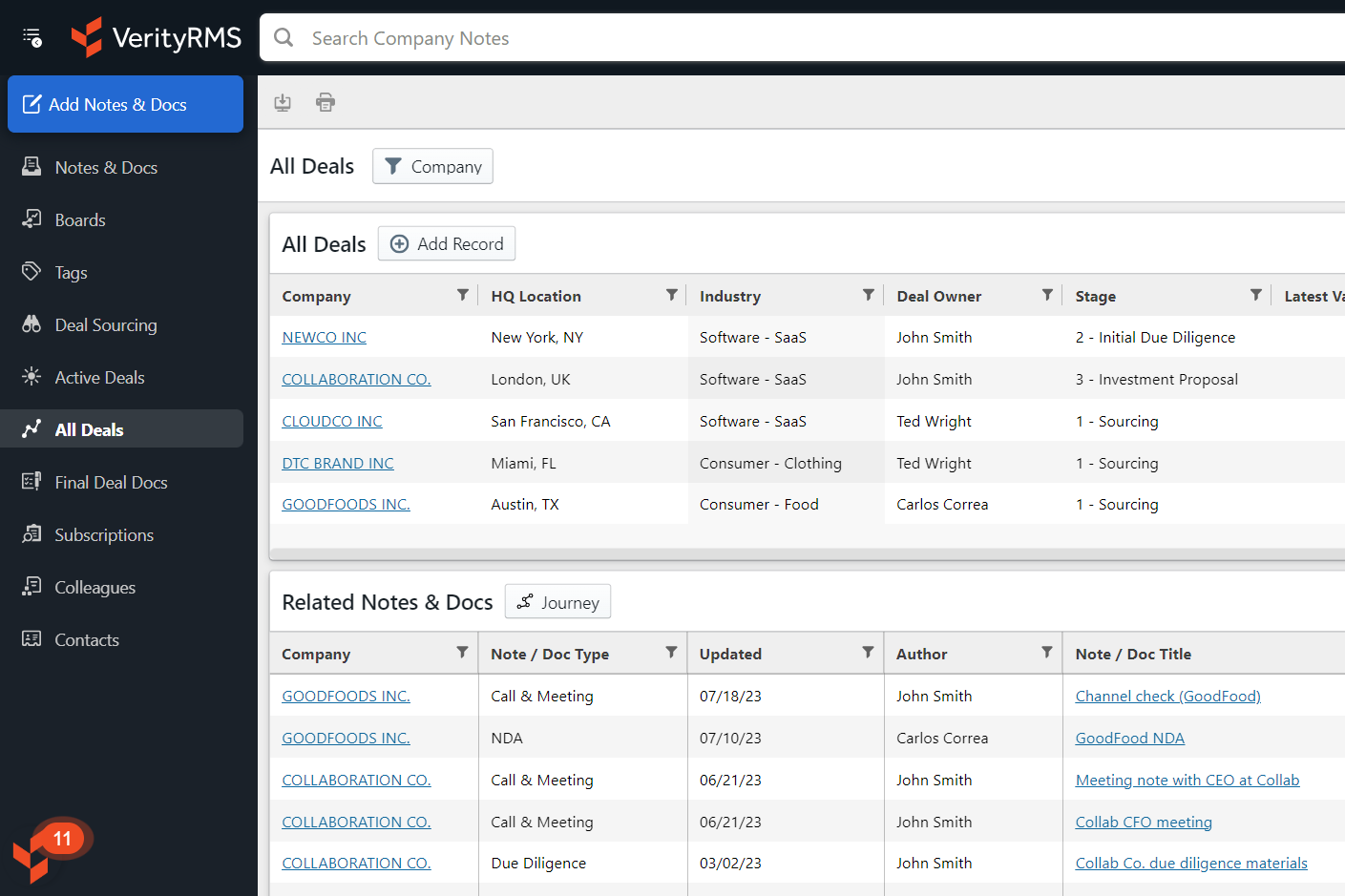

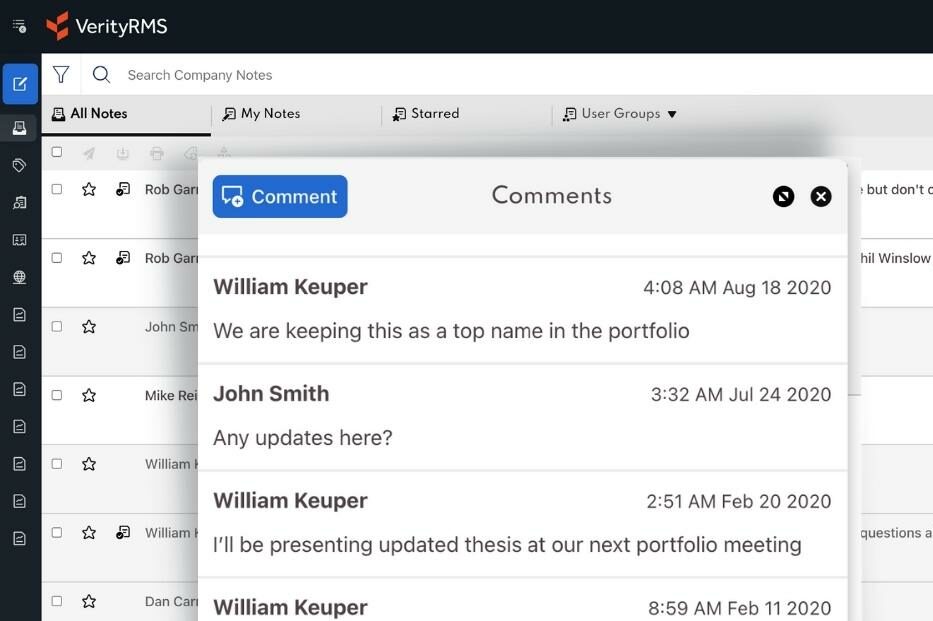

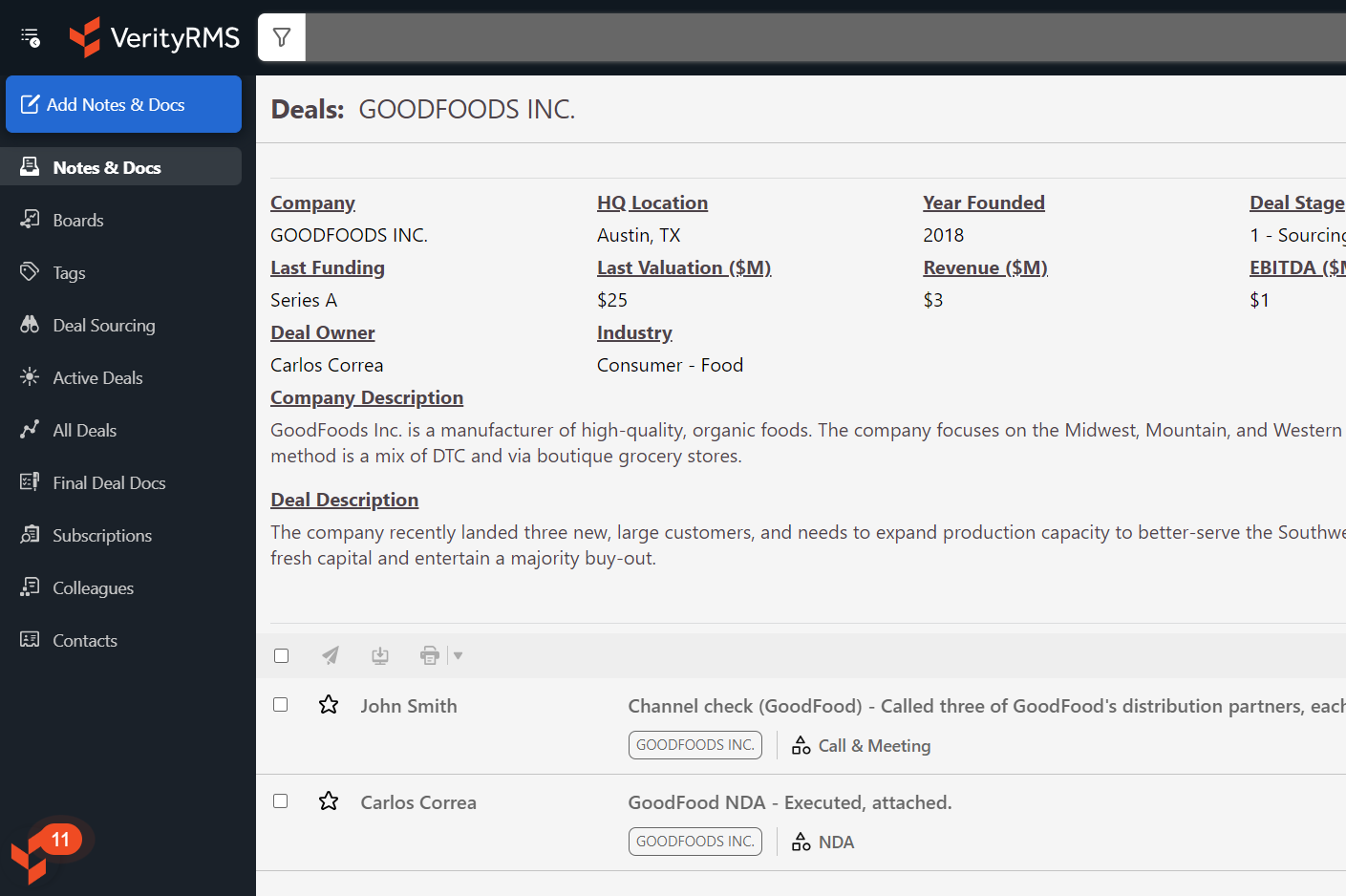

Private Equity

When deal teams have 24/7 access to the firm's proprietary knowledge — along with all the data & context that matters — private equity firms can outperform their rivals.

Products: VerityRMS for Private Equity

-

Streamline deal flows

-

Manage relationships

-

Organize notes & documents

-

Find content instantly

-

Don't lose an insight

Hybrid Model

Hybrid firms excel when they have a single technology partner to help scale and optimize performance across both public and private investment teams.

Products: VerityRMS, VerityESG, VerityData

-

Centralize and secure IP firm-wide

-

Meet individual team workflow needs

-

Scale research productivity

-

Drive best practices

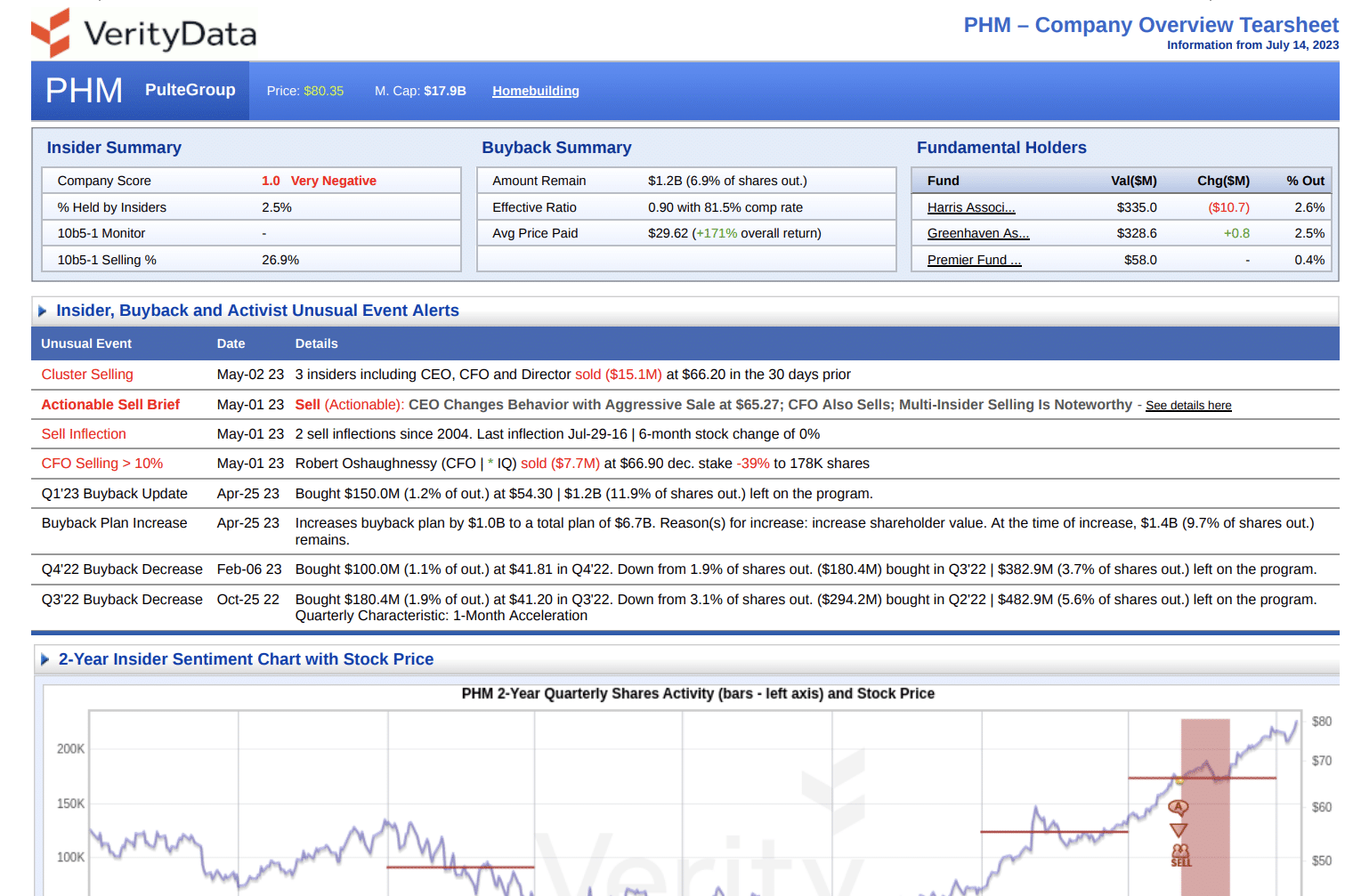

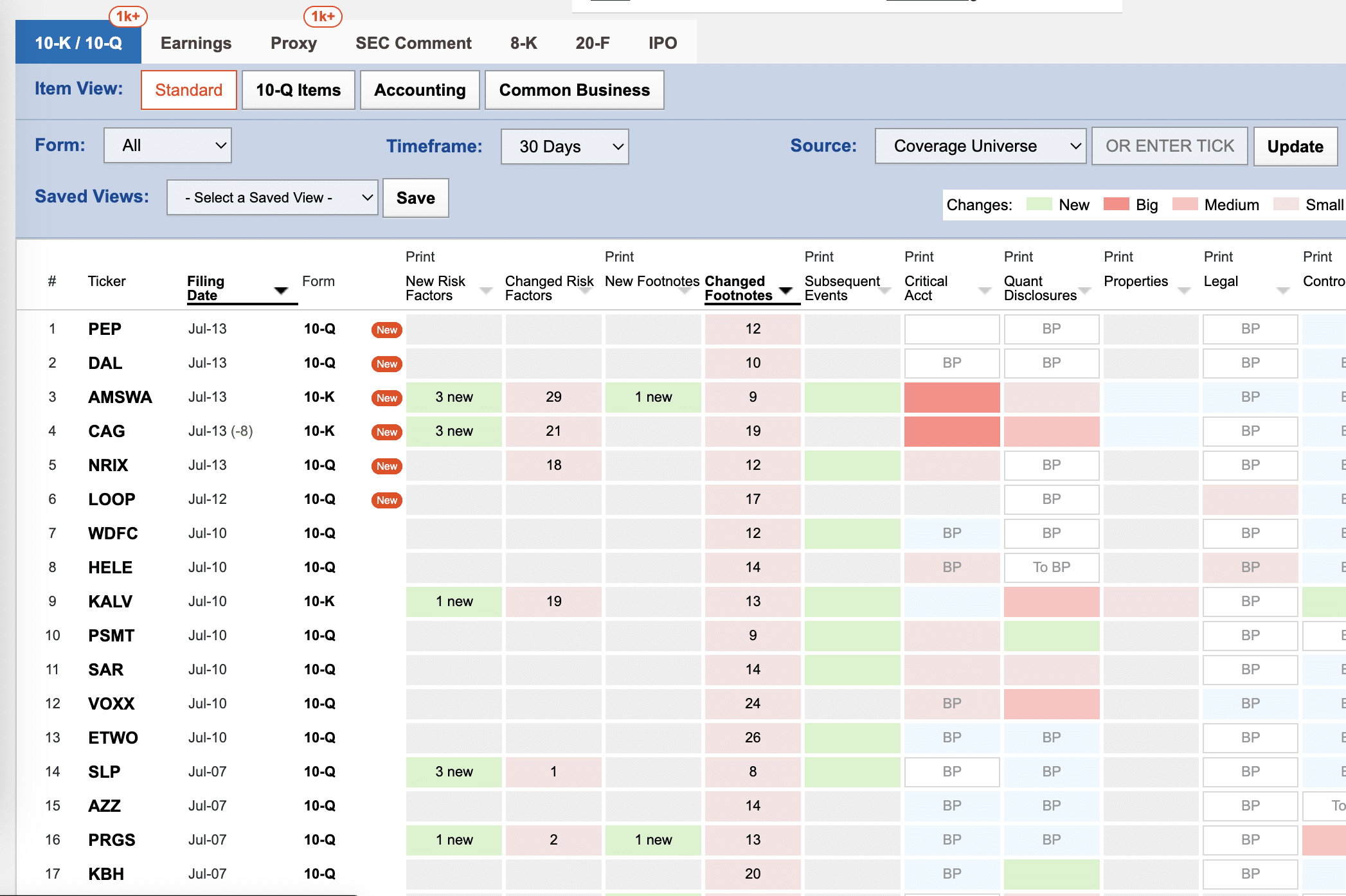

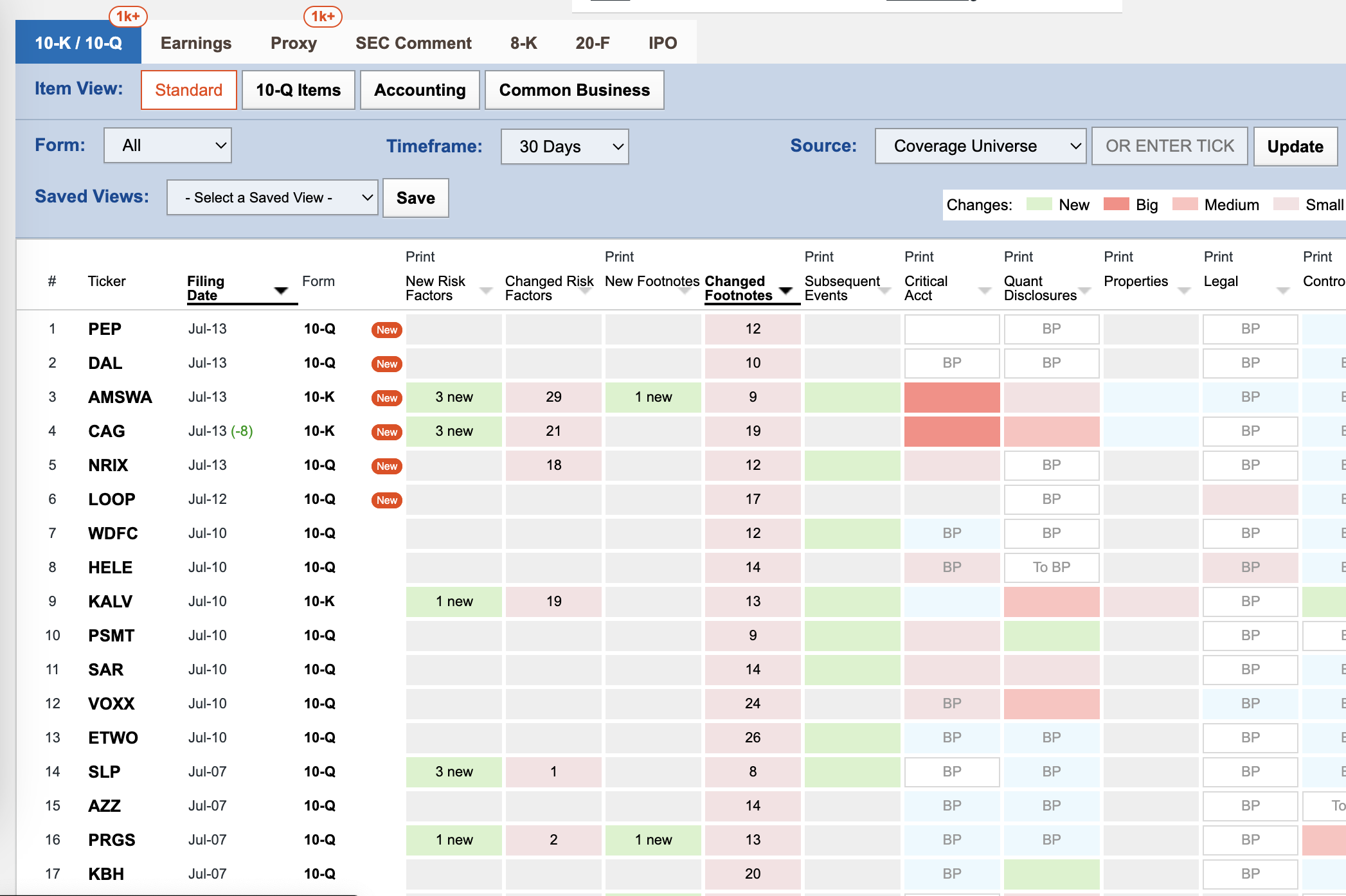

Quantitative

With differentiated data feeds — including insider activity, buybacks, management changes, 13F, and structured text from 10-K/Qs — quantitative and quantamental teams can build predictive, low-maintenance models that generate alpha.

Products: VerityData Feeds & SEC Filings API

-

Enhance edge with differentiated data

-

Integrate into your models, LLMs, & data lakes

-

Eliminate timely data scraping & cleansing

-

Scale with quality data — vetted by financial experts

Outperformance Starts Here

See how Verity accelerates winning investment decisions for the world's leading asset managers.

Request a Demo