In Rare Move, Influential Shareholder Buys $2M of Coca-Cola Co. (KO) Through LLC

The purchase is a rare show of positive sentiment for the Allen family, and given its positioning as a large and influential shareholder of KO for 40 years, the move to add exposure stands out as a notable positive.

One of 2,500 annual insider research briefs from the VerityData analysts. Originally published 11/02/2022 and distributed to VerityData | InsiderScore customers.

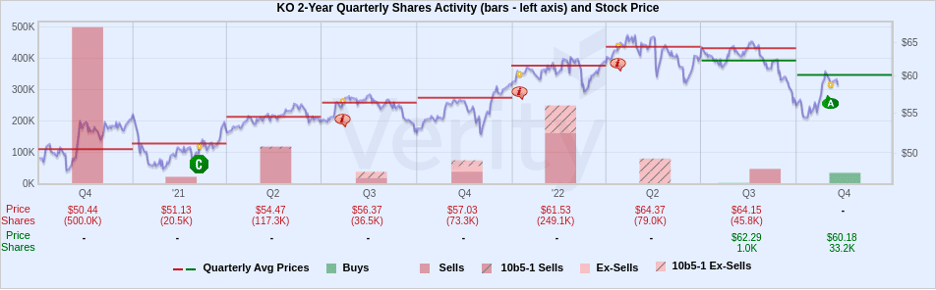

Herb Allen III, president of boutique investment bank Allen & Co., which has been a long-time, large shareholder of KO, bought $2M at $60.18 through an affiliated LLC. In December 2021, the younger Allen took the board seat that had been occupied by his father since 1982. Press reports have suggested the elder Allen wielded outsized influence on the KO board. For example, the Atlanta Journal Constitution noted:

“For much of his tenure, he was considered among the most powerful and involved directors overseeing the Atlanta-based beverage giant. He sometimes played an outsized role in who was chosen to lead the company and what businesses Coke tried to acquire.”

The purchase is a rare show of positive sentiment for the Allen family, and given its positioning as a large and influential shareholder of KO for 40 years, the move to add exposure stands out as a notable positive.

The Allen Family’s Association With KO Is Long-Running

Investment bank Allen & Co. was founded in 1922 by Charles Robert Allen. In 1966, he handed the reins to his nephew Herb Allen Jr., who was succeeded by his son Herb Allen III in 2002. Allen & Co. is well known for its Sun Valley Conference, which annually attracts billionaires from Bill Gates to Rupert Murdoch. Allen & Co. acquired its large stake in KO in 1982 when Columbia Pictures, in which Allen held a large holding, was sold to KO. As of February 2022, Allen & Co. and the Allen family owned 19.2M KO shares.

Allen III bought shares into an LLC, which controls a smaller holding and for which he is president. Allen & Co. bought in 2006 at $21.03 and in 2010 at $26.48, but the family and its affiliated entities had not otherwise purchased KO shares since the start of our database in 2004.

About the Research Brief

Data included in this report is sourced by VerityData | InsiderScore‘s comprehensive databases of insider trades, buybacks, at-the-market offerings, management changes, institutional investor disclosures, and more.

Outperformance Starts Here

See how Verity accelerates winning investment decisions for the world's leading asset managers.

Request a Demo