Unusual Insider Buying at $SHW, $PYPL, $EOG While Overall Sentiment ‘Slightly Positive’

A summary of notable insider trading activities from Verity’s research team.

The first month of the quarter is typically the lightest in terms of insider trading volume. January 2023 was no exception as most insiders were restricted from buying or selling outside 10b5-1 plans. Overall January insider buying volume and non-10b5-1 selling volume was typical. When looking at a ratio of sellers to buyers, sentiment was slightly more positive than is typical.

Putting January in Context

Roughly 230 insiders bought shares of their companies in January, a bit below 250 buyers in the first month of Q4’22 and also below the approximately 300 insiders who bought in January 2022. The 230 unique non-10b5-1 sellers in January 2023 was slightly lower than in October 2022 and somewhat above the over 200 who sold in January 2022.

Taken together, the ratio of sellers to buyers ended up at 1.18:1, below the average ratio of monthly sellers to buyers at ~1.59:1.

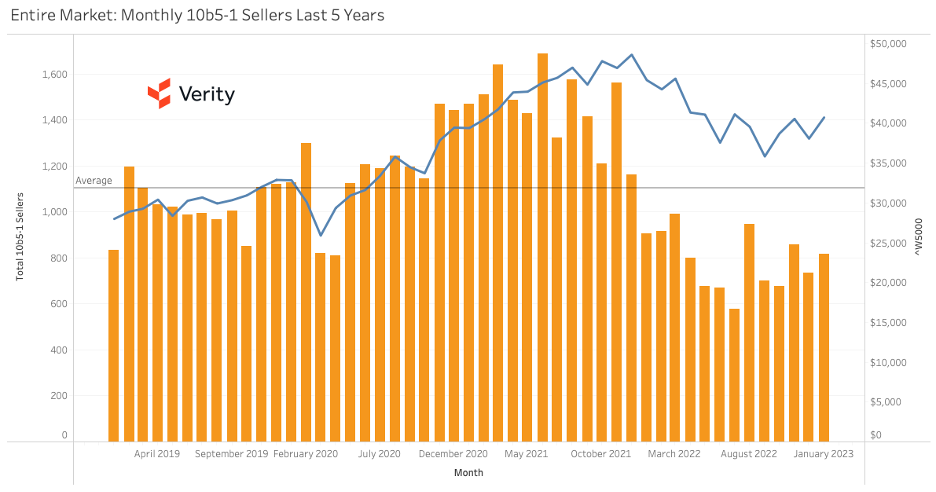

The level of 10b5-1 selling can be particularly insightful on a monthly basis because it’s a subset of insider activity that’s generally not impacted by blackout periods around earnings. The chart below shows the number of 10b5-1 sellers by month over the last five years.

Unusual Insider Signals to Note

As always, it’s important to look at company-specific stories where insiders are behaving unusually. Throughout the quarter, we have been alerting clients with real-time coverage of unusual insider behavior. Here is a small selection of that coverage from recent weeks.

Sherwin-Williams (SHW) – A $500K purchase by CEO John Morikis at $226.70 renews the strong positive sentiment at the paint manufacturer, distributor, and retailer. Like others at SHW, Morikis exhibited a long-standing sell bias before 2022. His buying this year is a notable deviation in behavior and the latest purchase picked up shares after a post-earnings dip. A continued lack of selling by other insiders supports the positive sentiment exhibited by Morikis. (1/30/23)

PayPal Holdings (PYPL) – No one has sold at the fintech company since mid-September 2022, generating the firm’s first-ever Extreme Cessation of Selling event, a positive sentiment development. Selling at the company has been tapering since Q2’21 but it didn’t completely cease for an unusually long period until now. In the backdrop at PYPL, activist investor Elliott Management built a stake in PYPL and also entered into an information-sharing agreement with the company in August. Since then, a new chief product officer has been hired to start 2023, Chief Accounting Officer Jeffrey Karbowski resigned, and CFO Blake Jorgensen has taken a temporary leave due to health reasons. There are a lot of moving parts that now include insiders exhibiting an unwillingness to sell in recent months. (1/11/23)

EOG Resources (EOG) – A $2.6M purchase by Director Michael Kerr at $130.49 sent a positive valuation message at the oil and gas producer. Insiders of EOG were last sellers near $146.00 in Q4’22 and Kerr’s buy reversed sentiment after a modest pullback in recent months. Kerr has been on the board for two years and his only other buy of $4.3M in November 2021 proved timely, strengthening the message of his latest buy. (1/18/22)

About the Data

Data included in this report is sourced by VerityData | InsiderScore‘s comprehensive databases of insider trades, buybacks, at-the-market offerings, management changes, institutional investor disclosures, and more.

For access, request a free trial of VerityData >>

For data inquiries relevant to this report, contact Ben Silverman.

Outperformance Starts Here

See how Verity accelerates winning investment decisions for the world's leading asset managers.

Request a Demo