How Deviations in Insider Buying & Selling Behavior Provide Company Valuation Insights

A research analyst dives into unusual option sales by the CEO of ADM, which provide a good example for understanding the importance of insider deviations when generating investment ideas or monitoring your portfolio.

One effective way to analyze insider activity is to examine individual behavior and look for significant deviations from the norm. This can help distinguish routine sales from opportunistic behavior. By focusing on these deviations, analysts can identify more valuable insights into insider activity.

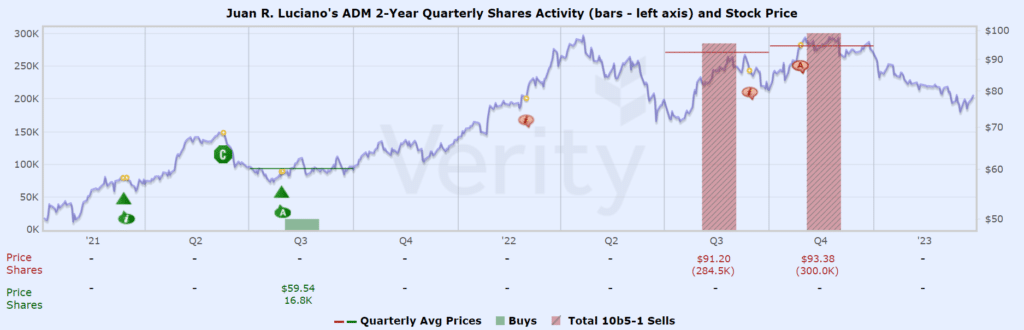

A recent case study that exemplifies the importance of deviations in behavior was option sales by Archer-Daniels-Midland (ADM) CEO Juan Luciano near the end of 2022.

In this article, I’ll dive into unusual option sales by CEO Juan Luciano of Archer-Daniels-Midland, which provide a good example for understanding the importance of insider deviations.

CEO Opportunistically Unloaded Non-Expiring Options for First Time

CEO Juan Luciano demonstrated an unusual shift in behavior at ADM in the second half of last year, which has proven to be especially timely.

Up until September 2022, Luciano had only sold options at the company that would expire in less than one year. Between October 2020 and January 2022, Luciano sold options three times, all of which expired within 7-12 months. This behavior was not deemed opportunistic because the options would expire soon regardless. Previously, Luciano had a buy bias at the company, including a well-timed buy of $1.0M at $59.54 in July 2021.

This changed in September 2022. Luciano aggressively offloaded options on strength that were not set to expire until early 2024 and 2026. For this sale, he used a new 10b5-1 plan, adopted in May 2022, that employed sale minimums between $90.53-$91.53. This was a negative shift that put the company on our radar.

Then, in October 2022, as the stock rallied again, Luciano continued to aggressively sell options not expiring until 2026, using the same 10b5-1 plan at triggers between $92.53-$93.53.

The CEO’s aggressiveness and clear, opportunistic price targets combined for a strong sign of negative sentiment and stood out as a meaningful deviation in his behavior.

Source: VerityData

Luciano was able to capture two separate local peaks for the stock, realizing total net proceeds of nearly $33 million. As of March 23, 2023, the stock had declined over 17% from his last sale.

Bottom Line

To detect meaningful insider activity, it is important to filter out transactions that are likely not significant, such as the sale of soon-to-expire options. The use of price triggers is another signal that insiders could be opportunistically offloading shares at prices they believe to be inflated. Additionally, it is best to analyze an individual transaction in the context of that specific insider’s history and previous behavior. By using these tools, we are able to identify Luciano’s sales as valuation-oriented and significant.

Start Capitalizing on Insider Trading Activity

Drive faster idea generation, decision-making, and confidence. Take advantage of the highest-integrity data, analytics, and propriety research covering the universe of insider activity.

Request access to VerityData >>

Outperformance Starts Here

See how Verity accelerates winning investment decisions for the world's leading asset managers.

Request a Demo