Insider Signals at $CMG, $F, $TSCO; Macro Sentiment ‘Slightly Negative’

A summary of notable insider trading activities from Verity’s research team.

- Insider sentiment was slightly negative in December as the Wilshire 5000 rallied 5.2%, a shift in sentiment from the neutral stance in November.

- The moderate amount of selling across the market was matched with low insider buying, producing a ratio of sellers-to-buyers that was above the historical norm.

Putting December in Context

Roughly 460 insiders bought shares of their companies in December, less than the 574 unique buyers in the third month of Q3’23. The amount of buyers in December 2023 is also a 37% decrease YoY from the approximately 732 insiders who bought in December 2022. That caused the number of buyers to drop 37% YoY in December 2023. The roughly 995 unique non-10b5-1 sellers in December 2023 were above the ~535 insiders who sold in September, the same seasonal month in the prior quarter. About 793 insiders sold in December 2022, leaving the non-10b5-1 seller count higher YoY in September 2023 by 26%.

Taken together, the ratio of non-10b5-1 sellers to buyers ended up at 2.3:1, solidly above the average ratio of monthly sellers to buyers of ~1.51:1 in the last five years. In aggregate, insiders exhibited slightly negative sentiment.

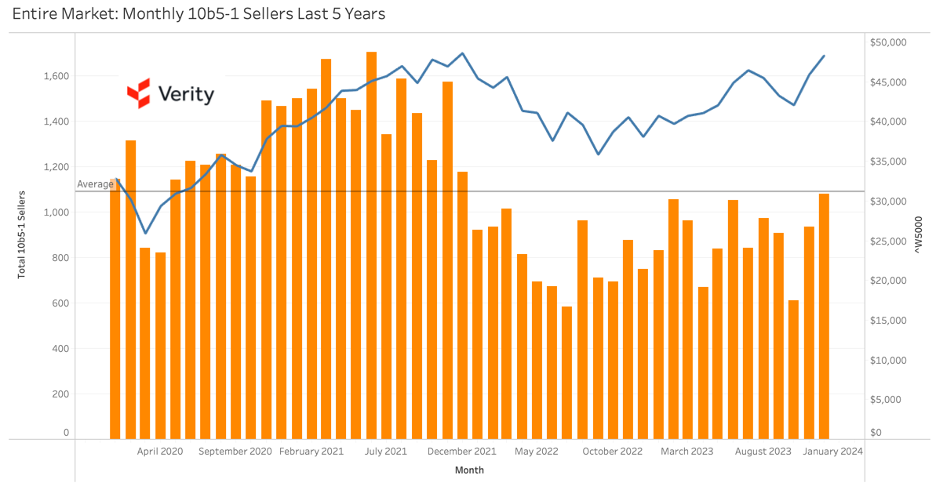

The level of 10b5-1 selling can be particularly insightful on a monthly basis because it’s a subset of insider activity that’s generally not impacted by blackout periods around earnings. The chart below shows the number of 10b5-1 sellers by month over the last five years.

Unusual Insider Signals to Note

As always, it’s important to look at company-specific stories where insiders are behaving unusually. Throughout the quarter, we have been alerting clients with real-time coverage of unusual insider behavior. Here is a small selection of that coverage from recent weeks.

+ Chipotle Mexican Grill (CMG) – A director at the casual dining chain operator with a deep background in the food production industry bought $2.0M at ~$2,285.00, behavior that sends a compelling positive valuation message after shares struck a fresh all-time high last week. Director Gregg Engles’ purchase was his first and the first by any CMG insider since May 2022. Engles’ buys in August 2020, March 2022, and May 2022 proved to be well-timed yet totaled only $700K at ~$1,270.00, making his recent purchase a much more demonstrative expression of his valuation view. His buy offers a counter to recent selling by seven insiders at similar prices this quarter, though that behavior isn’t unusual at the firm and Engles’ purchase offers the more unusual show of sentiment. (12/18/23)

+ Ford (F) – A $2M purchase at $11.05 by Chief EV, Digital and Design Officer Doug Field is unusual and sends a strong undervalued message at the automaker. Field is often referred to as the company’s “product guru” and, among other things, he’s in charge of developing electric vehicles. His purchase is the largest by non-Ford family member insider in at least 20 years, first by any insider since March 2022, and his first since joining the company in 2021. The only other activity by F insiders this year came in March when a group of executives exercised and sold options that were a week away from expiration. (12/12/23)

+ Tractor Supply (TSCO) – A cessation in selling has taken hold at the farm supplies retailer as insiders have moved to the sidelines as the stock has dipped below $220.00. A previous cessation occurred in Q3’22 as insiders refused to sell when the stock fell below $200.00. That proved to be timely as the stock would hit an all-time high of $251.17 in April of this year. Cessations in the more distant past, including Q2’20 and Q3’14, also proved to be well-timed, suggesting that insiders at the company have a good sense of how the stock should be valued. (12/7/23)

About the Data

Data included in this report is sourced by VerityData | InsiderScore‘s comprehensive databases of insider trades, buybacks, at-the-market offerings, management changes, institutional investor disclosures, and more.