How It Works

Step 1. Capture the Earnings Intel You Need

What internal data matters most to your earnings process? What insights drive your decisions? Put these front and center by adding fields to note templates that reflect how your team evaluates earnings — pre- or post-results. Teams can start with a standard setup and refine over time.

Step 2. Layer in Relevant Market & Event Data

VerityRMS comes standard with S&P Global Market Data and Wall Street Horizon so you can automatically populate earnings dates, estimates, fundamentals, and key events. This data can be integrated into analyst notes, tearsheets, and dashboard views — with no additional vendor agreements required.

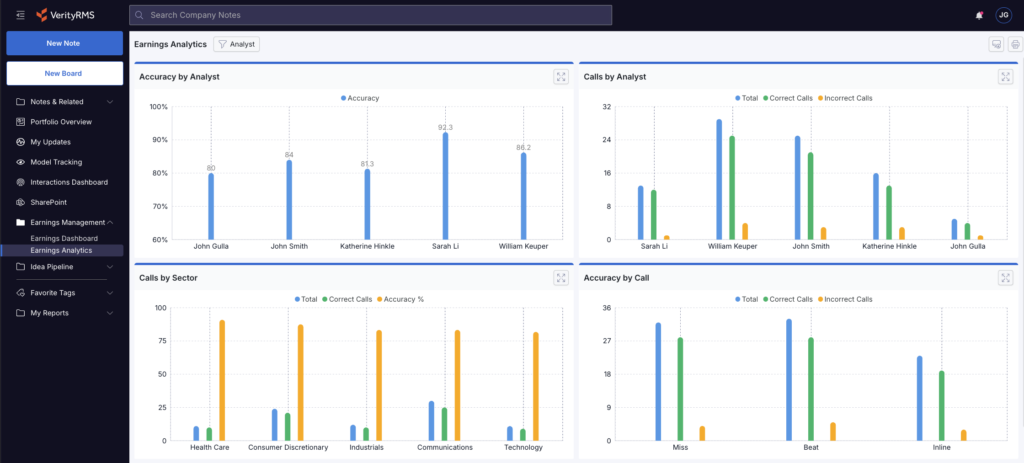

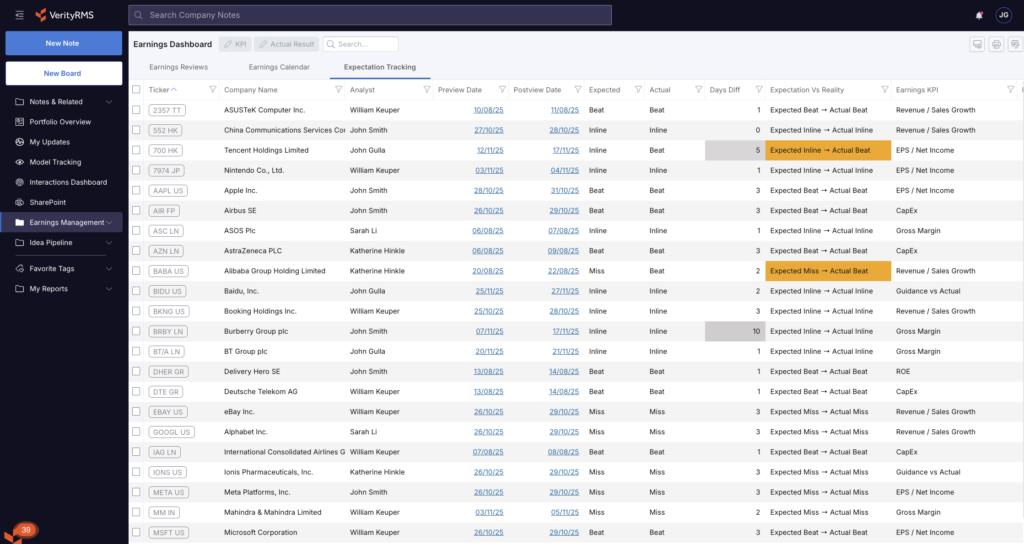

Step 3. Watch It All Come Together

Create dashboards and reports that give you exactly what you need at a glance. Track coverage, compare expectations and outcomes, spot gaps, and watch updates roll in — all from one screen.

Step 4. Keep Everyone Alerted

Rule-based alerts keep everyone in their best form. Notify analysts if something is missing or needed. Notify PMs when new analysis lands, when important metrics shift, or when something needs attention. You set the rules, and VerityRMS keeps watch.