How Investors Unlock Lockups With VerityData’s Lockup Database

Learn how investors use VerityData for a faster path through today’s SPAC & IPO complexity.

The New Lockup Puzzle

Tracking insider lockups associated with new issues used to be as easy as adding 90 or 180 days to the offering date. However, today many new issues seems to come with:

- Multiple tranches of stock that unlock on different dates.

- Price-based early-release clauses (ERPs) that fire if the stock trades above a hurdle.

- Blackout carve-outs that shift the unlocking schedule around earnings.

Miss one clause and a quiet position can turn into a volatility event overnight.

Why Lockups Matter (And How PMs & Analysts Use Them)

- Anticipate supply shocks. A large unlock can dramatically increase tradable float. Knowing the exact date and share count lets you press a long, size a short, hedge with options, or simply wait until the dust settles.

- Read insider conviction. ERPs and staggered waves reveal when management is eager or reluctant to sell. That’s real-time sentiment you can trade on.

- Keep models honest. Future unlocks flow straight into share-count, EPS, and EV/EBITDA assumptions, preventing valuation surprises.

- Trade with liquidity, not against it. Mapping every tranche helps you scale in or out without moving the market.

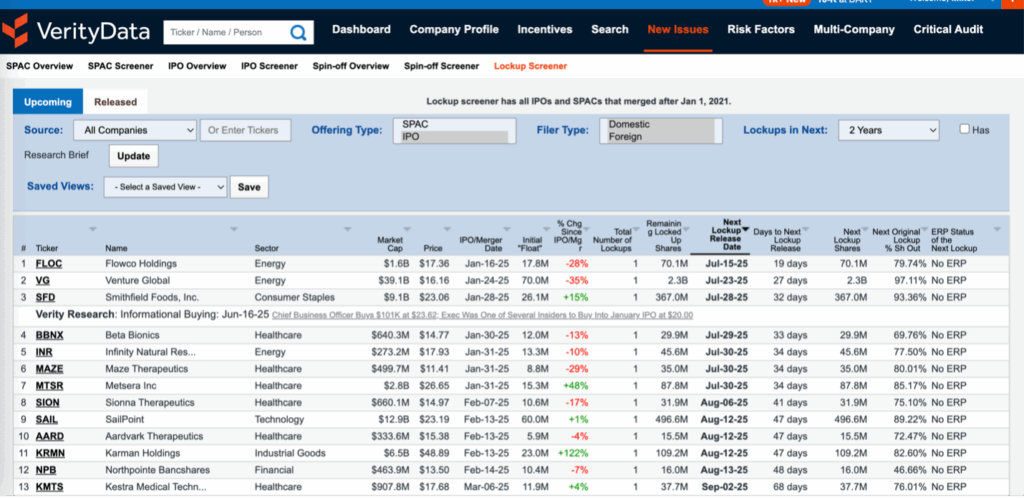

What Makes VerityData’s Lockup Tracker Different

- Clause-level clarity. Every date, share count, ERP, price hurdle, and blackout carve-out is parsed out of the filing and rendered plainly. No digging through filings or PDFs.

- Unified coverage. IPOs, SPACs and de-SPACs live in one feed with more than 1,800 U.S. new issues since 2020, updated daily.

- Lightning-fast screens. Filter across upcoming or recent released lockups.

- Model-ready exports. Push timelines straight into valuation sheets or risk dashboards with the VerityData Lockup feed.

TOST: A Real-World Example

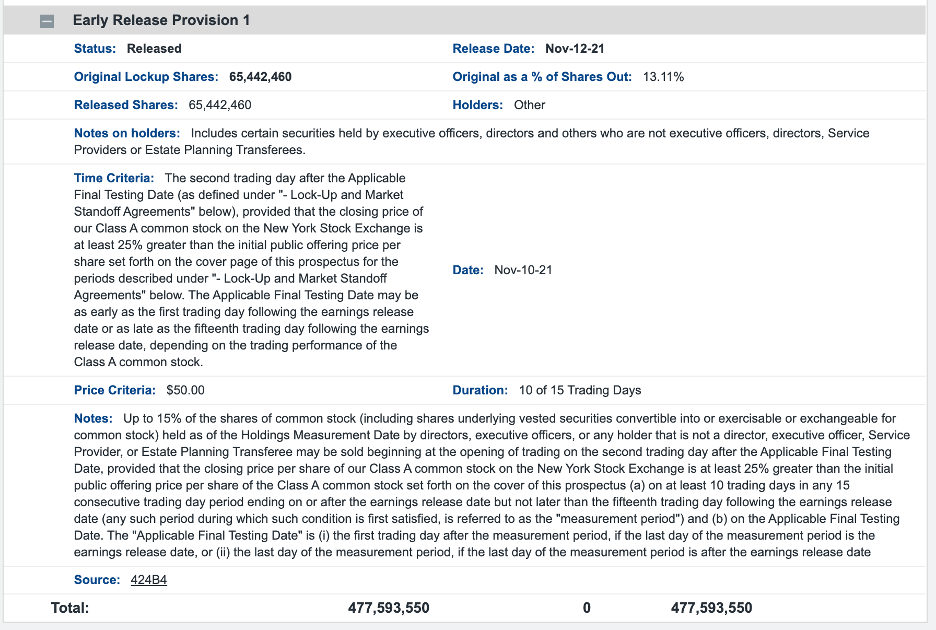

With VerityData’s Lockup Tracker, you could see ahead of time that Toast’s IPO carried three staggered unlocks that would rapidly expand the shares available to trade.

- Early employee window (Nov 11 2021). About 11 million employee shares — roughly 2% of outstanding shares — could be sold starting two days after Q3 earnings.

- Price-trigger release (Nov 12 2021). Another 65 million shares became tradable once Toast’s stock stayed at least 25 % above its $40.00 IPO price for 10 of 15 trading days.

- Main unlock (Feb 15 2022). Roughly 401 million shares — more than 90 % of all shares — were freed up right after full-year results, well before the usual 180-day mark.

In just five months, the amount of stock that could change hands went from a small slice to nearly the entire company. It’s movement you’d spot early by tracking each unlock date and trigger in one place.

Bottom Line

Lockups dictate when a wave of insider shares can hit the market. Each release changes supply, signals sentiment, and can jolt valuation. VerityData puts every date and clause in clear view so you can position with foresight instead of scrambling.

See VerityData in Action

Discover how VerityData accelerates idea generation and risk management. Get access to 15+ years of the most accurate and complete data of its kind — includes insider activity, stock buyback initiations & quarterly repurchases, lockups, at-the-market offerings, 13F/D/Gs, management changes, and more — along with 2,500 annual research briefs from VerityData experts.

Outperformance Starts Here

See how Verity accelerates winning investment decisions for the world's leading asset managers.

Request a Demo