7 Truths of Insider Selling: A Differentiated View on Valuation Signals

Investors should keep in mind these several critical factors, distilled from decades of expertise, to identify when insider selling behavior carries a meaningful message or valuation signal.

Insider selling is notoriously complicated. Our decades of experience at VerityData | InsiderScore show that insider selling is best understood by focusing on behaviors and deviations over raw data.

While dollar values and shares sold matter, behaviors like price targeting via 10b5-1 plans and selling long-life options for small gains can signal meaningful negative sentiment, regardless of sale size. To identify when insider selling behavior carries a meaningful message or valuation signal, you must understand several critical factors.

#1. Insiders Are Unique Market Participants

No other investor class is afforded the same opportunity as insiders — to acquire shares at a $0 or below–market cost basis. Insiders receive stock-based compensation on top of salary, bonuses, and other benefits. While companies emphasize executive and director equity ownership, most stock-based compensation eventually converts to cash during an insider’s tenure.

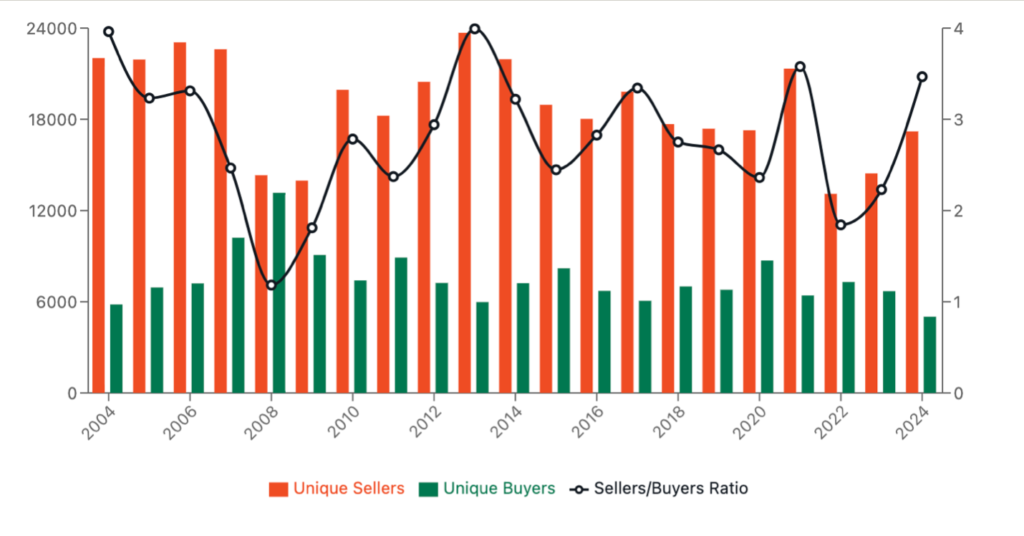

This fundamentally changes how we evaluate insider behavior—unlike other shareholders, they’re not risking cash. Therefore, the mere act of insider selling should not automatically be viewed as a meaningful data point. The chart below shows the imbalance between the number of insiders who sell annually versus buy.

#2. Rule 10b5-1 Selling Matters

While Rule 10b5-1 was designed to provide insiders a safe harbor for trading, it has evolved into a tool that allows for opportunistic selling. Recent regulatory changes have increased transparency but haven’t eliminated strategic behavior. These pre-planned sales continue to reveal crucial insights about insiders’ valuation views, fiscal prudence, and corporate governance practices. As the dominant method of selling, analyzing these plans often requires sophisticated understanding of the nuances among the various datapoints.

#3. Insider Selling Behaviors Beat Dollar Values

Insiders are not blunt actors. They rarely dump stock outright, instead they develop nuanced behaviors—individually and as groups—that can signal valuation concerns. A $50K sale can carry more significance than a $10M transaction by the same person. Rather than filtering transactions by arbitrary value thresholds, focus on specific behaviors.

Example: A Small Sale Predicts an Insider Sea Change

At Myriad Genetics (MYGN), CEO Paul Diaz’s $5.7M sale at $25.14 in May 2024 caught our attention because it marked his first sale since joining in August 2020. The red flag wasn’t the size of the sale but his follow-up $401K sale at $26.72 in September 2024. While Q2’24 saw just one other insider seller, Q3’24 brought five additional insiders selling ahead of Diaz. The May sale represented an isolated change; the Q3 activity signaled a broader behavioral shift. MYGN shares hit a three-year high shortly after Diaz’s September sale before losing over 50% of their value.

#4. Ownership Changes Can Mislead

Investors also often make mistakes in evaluating sales in relation to an insider’s ownership. Total ownership calculations require cross-referencing multiple filings, and Form 4 disclosures often don’t tell the complete story. Don’t make the mistake of believing that what’s on Form 4 is all the insider owns. Sometimes a sale represents a larger reduction in an insider’s available equity than initially apparent.

Example: Available Equity Selloff Signals Deeper Concerns

When Allegiant Travel (ALGT) Chief Marketing Officer Scott DeAngelo increased his selling on weakness in May 2024, he liquidated most of a recently vested restricted stock award. The sale’s significance became clear when considering his remaining shares were largely unvested and his options were underwater. His decision to clear out available equity sent a negative signal, and preceded further stock decline through August.

#5. Option Sale Importance Varies Greatly

Strike price and time until expiration are crucial variables in evaluating option sales. Selling long-dated options for minimal gains suggests limited confidence in future appreciation, while selling near-expiration options often reflects routine liquidity management rather than sentiment.

Example: Insiders Prioritize Quick Gains Over Long-Term Potential

At Tyson Foods (TSN) in November 2024, Director and former CEO Noel White led a strong increase in multi-insider selling when he sold multiple option tranches for just 9% gains—some with four years until expiration—signaled urgency to capture any available profit. Group President Wes Morris joined with similar small-gain sales of long-life options. Their lack of confidence proved prescient as shares fell 15% over the next two months to levels that would’ve put many of the options back underwater.

#6. Compare Insider Sales at Your Own Risk

Comparing insiders or companies to one another is usually a waste of time. Different compensation structures, trading cultures, and ownership expectations make cross-company comparisons problematic, even within the same sector.

Example: All Chip Companies Aren’t Equal

Semiconductor stocks have been booming due to AI fervor. But company structures and cultures give important context on their insider selling.

Nvidia (NVDA) shares have taken off but insider selling has been historically normal, not particularly outsized. Notably, NVDA stopped handing out options in 2013 in favor of restricted shares. So, it makes sense when we see CEO Jensen Huang start selling non-option shares after a decade of exclusively using expiring options to generate liquidity.

Meanwhile, Intel (INTC) has seen years of positive insider sentiment even as its stock has faltered and the company has posted dismal performance. In addition, at Advanced Micro Devices (AMD) after years of steady insider selling, insiders have gone to the sidelines as the shares have pulled back from a peak.

Each company requires individual analysis to understand what’s truly compelling insider behavior.

#7. Data Quality Is Paramount

The SEC provides minimal oversight of Form 4 filing accuracy, and many data providers apply only basic parsing, often conflating purchases and awards as “acquisitions.” Understanding filing nuances requires accurate, granular data. Building a database on completely free data is difficult but not impossible. Because Form 4 disclosures can be incomplete or prone to classification errors, we’ve built processes that ensure maximum accuracy — an essential step no matter which data vendor or tool you use.

About VerityData’s Insider Selling Research

VerityData clients get access to more than 2,500 annual research briefs every year, including insider selling briefs.

Actionable Sell Briefs: Our highest-conviction sell research, where insider behaviors suggest meaningful price sensitivity or lack of confidence. These briefs are must-reads for anyone following the covered stock and can be used to help with short-idea generation.

Informational Sell Briefs: Examines behavior that could be concerning and/or provides context that offers proper perspective. They are important for followers of the stock and can be helpful data points. Often, we highlight nuanced behaviors and valuation signaling of particular interest.

Unusual Events: Throughout the platform and reports you’ll see our Unusual Events, such as “New 10b5-1 Plan” “Early Exercise-and-Sale” and “Cluster Sale.” These events allow you to drill into important transactions and disclosures more quickly.

Differentiate Your Research With VerityData

Discover how VerityData accelerates idea generation and risk management. Get access to 15+ years of the most accurate and complete data of its kind — includes insider activity, stock buyback initiations & quarterly repurchases, lockups, at-the-market offerings, 13F/D/Gs, management changes, and more — along with 2,500 annual research briefs from VerityData experts.

Outperformance Starts Here

See how Verity accelerates winning investment decisions for the world's leading asset managers.

Request a Demo