March 14, 2023

As Investors Get Nervous, Banking Insiders Buy at Near-Record Levels

The SVB Financial (SIVB) & Signature Bank (SBNY) failures are driving insiders to signal strength by buying their own stock at heightened levels. VerityData research analysts share a few examples.

In the aftermath of the SVB Financial (SIVB) & Signature Bank (SBNY) failures, many are doubting the resilience of the U.S. banking system, driving insiders to signal strength by buying their own stock at heightened levels.

In fact, there were purchases by 83 bank insiders disclosed on March 13, 2023 (buy dates March 9 to March 13). That’s the fifth-highest number of buyers disclosed in one day since the Great Financial Crisis.

Note that it’s become increasingly rare for insiders in an industry or sector to buy en masse like this. When they do it has historically signaled an inflection point. The recent binge of buying is comparable to August 2011 (debt-ceiling crisis/S&P lowering U.S. credit rating), January 2016 (oil price turmoil/economic growth concerns), and March 2020 (COVID-19 pandemic).

Below are a few excerpts from the numerous research briefs published by VerityData analysts and sent to customers shortly after our technology surfaced the unusual behavior.

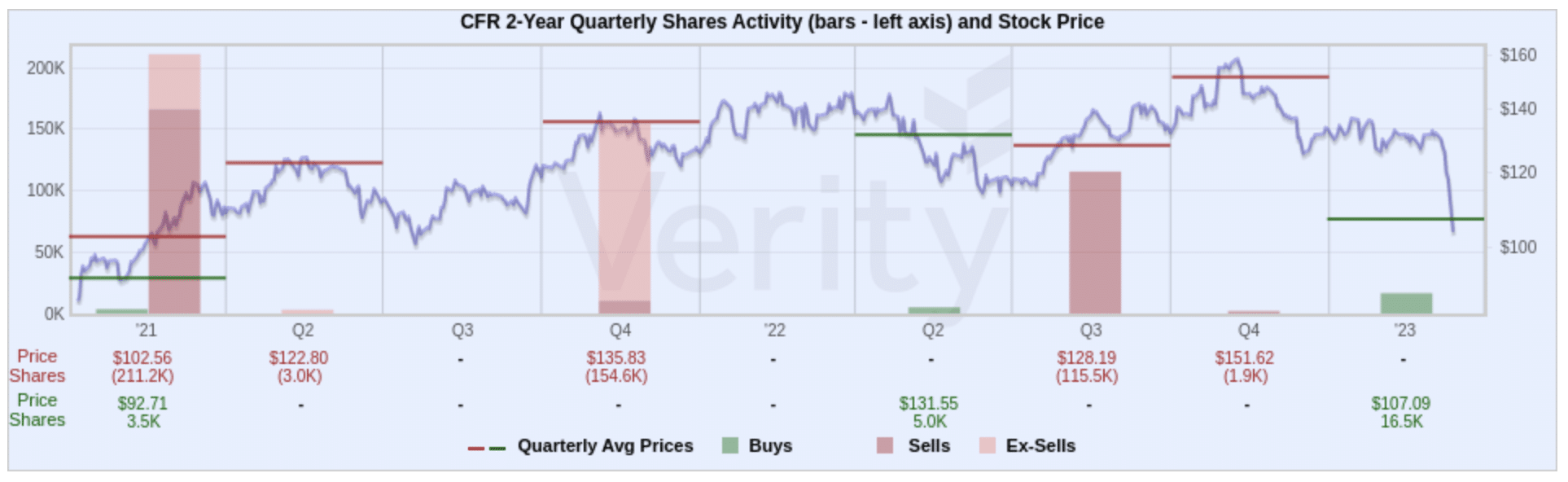

Cullen Frost CEO Makes $1M Buy, His First In At Least 20 Years; Director Adds $540K Buy

CEO Phillip Green Bought $1.0M in shares of the San Antonio-based bank at $106.59 on March 13 and Director Chris Avery chipped in a $540K buy at $108.09 the same day, marking the first multi-insider buying at the company in nearly three years.

Green’s buy was his first since our transaction database began on January 1, 2004 (he’s been an insider at the company the entire period), while Avery’s buy was his eighth since joining the board in 2015. It was his second-largest buy to date and it came at the second-highest price he’s paid. Both buyers showed conviction and, on a day when dozens of bank insiders bought stock as the sector was roiled by the failure of SVB Financial (SVB) and Signature Bank (SBNY), their conviction stands out.

Brief published 04/14/2023

Stifel CEO Buys $1.2M at $57.76 After Shares Dive

CEO Ronald Kruszewski bought $590K at $59.00 as shares dropped on March 10, then doubled down with another $575K across March 13/14 at $56.53, sending a positive valuation message at the investment bank.

Kruszewski and other insiders don’t trade often and they mostly have a sell bias. The purchase by Kruszewski is his third and follows an excellent buy in March 2020. His quick willingness to buy on the financial sector jolt lower amid news of the SVB Financial (SIVB) closure shouldn’t go unnoticed.

Brief published 04/13/2023

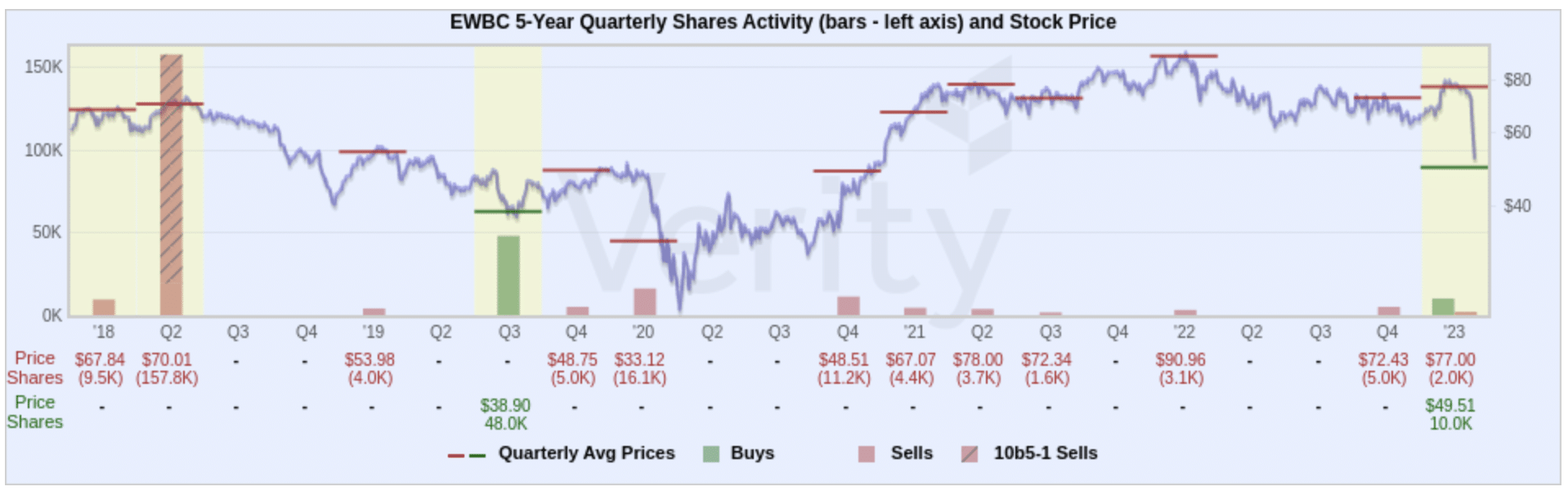

East West Bancorp CFO Buys on Weakness; Exec Has Short But Smart Track Record

The chief financial officer of the Los Angeles area-based bank that also has operations in China bought $495K at $49.51 on March 13, displaying compelling conviction as the stock was plunging alongside other regional banks.

CFO Irene Oh has a short but smart track record and on a day when dozens of insiders at small and mid-size banks disclosed buys, she was one of the few CFOs to do so. Oh bought less than two weeks after a performance-based stock vesting increased her holdings by more than 20%.

Brief published 04/13/2023

Bottom Line

As mentioned, these are but a few excerpts from a large cache of insider buying activity at banks. We’ll continue to track and monitor this activity for clients. What will happen remains to be seen. However, investors should pay close attention to names that were swept up in the rout of bank stocks despite not having the same type of issues with unrealized losses and deposits.

Get Full Access to Insider Activity & More

Data included in this report is sourced by VerityData | InsiderScore‘s comprehensive databases of insider trades, buybacks, at-the-market offerings, management changes, institutional investor disclosures, and more.

For access, request a free trial of VerityData | InsiderScore >>

Outperformance Starts Here

See how Verity accelerates winning investment decisions for the world's leading asset managers.

Request a Demo