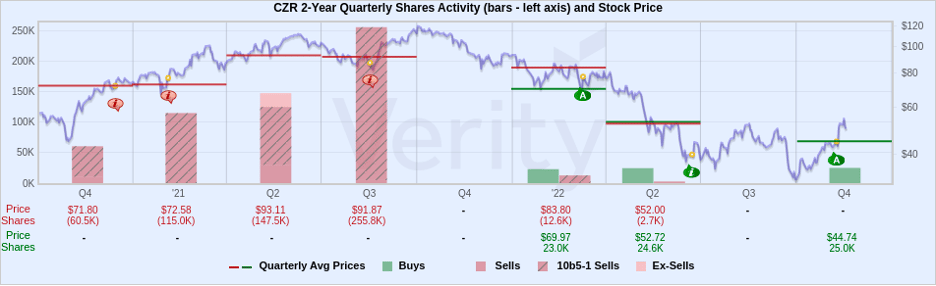

CZR Insider With History of Well-Timed Purchases Makes Largest Buy to Date

With his most aggressive buy to date, the director at casino and resort operator Caesars Entertainment spent $1.1M to buy at $44.74.

One of 2,500 annual insider research briefs from the VerityData analysts. Originally published 11/08/2022 and distributed to VerityData | InsiderScore customers.

Director Michael Pegram has been opportunistic in the past as he bought amid price troughs in 2016, 2018, and 2019. Outside of his March 2022 purchases, Pegram has shown a penchant for opportunistic buying and his return with the stock trading at ~2-year lows is notable, especially as he transacted his largest buy by dollar figure to date at CZR and its predecessor firm. With that background, Pegram’s buy should not go unnoticed.

History of Well-Timed Buys

Before this year, Pegram bought from November 2014 through September 2019 when the firm was known as Eldorado Resorts (former ERI). ERI gained an average of 42.5% and 36% six and 12 months out from his purchases during that Q4’14 – Q3’19 span. Pegram has benefited from ERI’s/CZR’s strong performance, but even so, he has picked his spots rather well amid various price troughs, most notably in Q4’16, Q4’18, and Q3’19.

Even with the effects of the pandemic, Pegram’s long-term positive sentiment panned out well as he eventually sold smartly at ~$110.50 in September 2021. He then reversed course in March of this year when he spent nearly $900K to buy at ~$69.00 which was clearly ill-timed. Now with CZR even lower, he’s returned with his most aggressive buy to date. It’s intriguing conviction that makes CZR worthy of additional review.

About the Research Brief

Data included in this report is sourced by VerityData | InsiderScore‘s comprehensive databases of insider trades, buybacks, at-the-market offerings, management changes, institutional investor disclosures, and more.

Outperformance Starts Here

See how Verity accelerates winning investment decisions for the world's leading asset managers.

Request a Demo