Case Study: $YEXT Execs Awarded Stock, Spike Follows

See how Verity analysts flagged unusual performance awards at YEXT ahead of the stock’s spike.

Tracking company stock-based compensation practices and deviations from expected behavior can be a powerful source for differentiated investment ideas.

When viewed through the correct lens, stock and option grants can be identified as opportunistic in nature, revealing undervalued signals or even presaging potentially material news.

A recent example at the small-cap technology firm Yext (YEXT) offers a case study in the value of the equity grant database and research unique to VerityData | InsiderScore.

Ahead of Earnings, YEXT Execs Receive Unexpected Stock Awards

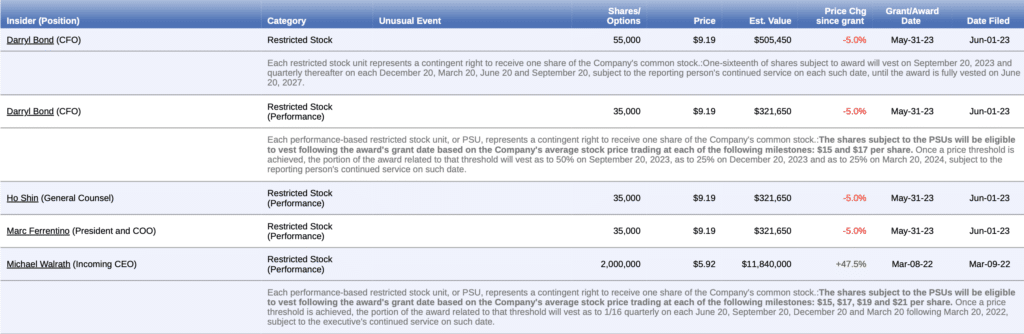

On June 2, with YEXT earnings set to be reported on June 6, VerityData issued a research brief to clients noting how three top executives of the AI and business analytics company were awarded unexpected stock awards on May 31.

Unusual Timing

The timing was unusual in that the award was granted just outside the four-business day window that would have triggered additional disclosure according to new SEC rules. The rules designed to curb the practice of awarding equity immediately prior to material news, including earnings releases.

Unusual Compared to a Previous Award

The awards were also unusual in comparison to a similar award that was granted to then-incoming CEO Michael Walrath. Walrath’s March 2022 award vests when the stock tops prices of $15.00, $17.00, $19.00 and $21.00. These new awards, meanwhile, have vesting targets of just $15.00 and $17.00.

While YEXT did not provide any detailed reasoning behind the award, Verity analysts stated “it’s reasonable to assume the company made an intentional decision to get these awards handed out prior to the upcoming earnings release.”

After Earnings, YEXT Stock Gains 46%

After the market closed on June 6, YEXT reported earnings that exceeded analyst estimates, while issuing upside guidance for the current quarter and the full year. On the earnings call, the company and analysts focused on the company’s positioning to take advantage of opportunities around generative AI.

YEXT shares closed at $9.25 on June 2, the day that VerityData’s research brief was issued to clients. On June 15, they closed $13.49, a gain of 46%.

Bottom Line

Companies have filed roughly 2 million transactions coded as stock-based compensation in the last 16+ years. Identifying how management is compensated and incentivized, and identifying unusually timed, sized, or constructed awards can provide valuable insight into valuation views, management incentives and actions, and board expectations, as well as unique investment opportunities.

Want Access to the Equity Grants Intel?

VerityData captures an array of data points around stock-based compensation and much more. Discover how leading institutional investors rely on VerityData for detailed and timely alerts and proprietary research that sparks differentiated investment ideas.

Outperformance Starts Here

See how Verity accelerates winning investment decisions for the world's leading asset managers.

Request a Demo