Something From Nothing: How to Spark Long Ideas From Unusual Pauses in Insider Selling

While most insider research focuses on insider buying as the lone long signal to look for, Cessation of Selling Events identify unusual changes in company-wide insider selling behavior that send compelling undervalued messages.

While most insider research focuses on insider buying as the lone long signal to look for, our proprietary Cessation of Selling behavior does not require insiders to buy. Instead, it focuses on unexpected lapses in insider selling.

The Cessation of Selling concept recognizes that generous stock-based compensation practices have made meaningful insider buying less common. Importantly, this allows us to find more frequent long ideas at high quality companies where insider buying is generally extremely infrequent, including instances where insiders have ceased selling due to an impending but as yet undisclosed corporate event.

Cessation of Selling Events: What Are They?

A Cessation of Selling event occurs when companies experience an unusual, unexpected pause in insider selling. It can be a powerful data point for sparking new investment ideas as well as mitigating risk in the portfolio. A key element when identifying a meaningful Cessation is understanding each company’s unique insider selling culture. Our research has found that companies that have stronger insider selling cultures, i.e. more consistent selling, generally have more meaningful Cessations.

Why Cessations Happen & What They Mean

Reason 1

Company-wide, insiders believe shares are undervalued/oversold, and they are unwilling to sell shares at a “depressed” price. Stock and option grants are a very important component of insiders’ compensation, often making up the bulk of their pay, and insiders often sell at regular intervals. Insiders may adjust the timing of their sales in order to get more out of their stock-based compensation. This may happen on weakness, but not always. An insider may decide: “Rather than generate liquidity from my stock-based compensation now, I’m going to wait until a later date when I believe the share price will be higher.”

Reason 2

Another reason for a lack of selling is a fairly obvious one: insiders may be legally unable to sell. For example, insiders could be prohibited from selling due to a material event (including M&A) that may be in progress. Several acquisitions over the past few years generated Cessation events including Fitbit (FIT), Carbonite (CARB), Tiffany (TIF), and Oxford Immunotec (OXFD). We had observed a Cessation of Selling at Kroger (KR) ahead of the news that it will attempt to combine with Albertsons (ACI). Disclaimer: Not all M&A events are preceded by Cessations, and in some situations if a material event happens quickly, there may not be enough time for a pause in selling to occur.

An Example

American Express (AXP) — In September 2022, insider selling ceased at the financial services giant, an unusual change in company-wide behavior that generated our Extreme Cessation of Selling Unusual Event.

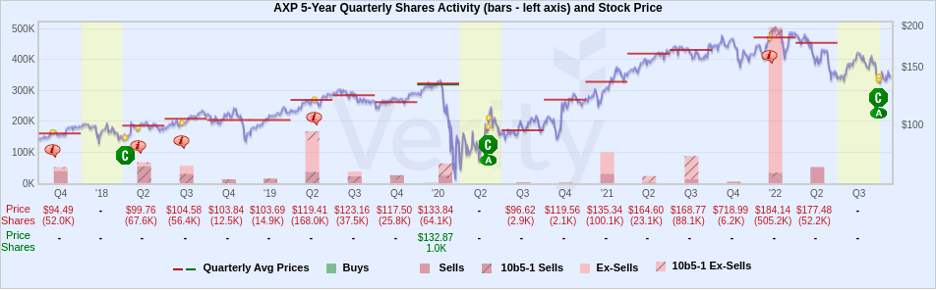

Click for full-size. AXP five-year history shows three Cessation of Selling Events — in Q2 of 2018 and 2020 as well as Q3 2022. Source: VerityData | InsiderScore

Insiders have been consistent sellers at AXP for more than a decade, so it stood out that none had sold since early June. It was the first calendar quarter without selling since Q2’20 and before that, it was also two years since the prior cessation. We note that buying is also uncommon at AXP, so any positive sentiment message is generally done through pauses in selling.

How Do You Surface a Cessation Event?

At Verity, we’ve developed proprietary algorithm to flag when companies are experiencing an unusual pause and alert clients when it happens.

To understand a company’s selling culture, we analyze the consistency of insider selling on a rolling multi-quarter and multi-year basis. Given that individual company selling cultures can vary, we’ve developed multiple methods to assess the selling culture, allowing us to best understand when insiders are deviating from each company’s specific baseline behavior.

Since we’re looking at multiple years of history and even one inaccurate transaction can misrepresent a Cessation, data integrity is the most critical pre-condition when identifying Cessations. Other data providers often incorrectly display non-discretionary selling, so we caution against trying to reconstruct Cessations on other platforms.

Bottom Line

Given the above situations, we believe that being aware of Cessations is a good risk management practice and a good reason to retest your conviction level. Cessations also represent a highly differentiated source for idea generation.

Take Advantage of Cessation of Selling Events

As a VerityData client, you will be alerted to these important behaviors with 1) Unusual Event Alerts in your reports and on the platform, 2) Research Briefs, and 3) integration within our various Excel templates.

Outperformance Starts Here

See how Verity accelerates winning investment decisions for the world's leading asset managers.

Request a Demo