Skeptical of a Deal Intelligence Platform? Here’s Why Private Equity Firms Should Take a Look

Here's why private equity firms should reassess whether their current tech ecosystem is working against their best interests.

In a survey of current solutions used by deal teams at PE firms, we’ve identified a missing link in the PE tech stack. It’s our stance that firms that take their most valued IP seriously have been underserved by CRMs, shared drives, and emails.

Our response is a new kind of software. A deal intelligence platform designed to give deal teams, operating partners, and finance more real-time power and control to win over people and close deals. Not to mention, help to create value post-investment.

Throughout the development of our solution, we’ve interfaced with private equity firms, industry consultants, and other industry stakeholders to fully grasp the problems at hand, and to better vet how Verity can add value.

What follows represents transparency into those conversations as well as our response.

Before we get started, first principles.

- Price and relationships close deals.

- Relationships are the difference when price is similar.

- PE firms rely on proprietary research & relationship intelligence to win the popularity contest with target companies.

- Your connection to intelligence should be instant.

If this rings true to you, and you’re open to reimagining how your firm manages deal-critical intellectual property, keep reading.

“You Say ‘Missing Link.’ Doesn’t This Technology Exist?”

Certainly, there are CRM or CRM-like solutions for private equity teams that store deal-related information and that want to be an all-in-one solution.

But the reality is that much of what matters — the true intelligence — is handicapped in these systems. That it is if it even makes it in there.

If you’re on the deal team, finding what you need when you need it requires considerable effort: last-minute phone calls, urgent emails, scouring of the shared drive. These activities are the Elmer’s glue that connects the individuals with intelligence they need. Like Elmer’s glue, they are better than nothing, but shouldn’t be relied on to hold anything of great importance together for any length of time.

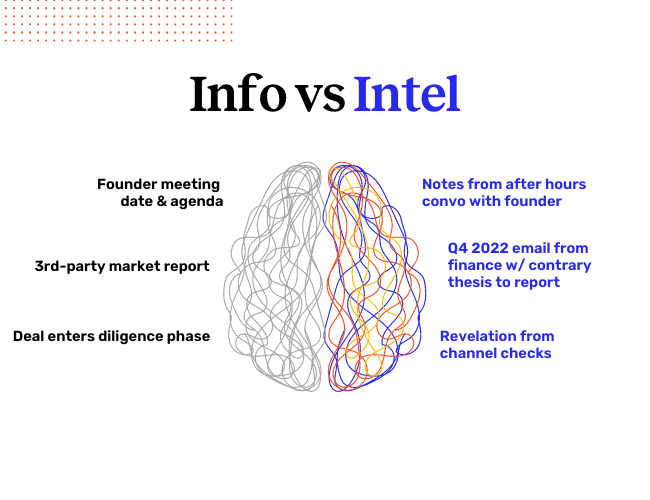

Existing solutions struggle to discriminate information from deal intelligence. It’s hard for it to rise to the top when it’s needed.

With VerityRMS for Private Equity, finance, deal, and ops teams can easily:

- Push intelligence into the system.

- Pull intelligence out of the system.

Whether you’re on the road meeting with management or working from home or office.

“We’ll Never Replace Our CRM.”

We couldn’t agree more. If you already have a CRM, it’s your golden record for the simple fact that a company exists on the team’s radar. It lets you track companies and deals by stage, from sourcing to closing.

But simply knowing a deal exists in Stage X isn’t enough. It’s the critical intel you’re gathering along the way that actually helps you to get to the closing table.

So, by design, our platform complements your existing CRM and can close the distance between your team and the intelligence they need to access on the road, before meetings.

For teams that don’t have or are less than completely satisfied with a CRM, our platform easily fulfills that basic function while adding another layer of value.

“The Deal Team Is Too Busy for More Software”

The deal team doesn’t always have time to manually update records or files within their traditional CRMs.

This is precisely what we’ve designed for within our deal intelligence platform.

However, we’ve reframed this, “The deal team doesn’t want to waste time on trivial and low-value activities.”

That’s another reason why our platform is a missing link. We’re trimming low-value activities — like entering data into numerous systems, retrieving data from numerous systems — out of their day-to-day reality.

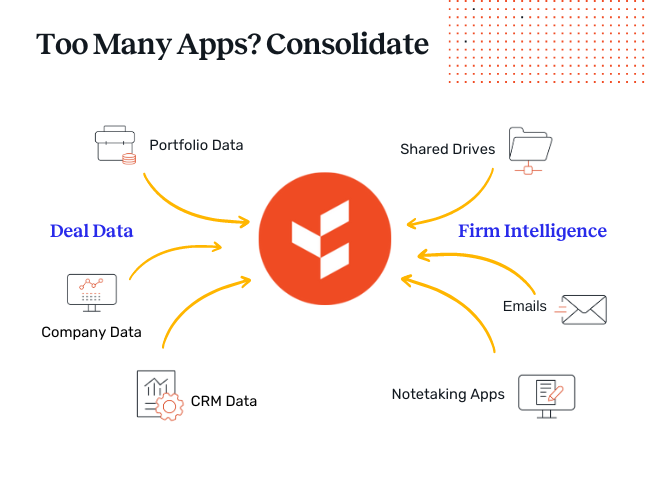

“You’re Suggesting We Add Another Tool. Aren’t You Contributing to the App Overload Problem?”

From a distance, it looks like we’re compounding the problem. Another app to switch to. Another place to lose information. More software to learn.

Switching between applications to gather data on specific clients or projects is frustrating and time-consuming. More than a minor nuisance, it’s a large and underreported drag on team efficiency, effectiveness, and overall deal velocity.

However, it is precisely this problem that we’re addressing. Our deal intelligence platform connects with all of the apps you use and need. We’re simply bringing the deal-critical elements together so your teams have one place to go to access it and put it to use.

“Isn’t Verity Focused on Public Equity? What Can You Bring to the Private Side?”

Historically, yes, Verity has a reputation for partnering with large and sophisticated public equity firms managing tens and hundreds of billions of dollars. Over the past several years, though, as public market players have turned into hybrid shops with private equity fund vehicles, we’ve evolved with those clients. So while VerityRMS for Private Equity is a new product launch, we’ve been supporting PE for years.

In truth, the differences between public and private equity are surface level: how teams talk about their work (deals vs ideas), the vendors they get data from.

Zoom out, though, and there is much in common. Both are direct investors. Both have a bias for (and pride in) their diligence and research — and place a premium on being able to act quickly and confidently. Both create large volumes of information that will later be a deciding factor in their success.

See How It Works

Intelligence is power. Unlike CRMs or shared drives, we think VerityRMS for Private Equity puts more power into the hands of deal teams to win over management and ultimately close deals.

With everything, the devil is in the details of course. To see how it works, I encourage you to check out the deal intelligence platform page and/or schedule a short demo with me to tour the platform.

Outperformance Starts Here

See how Verity accelerates winning investment decisions for the world's leading asset managers.

Request a Demo