3 Reasons Why Asset Managers Stumble Toward a Solid ESG Investment Process

Find out how asset managers are navigating the labyrinthine world of ESG & impact investing with process and workflow improvements.

The investment management community continues to play catch up with constantly evolving investor demands, new frameworks, shifting regulations, and more. Despite that, certain managers are finding ways to differentiate their ESG and impact credentials, while future-proofing their processes and operational effectiveness.

Why Your ESG Investment Process Matters

Fund managers are increasingly on the hook with investors to be true stewards of client capital, not just generating returns but demonstrating impacts. Whether they like it or not, these stewardship questions are likely here to stay, and are only getting more granular.

Questions that were once as simple as, “Do you have an ESG policy in place?” have become more probing. The latest DDQ template from PRI suggests investors ask funds more pointed questions, like:

- How have you … ?

- Are you actively … ?

- When did you last … ?

Leading LPs and pension funds are going even further.

The fact is, clients want proof of engagement and impact. They are hungry for a cohesive story around their investments — regardless of how fragmented the landscape is.

In this article, I’ll share a few of the growth areas we’ve identified at Verity as we help our customers adapt to this new era of investing.

ESG Process Problem: Inconsistent ESG Data Capture

One of the biggest challenges funds face is often not top of mind. It’s capturing the ESG data in the first place. The solution starts with integrating ESG into the daily work of the investment team. For some asset managers, that’s already integrated into their ethos. For many, often larger managers, this is no small task. Either way, ESG needs to be part of the process — without adding steps and time to the process

Analysts and fund managers have the most frequent access to companies. They’re more intimately familiar with the companies, sectors, and competitors than anyone else — yes, even ESG officers, etc. — in the fund. How do funds give them the tools they need to do their jobs more efficiently, while effectively capturing their insights from engagements?

Clients expect to see ESG and stewardship integrated into the investment process. ESG “after the fact” is not only less accurate for reporting purposes, it’s not proper stewardship or engagement. The fastest, most consistent, and most exacting path to differentiate your ESG process is through the investment team. Doing so requires easy and efficient data capture.

>Make ESG Easy for Analysts

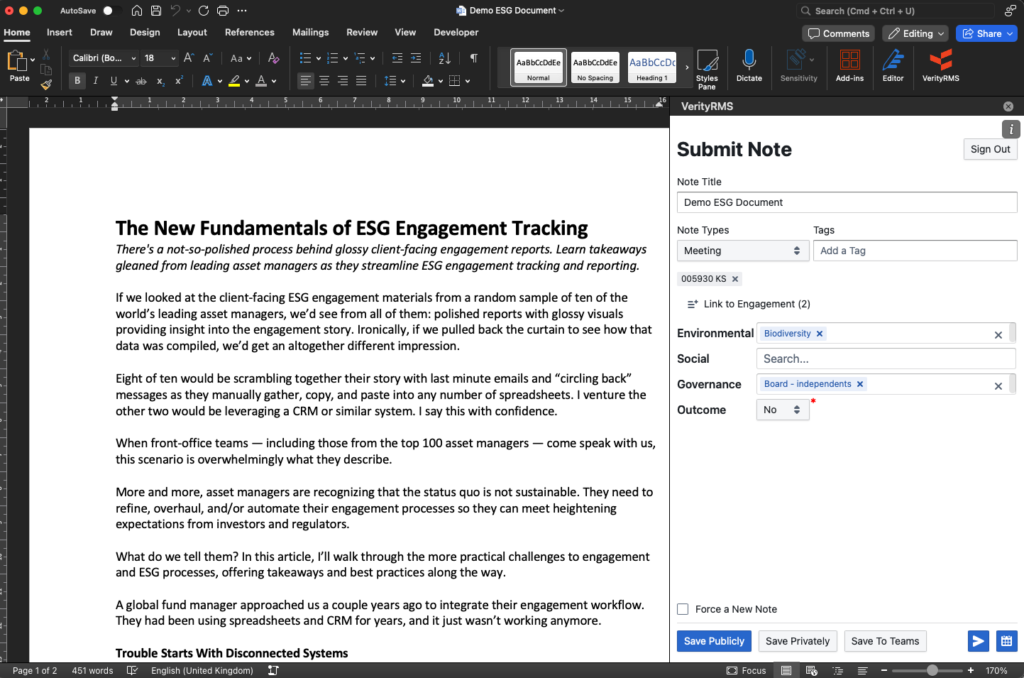

It’s with this feedback from customers that we continue to make ESG data capture as simple and intuitive as possible in VerityESG, a standalone ESG engagement tracker, as well as in VerityRMS, a research management system.

Features like automated Office add-ins, NLP/AI search, and fully configurable templates take steps out of a cumbersome process and remove inconsistency and uncertainty around data capture – all while integrating with the investment team’s existing processes.

ESG Process Problem: Spreadsheets

Spreadsheets have their purposes. For engagement reporting, they are at best manual and cumbersome, and worst inaccurate and siloed. Beyond that, they aren’t particularly competitive. ESG reporting – especially to satisfy client questions to a differentiated degree – requires a level of automation and scale that most fund manager’s existing technology stacks aren’t prepared for yet.

>Adapt With Automation

Many funds are using modern, purpose-built software to thoughtfully implement best practices and automate reporting. It makes it easier to give accurate, timely answers to clients and regulators alike. Keep in mind that automation requires a certain level of scalability. Trying to achieve this with a spreadsheet is fitting a square peg into a round hole.

>Integrate Into the Portfolio

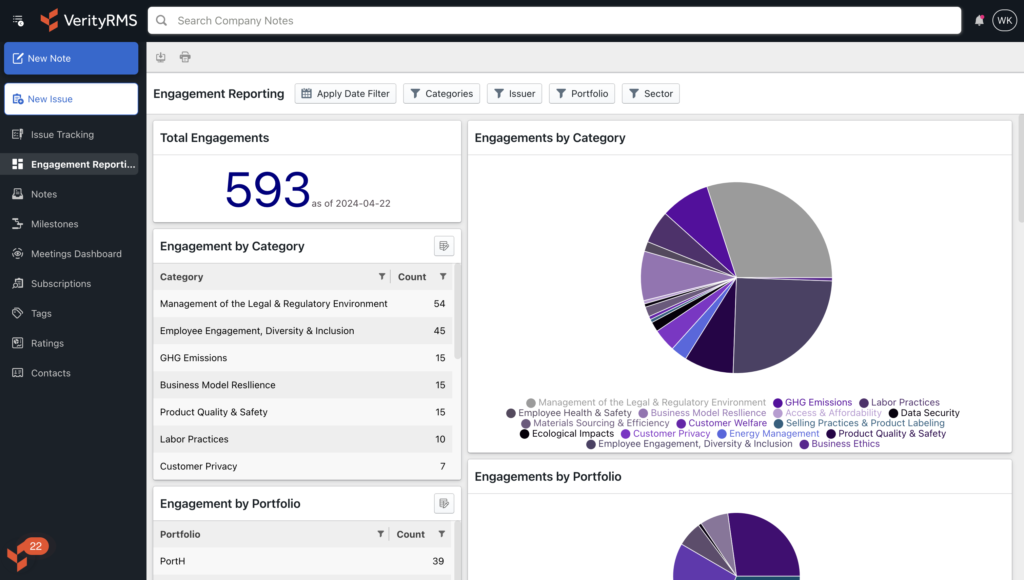

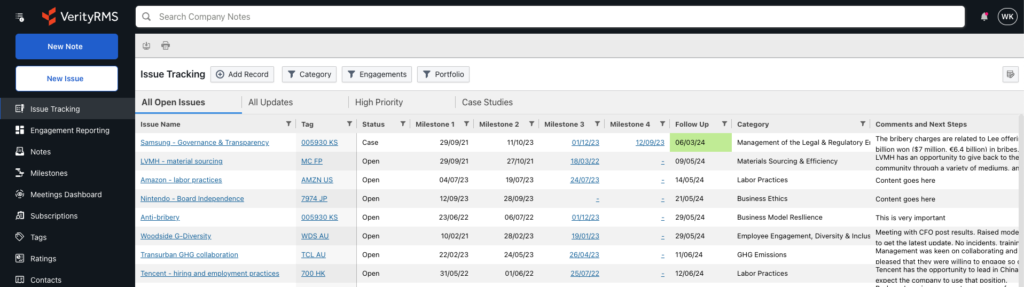

When you bring ESG and engagement data together you can make investor and regulatory reporting more effective and automated. It’s why we’ve worked with funds to develop another instrumental ESG transformation: an engagement tracker that gives funds an integrated view into precisely what’s been done and where.

What’s more, asset managers can easily visualize and report on their ESG data at a portfolio level – fully automated and integrated. No manual steps, no data delays, just the latest data, holdings and ESG insights in one place.

More and more, investors want to know about the real-world impact of their investments. Tracking engagement helps get you prove it.

[CLICK TO EXPAND] The ESG engagement tracker in VerityESG.

ESG Process Problem: Patchworked Reporting

Answering investor questions around engagement or similar can become a forensic dive into a mess of data. One of the core challenges for many funds is pulling all this together to tell a cohesive story without a herculean effort.

>Uniting Your Data Mosaic

At Verity, we are seeing success and efficiencies when funds are eliminating data silos, bringing their relevant data together to provide investment teams with the insights they need.

What good is ESG data if it sits in a spreadsheet or file server?

Empowering ESG teams and fund managers with relevant data — voting history, ESG ratings, company reported data, etc. — from across your ecosystem not only makes them more informed, it also builds the firm’s ESG mosaic in a smart, scalable way.

If you want to build the story, you need to bring the data together. It’s a driving reason for many funds as they engage with Verity to transform the processes for ESG and sustainable investing. They can pipe data in together so teams can access, use, and share it.

Bottom Line

Disparate systems, lack of automation, and haphazard workflows are putting up a lot of resistance for fund managers and ESG teams.

ESG and engagement questions are only going to get more granular. Leading funds have already started addressing these problems with a guiding principle: ESG should work for you, not the other way around.

Start Making Headway With Your ESG Investment Process

Verity offers a purpose-built ESG engagement trackers that helps funds capture data, track the full engagement lifecycle, and streamline compliance and reporting. All in one integrated and configurable software platform.

Outperformance Starts Here

See how Verity accelerates winning investment decisions for the world's leading asset managers.

Request a Demo