The Executive Compensation Data Investors Actually Need. New From VerityData.

The new Incentive Compensation Dataset from VerityData was built with investors, for investors, to eliminate slow manual data wrangling and elevate differentiated insights.

Management incentives are a critical input for investment decisions. But disentangling that information from proxy filings has been extremely time-intensive. That’s why, for the past year, we’ve been sitting down with portfolio managers, analysts, and governance teams to build an executive compensation dataset that actually meets the needs of investors.

We wanted to go beyond just capturing numbers from filings. Instead, we focused on elevating and organizing the changes that matter. The result? We’re helping investors quickly understand how executive pay structures shape corporate behavior and what those incentives reveal about the underlying motivations that will impact future performance — without the time-consuming process of pulling data themselves.

Said one portfolio manager:

"This dataset could be one of the most valuable in the space.”

The Problem With Existing Compensation Databases

These conversations we had with investors reinforced what we already knew: most executive compensation data today is too static, too slow, and takes too long to interpret. Analysts and governance teams don’t just need to see what a CEO got paid last year. They need to understand the incentives behind that pay, how they may have changed year over year, how they compare to industry peers, and access it all instantly, without poring over dense filings.

It’s not that data providers don’t track executive pay. They do. But solutions often share compensation figures in lengthy reports without context, leaving analysts to do the heavy lifting.

Many investment teams try to take it on themselves, but it’s not easy.

As one data scientist told us:

"Parsing proxies is the hardest thing we’ve tried to do, and we haven’t been successful.”

Investors already know where to find executive pay data. It’s in proxy statements. The problem isn’t access; it’s usability. These filings are dense, filled with legal jargon, and often bury important incentive details deep in footnotes.

Instead of forcing investors to spend hours piecing together information from scattered sources, VerityData’s Incentive Compensation Dataset does the work for them — surfacing key trends, tracking incentive changes, and enabling quick company comparisons.

“Having a database of stock price targets and incentive structures would be a huge time-saver.”

Designed for Investors: VerityData’s Incentive Compensation Dataset

VerityData’s Incentive Compensation Dataset is designed for investors who don’t just want data, they want differentiated investment insights as quickly as possible.

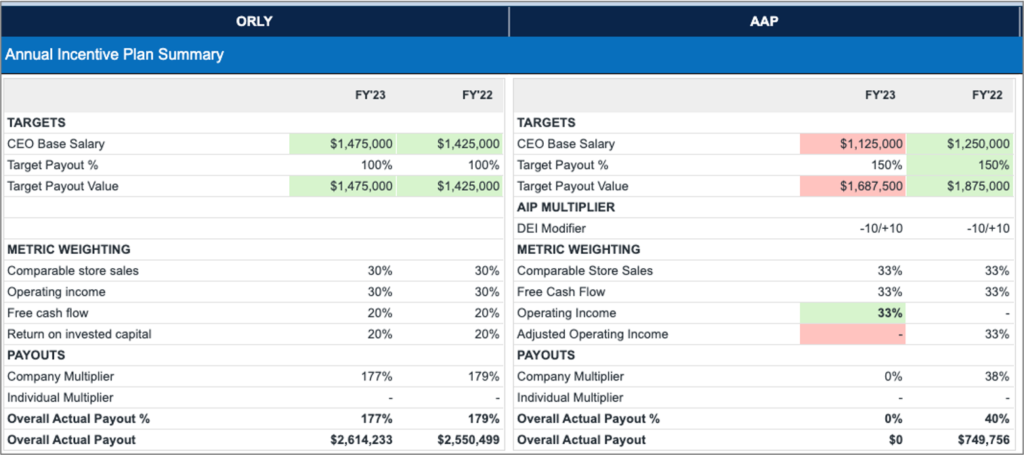

Rather than just reporting last year’s pay package, VerityData helps investors answer critical questions without tedious data extraction — across both a company’s annual incentive plan and its long-term incentive plan.

- What are the specific metrics driving management motivations?

- How are these metric weightings changing year-over-year? Are there new metrics?

- For long-term incentive plans: what’s the breakdown of Performance vs. Restricted vs. Options payouts? Is the pay-package shifting in advantageous ways?

- How do their plans and incentives compare to peers?

- How did the company perform vs. metric targets? Does management sandbag?

One investor immediately saw the power of this approach:

“Screening on highest RSU changes and non-financial metrics resonated. This is a gap in what’s available today.”

With VerityData, investors can quickly screen for anomalies, compare across companies, and track changes in real-time.

5 Ways Investors Are Using This Executive Compensation Database Today

The value of VerityData’s Incentive Compensation Dataset is in how much time it saves investors and the differentiated insights it helps generate. Here are just a few ways firms can streamline their research and idea generation.

1. Company Deep Dives & Investment Thesis Alignment

Understanding management incentive compensation is a standard part of many firms’ due diligence research process. It’s a cumbersome and painful exercise for analysts. By using VerityData, analysts can focus on what matters: the critical analysis

- Is management aligned on the metrics that support your investment thesis?

- Is there appropriate risk in the incentive plan structure to motivate management decisions around your key drivers?

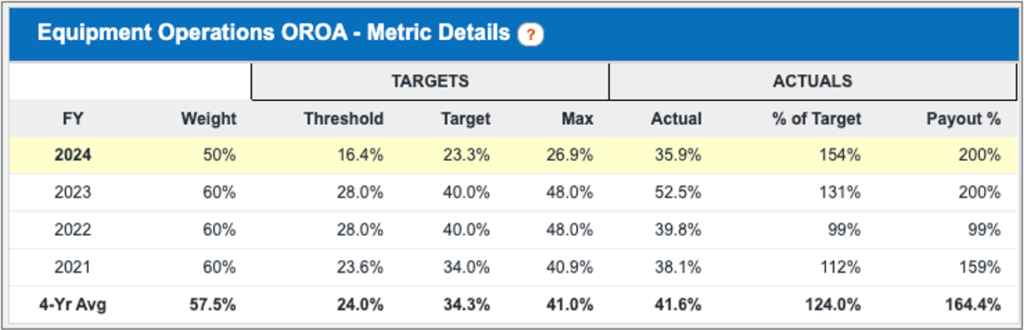

With multiple years of history, analysts can easily see how incentives — and ultimately, motivations — are changing or not. The actual metric-level detail provides perspective into whether management is sandbagging targets or maintaining reasonable and stretch goals.

With VerityData, you can review metric-level details including targets, actuals, and payout amounts. How aggressive is a company versus your model? Does management sandbag?

2. Differentiated Idea Generation

Compensation data isn’t just a governance tool. It can be an investment signal.

When a company suddenly shifts its incentive structure — say, from profit-based to revenue-based — it can reveal an underlying shift in strategy. When a company adjusts its long-term incentives to favor one type of instrument more heavily, it can offer insight into management’s risk tolerance.

One hedge fund PM saw this immediately: “A shift from all options to RSUs is something I consider bearish.”

Others are using VerityData to screen for unusual executive pay structures in seconds, not hours.

3. Proxy Voting & Shareholder Activism

Institutional investors need to know when executive pay is out of sync with performance. But they don’t have time to sift through thousands of pages of proxy filings. With VerityData, governance teams can screen for outlier pay structures, track shifting incentive metrics, and quickly identify potential shareholder red flags.

4. Pay-for-Performance Alignment

It’s easy to say a company pays for performance. Does it really?

VerityData lets investors track changes in incentive structures, comparing a company’s historical pay metrics against shareholder returns — without having to track down past disclosures.

Most companies claim to have a pay-for-performance structure. But do they? Just because an executive earns a massive bonus doesn’t mean they delivered long-term value to shareholders.

That’s exactly what the Incentive Compensation Dataset is built for: helping investors spot misalignments instantly, rather than wasting time compiling incentive data.

5. Peer Benchmarking

Not all pay packages are created equal. Investors need to know how a company’s executive incentives stack up against peers — without having to collect and format the data themselves. From comparing the types and weights of the metrics to the value of the overall compensation plan, the deeper you go the more insight you can derive.

With VerityData, firms can easily benchmark executive pay against industry peers and track changes over time.

The New Benchmark for Executive Compensation Data

Regulatory shifts over the past decade — from say-on-pay votes to increased disclosure requirements — have forced companies to be more transparent about executive compensation. But transparency alone isn’t enough. As more data floods the market, investors need better tools to extract meaningful insights without spending days compiling information manually.

That’s why we built VerityData’s new Incentive Compensation Dataset: to cut through the noise and surface what actually matters quickly. We’re excited to bring a new level of clarity and efficiency to executive compensation data. And we’re just getting started.

Get Early Access to VerityData’s Incentive Compensation Data

If you’re still relying on outdated, time-intensive methods, you’re wasting valuable resources. Get in touch to see how VerityData can help you turn executive compensation data into instant, actionable insights.

Want to see how VerityData can save you hours of tedious research?

Outperformance Starts Here

See how Verity accelerates winning investment decisions for the world's leading asset managers.

Request a Demo