SEC’s Required Digital Filing of Form 144s Provides Opportunities & Pitfalls for Investors

The new requirement offers insights into insider sales, but only if used wisely. Verity's Head of Research explains.

Table of Contents

Effective April 13, 2023, the SEC required that all Form 144s be filed electronically through the EDGAR system. Previously, these important filings related to sales by insiders and others were largely filed on paper via mail or fax, hand-processed in an SEC office, only made available in-person for 90 days at the SEC library, and then destroyed. Only a small percentage of these filings were available digitally, and most of those were in PDF format, making data extraction difficult.

The electronic filing requirement brought an end to this regulatory oversight and increased transparency into insider selling for investors. However, Form 144s are an odd creature and while there are many advantages to analyzing Form 144s, the timing of and the information contained in such filings can cause confusion and result in wasting one thing investors can never get back – time.

We have added Form 144s to our database of filings and are parsing out the critical information contained in the filings. Read on to understand how Form 144s can help inform your investment process but pay close attention to the drawbacks of Form 144s. To get maximum value out of Form 144s and to avoid potential “information traps”, you should use Form 144s in conjunction with Form 4s and an insiders’ trading history.

What Are Form 144s? Intent to Sell Disclosures

Insider transactions – including all purchases, sales, option exercises, equity grants and awards, gifts, and transfers – are required to be disclosed within two business days of the transaction on a Form 4 filed with the SEC.

Form 144s disclose only an intent to sell restricted or control securities valued at over $50,000 or comprising more than 5,000 shares within a 90-day period following the filing. The filings relate only to sales expected to occur within that period and do not disclose the actual transactions. Form 144s can be filed up until 10:00 PM ET on the day the sale order is given to the broker.

Form 144s Filed by More Than Just Insiders

Insiders are members of a company’s board, key executives (including the principal executive officer and principal accounting officer), and 10% shareholders. These are the people and entities who must file Form 4s.

Form 144s are filed by insiders and by others. That’s because the filings relate to the sale of certain types of securities. For example, a former executive who, years after leaving a company received shares through performance-based restricted stock vesting, may file a Form 144 disclosing their intent to sell those shares. Additionally, investors who bought shares outside of a registered offering (example: pre-IPO investors) may file Form 144s when they intend to sell those shares.

Information Advantages to Form 144s

The biggest advantage of Form 144s is that intended sales of shares of foreign private issuers are often disclosed. Companies such as Sweden’s Spotify (SPOT) and China’s Baidu (BIDU) trade on U.S. exchanges but are not required to file the same disclosures as U.S. companies. This includes insider trades. Tracking down insider trading information about such companies can be difficult but Form 144s help provide a window into what insiders and others are doing at these companies.

One of the disclosures required to be made on Form 144s is any sales during the prior three months. While this data is available on Form 4s for domestic issuers, it’s not on Form 4s for foreign private issuers, meaning that with the new digital filing rules we can start building some insider trading histories at these companies.

Another advantage is that Form 144s are required to be filed before the actual sale. With the new digital filing rule that means that Form 144s are often publicly available before the Form 4 that will report the actual sale.

As noted, it’s not just insiders who file Form 144s. Being aware of sales by former executives and other shareholders not required to disclose actual sales on Form 4s can provide important insight into the actions of people and organizations who themselves have or have an information advantage or were simply long-time shareholders.

Lastly, one of the disclosures required on Form 144s is an accounting of how the shares to be sold were acquired. This information can provide insight into how an insider manages their holdings. Are they selling shares acquired years ago or just recently?

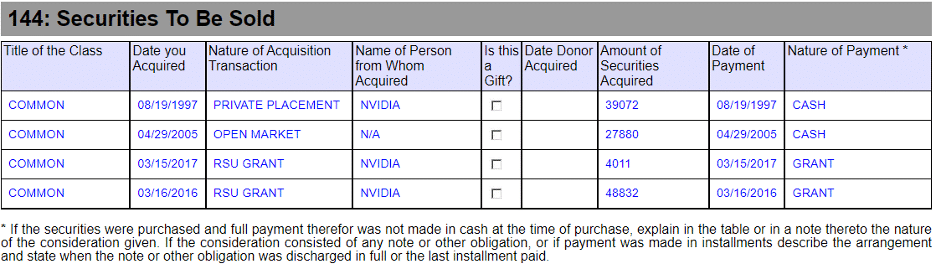

The graphic below shows a portion of a Form 144 filed by a director of NVIDIA (NVDA). The Securities To Be Sold table shows that he intended to sell shares acquired over a 20-year period, including some he bought in a private placement and others he received via annual stock awards.

Form 144 Has Serious Drawbacks

Form 144s provide an incomplete picture of insider activity and can be confusing.

The biggest touchpoint for confusion is when a Form 144 is filed and the subsequent Form 4 disclosing the actual sale that does not involve the same number of shares. This could be because the insider intends to sell 90,000 shares over the next 90 days using a Rule 10b5-1 plan in increments of 30,000 shares once a month. It could also mean that the insider intended to sell a certain number of shares but wasn’t able to.

Form 144s don’t have accurate pricing information. Because Form 144s are filed prior to sale, there’s no price of sale reported, just an actual value of the proposed sale based on the then current market price (often the previous day’s close). The benefit of Form 4s is the filings include pricing information that can help investors identify minimum sale price thresholds and trigger prices, creating important valuation-related insights and context.

A common Form 4 disclosure is sales related to covering the taxes on restricted stock vestings. These sales are often accomplished via withholdings by the company or non-discretionary sell-to-cover transactions. Such sales are largely meaningless when it comes to analyzing insider activity. On Form 144s, these intended sales look just like any other intended sale.

If the securities an insider sells were not restricted or control securities, they don’t have to file Form 144s. This means that solely monitoring Form 144s would result in missed sales. Additionally, sales by family members of insiders are not required to be reported on Form 144s even if such sales may be required to be reported on Form 4s.

The excerpt below from a Form 144 file by the CEO of Chewy (CHWY) discloses an intent to sell shares. The sale was to cover taxes on a restricted stock vesting, something he’s done each year since 2000. The Form 144 does not provide that meaningful context and the sale does not provide investors with any meaningful data points.

Example at Global Payment (GPN)

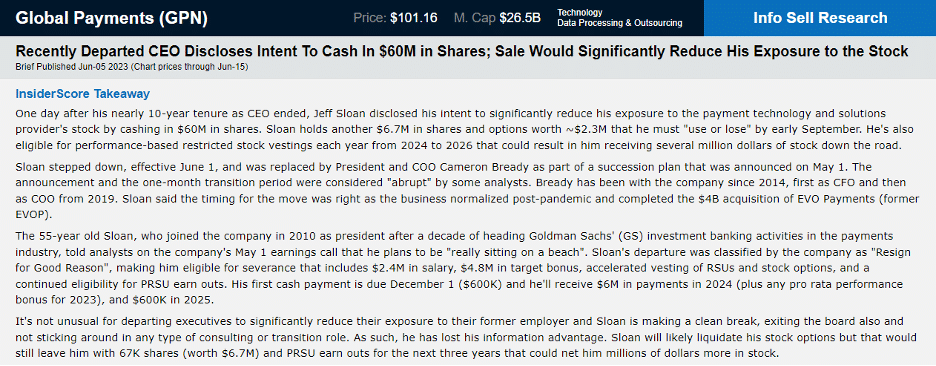

Global Payment (GPN) announced on May 1, 2023, that Jeff Sloan would resign as CEO effective June 1, an announcement that some Wall Street analysts deemed “abrupt.” Sloan’s resignation meant he was no longer considered an insider, and therefore not required to file Form 4s for trades executed after his departure.

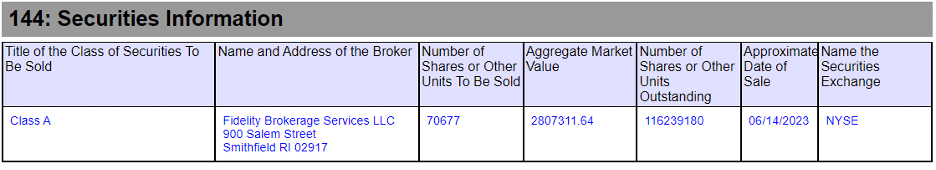

Late on Friday, June 2, Sloan filed a Form 144, signaling his intent to sell about $60M in stock, which would clear out most of his stock ownership. Without context, such a large sale could be interpreted as a lack of confidence. When you include a broader, more diverse range of data points (in this case: earnings transcripts, macro management change trends), the sale is much less suspect of opportunistic behavior.

We explained the situation to our clients in an research brief, excerpted below.

The 55-year old Sloan, who joined the company in 2010 as president, told analysts on the company’s May 1 earnings call that he plans to be “really sitting on a beach.” Sloan’s departure was classified by the company as “Resign for Good Reason”, making him eligible for severance that includes $2.4M in salary, $4.8M in target bonus, accelerated vesting of RSUs and stock options, and a continued eligibility for PRSU earn outs. His first cash payment is due December 1 ($600K) and he’ll receive $6M in payments in 2024 (plus any pro rata performance bonus for 2023), and $600K in 2025.It’s not unusual for departing executives to significantly reduce their exposure to their former employer and Sloan is making a clean break, exiting the board also and not sticking around in any type of consulting or transition role. As such, he has lost his information advantage. Sloan will likely liquidate his stock options but that would still leave him with 67K shares (worth $6.7M) and PRSU earn outs for the next three years that could net him millions of dollars more in stock.

Bottom Line

The digital filing requirement for Form 144s offers more insights into insider selling, especially in foreign private issuers, but requires careful handling. Its limitations can cause potential confusion, so is best used in conjunction with other data points By using Form 144s alongside Form 4s and an insider’s trading history, investors can gain a better understanding of insider activities and make more informed investment decisions.

How We’re Interpreting Form 4s, 144s, & Other Insider Activity

With VerityData | InsiderScore, we’re alerting institutional investors to important movements on the companies they track, with 10+ structured datasets and 2,500+ research briefs published annually. Reach out to see how it works.