How to Generate Investment Ideas From Insider Equity Grants

VerityData research analyst dives into stock-based compensation, its importance, and how to use it to find investment ideas.

Stock-based compensation is another powerful source for generating investment ideas. The raw data available from the SEC, however, is difficult to glean insights from.

In this article, I’ll share a few ways that our research team screens the equity grants database available in VerityData | InsiderScore as we put together regular research briefs for our customers.

As is the case with other insider behaviors, deviations in insider grant behavior at individual companies can offer opportunities for differentiated idea generation.

Three Types of Equity Grants

At VerityData, our technology harvests three types of equity grants. The research team tracks movements on these with emphasis on the first two.

Stock Options, which have a strike price and are typically cleaner, more consistently disclosed than other types of awards/grants.

Restricted Stock Units are zero-cost basis shares. Compared to the others, RSUs are more likely to have performance-based vesting criteria, and these performance-based RSUs may be disclosed at the time of award or at the time of vesting.

Deferred captures deferred compensation, employee stock purchase programs, dividend reinvestments, and similar programs. We do not view deferred awards/grants as typically meaningful.

One exception is that a small subset of performance-based awards — those measuring performance against a benchmark or peer group — do not have to be disclosed at the time of the grant. Those are instead disclosed at the time of vesting and are included in our database at that time.

With that in mind, here are a few ways you can analyze stock-based compensation.

Discover Opportunistic Behaviors

There is precedent for companies sometimes changing their equity-granting behavior to capture low prices. If these grants come ahead of material news, the practice is sometimes referred to as “spring loading”, a practice the SEC has been looking into.

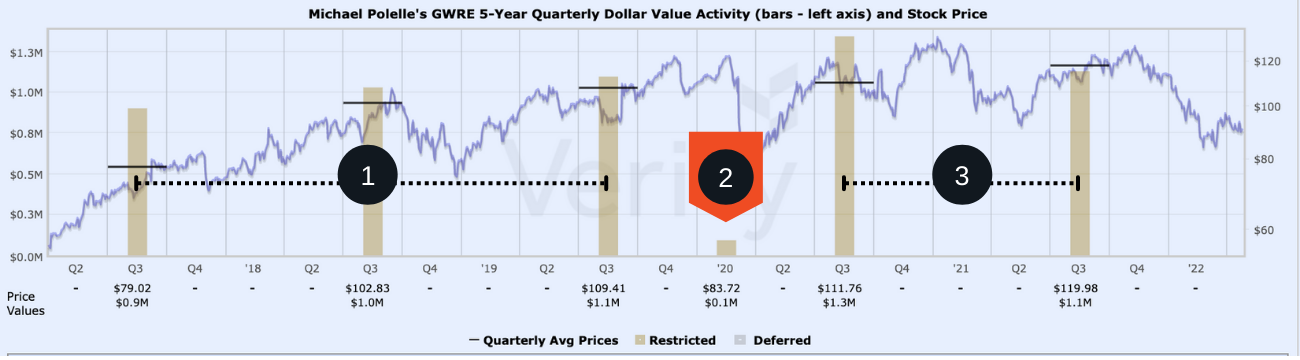

In the example of Guidewire Software (GWRE), the company added an extra, off-cadence grant near its pandemic low. Performance-based restricted stock awards given to the CFO, COO, Chief Delivery Officer, and CAO on March 10, 2020, were unusual because the company typically doles out such awards in September. The timing of the awards on weakness suggests valuation-based opportunism.

Source: VerityData

- On-Cadence — The board typically handed out performance-based awards in September of each year.

- Off-Cadence — Shares down 33% from all-time high at the time of off-cadence March 2020 award. The issue would eventually hit a 27-month low of $71.64 on April 3 of that year.

- Return to On-Cadence — Shares quickly recovered and GWRE returned to its typical award cadence.

Get Insights Into Company Growth Outlook

It is common for a portion of equity-based compensation to have performance-based vesting conditions. This condition can be a fundamental target (e.g. Revenue or EBITDA), a price-based/shareholder-return target (absolute or relative to a benchmark), or event-based (e.g. an FDA approval or a production target) or a blend. These targets offer insight into what the company believes are achievable quantitative or qualitative forward-looking goals.

Make Inferences on Overall Trends

In reviewing this data at a company level, we can see shifts in equity compensation trends and make inferences based on them.

For example, a shift from granting zero-cost-basis restricted stock to options suggests a shift of the risk/reward profile in a more aggressive direction, while shift from options to restricted stock is a more conservative move.

Glean Valuation Insights

Price-based vesting targets offer a marker for what the company sees as an achievable return for the period being measured. These targets can be compared to fundamental growth estimates and other datapoints to inform forward-looking valuation estimates.

CloudFlare (NET) provides a useful example. In a brief we shared with VerityData customers in December 2021, we noted that CEO Matthew Prince and COO Michelle Zatlyn had each received 3.96M options with an exercise price of $136.81 comprised of eight tranches that become eligible to vest on achievement of certain stock price targets within 10 years of December 22, 2021. The number of options that vest increases at successively higher price targets as noted in the table below.

| Tranche | % of Award Earned | # of Options | Stock Price Targets | Value at Target |

| 1 | 5% | 198,000 | $156.00 | $3,800,000 |

| 2 | 5% | 198,000 | $203.00 | $13,266,000 |

| 3 | 10% | 396,000 | $263.00 | $50,292,000 |

| 4 | 10% | 396,000 | $343.00 | $81,972,000 |

| 5 | 10% | 396,000 | $446.00 | $122,760,000 |

| 6 | 20% | 792,000 | $579.00 | $350,856,000 |

| 7 | 20% | 792,000 | $753.00 | $488,664,000 |

| 8 | 20% | 792,000 | $979.00 | $667,656,000 |

Source: VerityData

The awards could be worth more than $1.9B each if the stock reaches the highest target. Neither executive had received equity awards since NET’s October 2019 IPO. Prince and Zatlyn have large stakes in the company they co-founded, and it’s worth being aware of the large awards and prices at which the top executives are incentivized.

Bottom Line

Companies have filed roughly 2 million transactions coded as stock-based compensation in the last 16+ years. Identifying how management is compensated and incentivized, and identifying unusually timed, sized, or constructed awards/grants can provide valuable insight into valuation views, management incentives and actions, and board expectations. These grants can be opportunistic in nature, revealing undervalued messages.

Want Access to the Equity Grants Database?

Generate ideas and manage risk with insights, research, and technology available in VerityData | InsiderScore.

Outperformance Starts Here

See how Verity accelerates winning investment decisions for the world's leading asset managers.

Request a Demo