How Credit Analysts Track & Update 100s of Ratings Automatically With VerityRMS

Find out how fixed-income teams use VerityRMS to keep credit ratings updated with minimal effort.

Credit analysts have challenges that their counterparts in public equity don’t. Whereas an equity analyst has only a handful of names to track and update at any given time, a credit analyst can have issuer hierarchies with hundreds of entities — each with sophisticated dependencies.

Aside from the effort required, there’s also potential for human error. Credit analysts cover so many ratings that some updates can slip through the cracks. It’s why some firms frequently mandate regular, periodic reviews of all ratings of every entity.

In the world of credit analysis, there is a lot to stay on top of. In this blog, I’ll demonstrate how fixed-income teams rely on VerityRMS to stay up to date.

Related: Is It Time for Fixed Income Teams to Get Onboard With RMS?

Tracking Many Issuers, Many Ratings

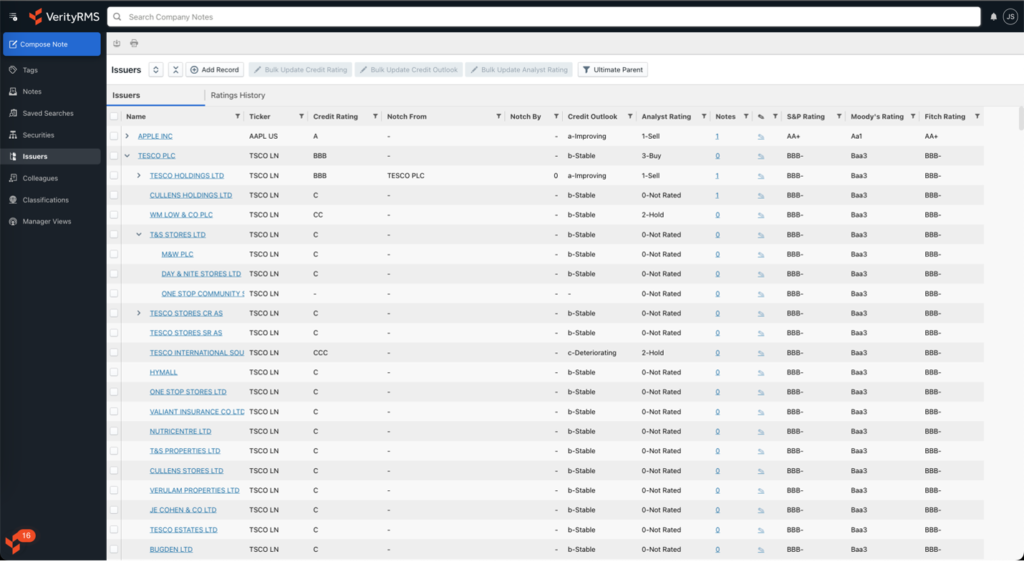

With VerityRMS, credit analysts can easily organize, track, and view issuers within hierarchies, their respective ratings, and/or any other data they want to bring into the system.

The system is flexible, accommodating a variety of rating methodologies. For example, you can easily use or combine classic rating methods:

- Basic (buy, sell, hold)

- Credit rating (AAA, AA, etc.)

- Credit status (improving, deteriorating, neutral)

Collectively, these ratings are viewable in any number of custom dashboards.

Notching Entities Automatically

Analysts can save substantial amounts of time within VerityRMS through notching, which avoids the tedious, error-prone manual labor of updating each rating individually.

You can notch an entity to its ultimate issuer, an issuer within a specific country, or even the rating of an underwriting bank.

In the example below, a Tesco entity is notched -3 to the parent issuer. Any update made to the parent rating will automatically adjust the rating of the connected entities.

Preventing Stale Ratings With Alerts

As I mentioned in the beginning, many firms require analysts to update their ratings on a steady schedule. Within VerityRMS, you can create automated alerts that remind analysts to review and update their ratings.

Find Out How Fixed Income & Hybrid Firms Scale With VerityRMS

Upgrade the research process with VerityRMS for Fixed Income, the built-for-purpose research management system that powers efficiency throughout the front office.

Outperformance Starts Here

See how Verity accelerates winning investment decisions for the world's leading asset managers.

Request a Demo