How Funds Harvest Intel From SEC Filings With the VerityData API

Need high-integrity financial data for internal apps or teams? The VerityData | inFilings API offers access to accurate & structured SEC filings.

Every week thousands of VerityData inFilings users log in to our cloud-based application to search, discover, and monitor a wide range of company disclosures and public filings: 10-Ks, 10-Qs, earnings transcripts, and more.

Heatmaps and alerts within inFilings make it easy to discover what is new or changed. NLP-powered redlines filter out boilerplate plate and unchanged language to let you compare sections of a filing over time and/or against other tickers. Search features help you find what you are looking for — or even what you didn’t think to look for.

Importantly, it’s all built on top of extremely clean, accurate, and in some cases proprietary datasets that we’ve structured to make especially useful to analysts and portfolio managers. In fact, the quality of the inFilings datasets alone makes them sought after by funds who want better SEC data in their own applications.

In this blog, we’ll cover how customers can take advantage of the API to:

· Greatly increase the overall accuracy of research.

· Consolidate filings sources to a single vendor.

· Help analysts and researchers work quickly & efficiently.

One customer began using the inFilings API after years of attempting to scrape and structure raw SEC filings with their in-house team.

Why Use the inFilings API?

There are two use cases for customers who take advantage of the API. They either want to bring filings into a 3rd party application or to use them for analysis by their data science teams.

#1: Provide Filings to Internal Data Science Teams

Data science teams may wish to perform entity analysis, research specific themes — such as ESG or cryptocurrency — or see trends in sentiment in different 10-K or 10-Q sections. The inFilings API gives them access to a clean and structured dataset of filings. In fact, one customer had attempted for years to scrape and structure filings with a large in-house team. They were unable to achieve the results and reliability they needed until they started using the API. Rather than sourcing filings from multiple sources, they were able to get everything they needed from one vendor.

#2: Import Filings Data Into 3rd Party App

inFilings customers can also use the API to embed structured filings within an internal application. For example, you may want to bring in just the risk factor sections of 10-Ks/10-Qs — along with their redlines — into a risk management application.

Complete Filings From 5,000 Companies

The inFilings API offers access to complete structured text of nearly 150,000 10-K,10-Q, IPO, and SPAC filings organized by millions of structured sections. Complete history goes back early as 2014 and includes over 5,000 companies.

| Filing Type | # Structured Filings | # Structured Sections |

| 10-K | 40,000+ | 13,000,000+ |

| 10-Q | 100,000+ | 15,000,000+ |

| IPO Filing | 5,000+ | 3,500,000+ |

With this added level of detail – you can run a more accurate linguistics analysis, create sentiment scores, compare disclosure tendencies within industries, and more. You’re no longer limited to unstructured text available from other services.

How the Data Is Structured

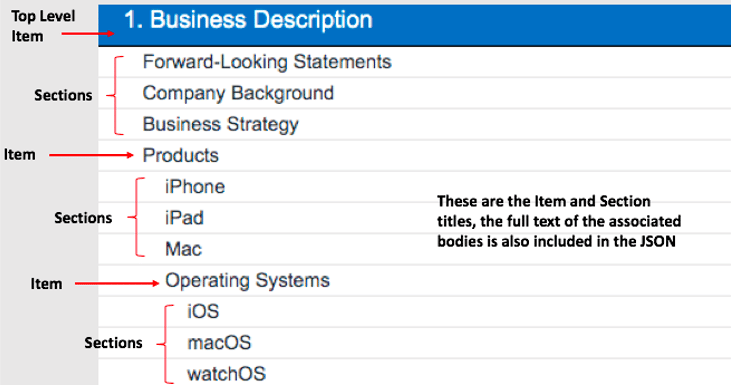

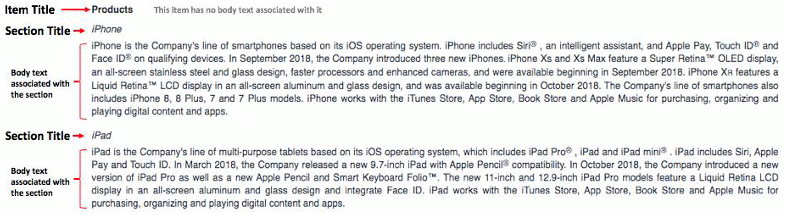

Filings data is structured by item and section title with full text of the associated bodies also included in the JSON.

Example of a Structured Filing

Example of Title & Body Text Associations

Analyst-Reviewed Data Intake

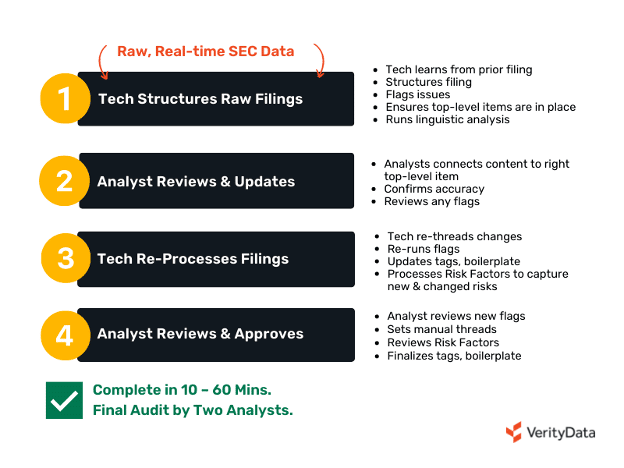

In order to ensure filings are structured properly, content is in the right place, and that special considerations are made for areas of high importance, like Risk Factors, we have developed a systematic intake process that includes layers of human oversight and intervention. As soon as filings are published, they are processed by our proprietary parsing technology, reviewed by our team of analysts, and ultimately made available to customers — within one hour.

Want Access to Better Filings Data?

Accelerate analysis with clean, structured, and exclusive data available through the inFilings API.

Outperformance Starts Here

See how Verity accelerates winning investment decisions for the world's leading asset managers.

Request a Demo