How Portfolio Managers Uncover Portfolio Blindspots With VerityRMS

If the stock is down, you know. When the stock is up, you know. To stay ahead on the rest of the companies in the portfolio, PMs benefit from automated alerts and dashboards elevating crucial information.

The extremes in your portfolio are easy to identify. The Market, CNBC, and Bloomberg all tell you the big movers. But staying on top of outliers that are slowly moving upward or downward? That requires process.

In this article, I’ll share common ways that PMs use VerityRMS to bolster their investment process, increase efficiency, and draw attention to potential capital erosion or appreciation that can be harder to systematically identify.

Attention is a finite resource. Here’s how PMs maximize it with common dashboards, alerts, and tearsheets available in a modern research management system.

Common Dashboards

Dashboards in VerityRMS are useful for consolidating views to get big picture quantitative and qualitative information in one place.

Examples of intelligence you can discover with dashboards:

- Is conviction increasing as a stock underperforms?

- When did we last talk to management & how did it affect conviction?

- Is our thesis being confirmed or refuted? Should we adjust the portfolio?

- Is our price target stale? What was the rationale for the latest change?

With dashboards, you can answer those questions and identify inconsistencies in your process. They help you discover potential blindspots and allocate dollars where you have conviction.

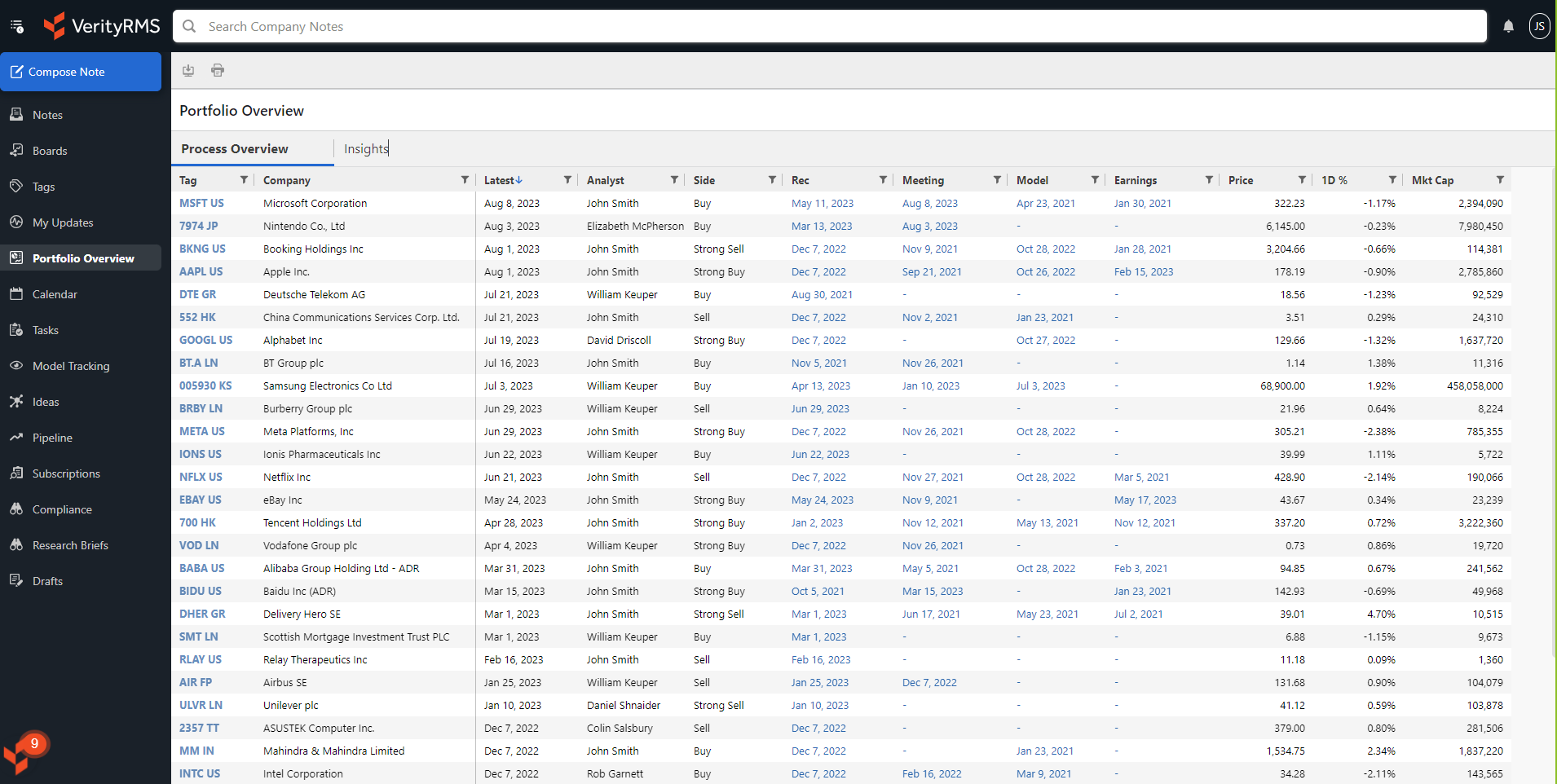

Portfolio Overview Dashboard

[CLICK TO ENLARGE] The portfolio overview dashboard is one of the most common. PMs get a broad overview of their investment universe, with highlighted rules like time since update, change in conviction, stale price target, last meeting (with notes) with management, etc.

Model Tracking Dashboard

[CLICK TO ENLARGE] With all analyst estimates in one view, PMs can see deltas relative to the rest of the portfolio. When that info is consolidated with qualitative content, like conviction, PMs can quickly and confidently make allocation decisions.

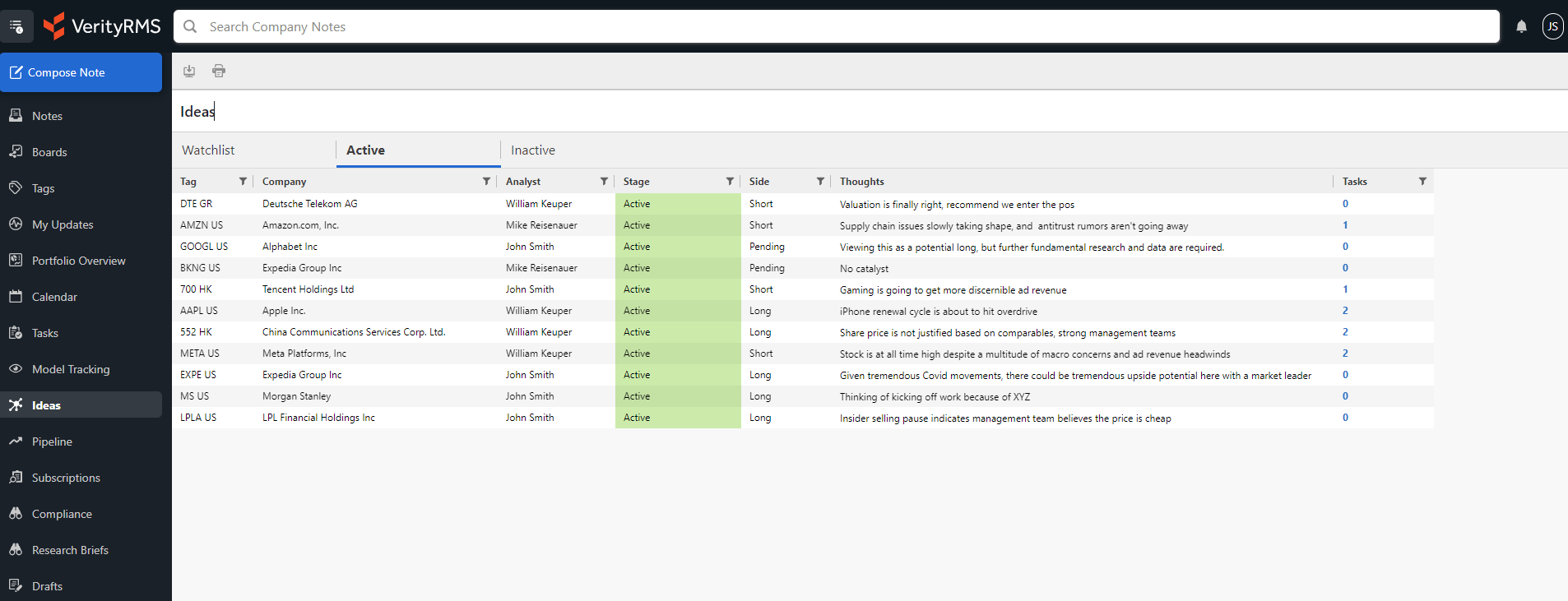

Idea Pipeline Dashboard

[CLICK TO ENLARGE] What ideas are being worked? How does analyst conviction compare to existing names? Other ideas? This dashboard keeps PMs to see new and old ideas in one place to help in portfolio construction.

Common Alerts & Workflows

How do you know what you’re missing? How do you ensure your investment process is being followed when asked by allocators? With an RMS, PMs can set up alerts and automate workflows that put your team ahead of the change rather than behind it.

- Is it time to talk to the management team?

- Did analyst conviction or price targets change?

- Why did you buy or sell a stock?

- Did you get an answer to that question your investment case hinges on?

Examples of If/Then Rules

An RMS allows you to track any number of questions through easy-to-create if/then rules. For example:

- If your team hasn’t talked to management in 6 months … Then assign a task to the covering analyst.

- If an analyst changes conviction/price target … Then send a notification.

- If a stock is down, but your conviction is increasing … Then send notification.

Alerts are delivered to you either in the app, via email, or both.

Importantly, time is saved and human error is reduced. The investment team doesn’t have to add steps to their workflow or set up alerts on their calendar. And you’re no longer waiting or wondering about a potential blindspot. The RMS takes on administrative burden, so you and your team can focus on generating alpha.

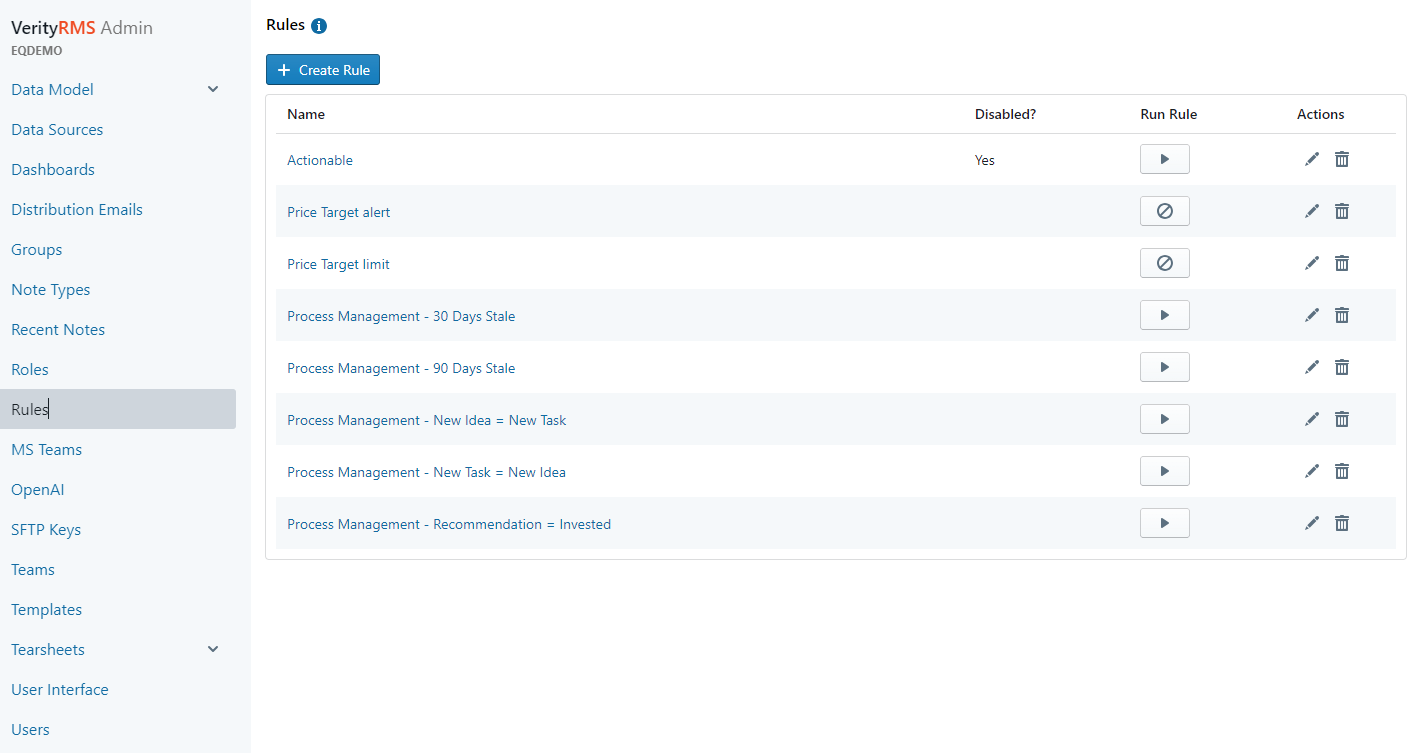

Setting Up If/Then Rules

The VerityRMS Rules Engine lets PMs quickly create custom if/then rules to streamline investment processes and send alerts with relevant, timely information.

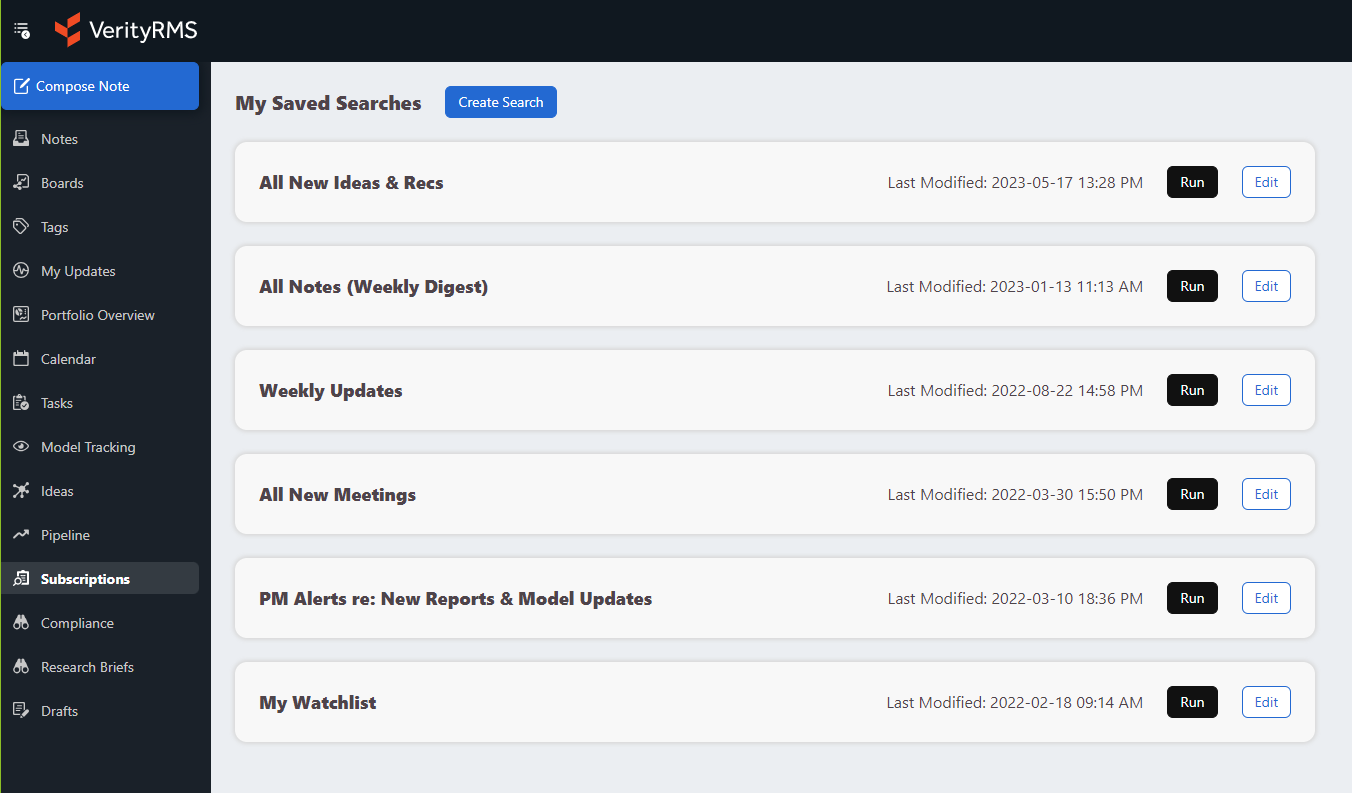

Getting Email Alerts

Setting up email alerts is simple and straightforward. In this example, a PM gets alerted to new ideas & recommendations, new meetings, new reports & model updates and also gets weekly updates sharing all research notes.

Tearsheets

Good data utilization is essential to your investment process. But how do you see data from multiple sources — internal and external — efficiently?

Without a modern RMS, data proliferation offers benefits with some major drawbacks. The more data you have, the slower you move. File names change, macros break, and Excel load times seem to get longer and longer.

With VerityRMS, portfolio managers and analyst can consolidate data in one place: estimates and conviction, qualitative notes and perspectives, market data. In fact, any data that matters to you and is in the system can be consolidated easily and presented to you via dashboards and tearsheets. You get a complete view of all relevant information in one place.

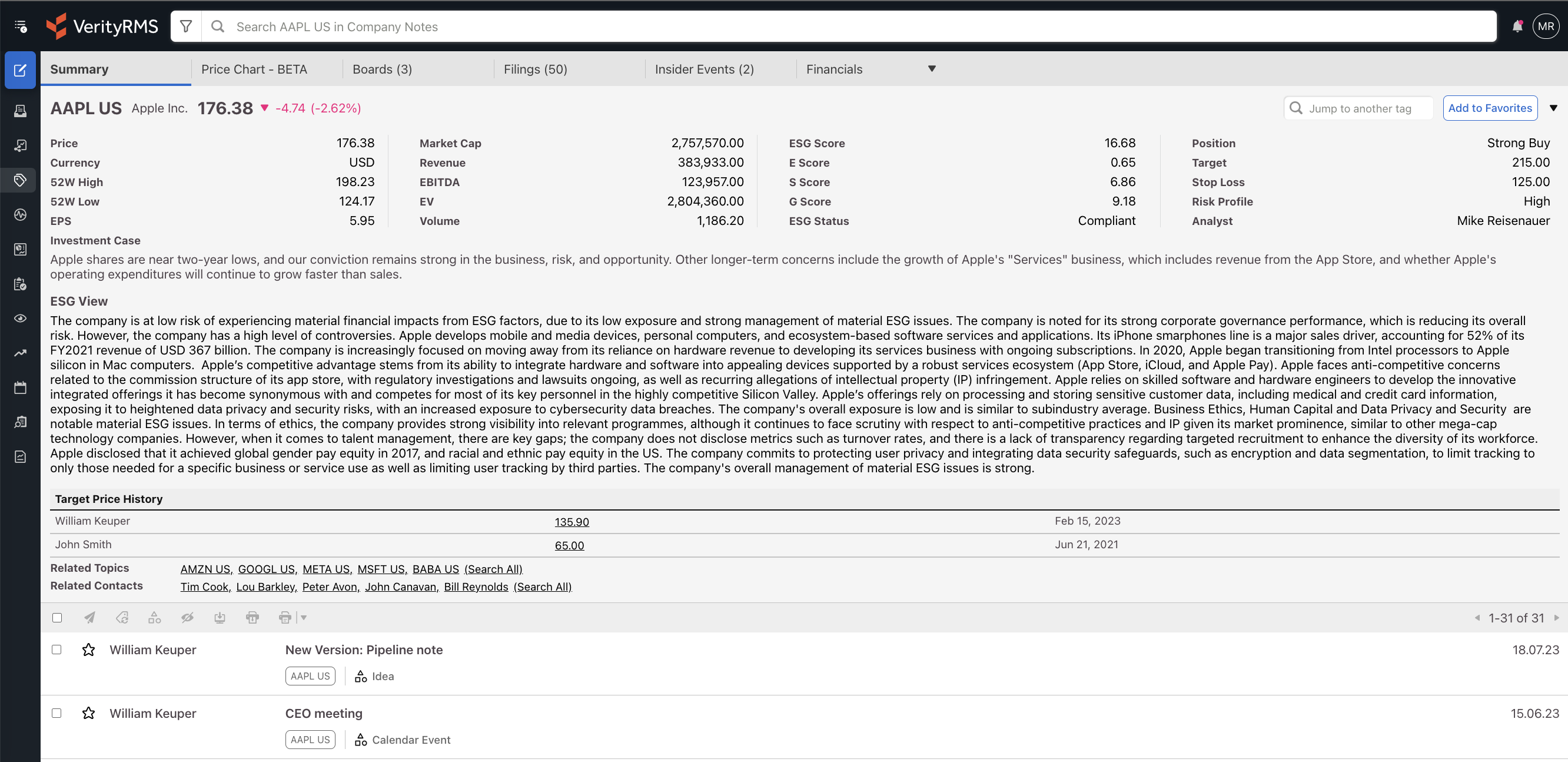

[CLICK TO ENLARGE] Tearsheets, like this one for Apple, consolidate third-party market data and ESG data alongside investment theses, target prices, and all research notes tagged with the company’s ticker.

Bottom Line

Portfolio managers have a lot to keep tabs on. With VerityRMS, you can centralized information in one place and get transparency into each step of your process. It lets you spend more time generating alpha and less time handling administrative tasks and questions. The result is a more-complete mosaic empowering better portfolio decisions.

See VerityRMS in Action

At Verity, we offer the modern research management system trusted by global asset managers. Request your custom demo to explore the possibilities VerityRMS can bring to your workflows.