Surging $HNZP Stock Triggered VerityData Alert 9 Days Before M&A Announcement

Horizon Therapeutics stock was up 27% at end of day after its M&A announcement. Nine days before, a lack of insider selling at the biotech company triggered a proprietary VerityData alert and subsequent actionable buy brief by our research team.

VerityData’s proprietary Cessation of Selling events — which allow us to find more frequent long ideas at high-quality companies — can and have been precursors to notable events, such as M&A announcements.

Such was the case when Horizon Therapeutics, a rare-disease biotech company, issued a public statement disclosing it was “engaged in highly preliminary discussions” with major pharmaceutical companies that “may or may not lead to an offer being made for the entire share capital of the Company.”

Horizon Therapeutics shares surged 27% on Wednesday, November 30, the day of the M&A announcement.

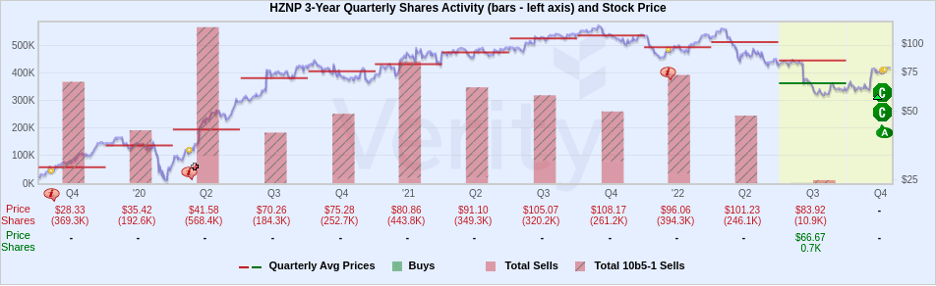

On November 21, a lack of insider selling since late July generated our Extreme Cessation of Selling Unusual Event, unusual behavior that contrasts with a lengthy sales streak dating back to Q2’18. The company-wide willingness to pause selling was in part driven by minimum price thresholds in 10b5-1 and suggests insiders are waiting out for a stronger recovery in shares.

The positive valuation message is bolstered by an aggressive buyback pace in September and October that combined to retire 1.7% of the outstanding. HZNP never executed a material buyback before so the move to spend nearly $250M in a short two-month span is unusual.

Insider Selling Paused Since Late July

The last sale at HZNP was on July 29 when Chief Business Officer Andy Pasternak sold at $82.57. It’s an unusually long period without sales after a consistent sell culture that has seen at least one seller per quarter since Q2’18. The 18-quarter streak of selling was particularly strong in 2020 and 2021 when it was common to see six or more insiders sell in a quarter.

Note that much of the selling has been guided by 10b5-1 plans, with some employing price sensitivity. CEO Timothy Walbert, for instance, sold every month from November 2021 to June 2022 using a $90.00 minimum price threshold. Shares hadn’t traded to $90.00 since June and Walbert has been absent since.

HZNP reported earnings on November 2 driving shares as high as $78.82 by November 8 from a pre-earnings close of $63.18. The rally wasn’t enough to bring out any sellers, however, indicating the stock was still under a level insiders view shares as undervalued.

HZNP 3-Year Quarterly Shares Activity

Extreme cessation of selling events denoted by green icons. Source: VerityData | InsiderScore

Company Executed First Material Buyback in Q3’22

HZNP authorized a $500M buyback plan on September 9 and spent $113.4M in September and another $135.5M in October, as examined in a November 4 Informational Buyback Brief. The company’s only other buyback program was barely used in Q2’17 during a drop that quarter. Soon after the buyback plan was put into place, management participated in a September 13 industry conference.

CEO Timothy Walbert said at the time, “We saw significant rationale to (announce the buyback plan)…we see ourselves as undervalued and whether that’s looking at the valuation of TEPEZZA alone or our pipeline or KRYSTEXXA, UPLIZNA, we see significant opportunity to drive further valuation and saw as a unique opportunity to take advantage of that.” CFO Aaron Cox said on the latest earnings call on November 2 that the strong balance sheet and cash generation “gives us the flexibility to opportunistically repurchase shares.”

About the Research Brief

Data included in this report is sourced by VerityData | InsiderScore‘s comprehensive databases of insider trades, buybacks, at-the-market offerings, management changes, institutional investor disclosures, and more.

Outperformance Starts Here

See how Verity accelerates winning investment decisions for the world's leading asset managers.

Request a Demo