How Responsible Investing Teams Simplify ICSWG Engagement Reporting With VerityESG

Discover how asset managers fulfill ICSWG reporting requirements with VerityESG to prove stewardship at scale.

Asset managers face rising demands for transparency and accountability in their stewardship and engagement activities. One of the key frameworks in this domain is the Investment Consultants Sustainability Working Group (ICSWG) reporting, a standardized approach aimed at enhancing the disclosure of ESG-related engagement efforts. For stewardship and responsible investing teams, understanding and efficiently fulfilling ICSWG requirements is important — especially to maintain trust with investors.

In this article, we’ll show you how teams fulfill ICSWG reporting requirements with VerityESG to:

- Build Trust: Investors increasingly expect transparency on how asset managers are influencing companies on ESG issues.

- Demonstrate Outcomes: By detailing the rationale, process, and outcomes of ESG engagements, firms can provide evidence of their impact and hold themselves accountable

- Show Progress: Structured engagement reporting allows for better tracking of ESG progress over time, enabling firms to refine their strategies and increase the effectiveness of their stewardship efforts.

ICSWG Reporting: Why It Matters & How to Scale

For asset managers committed to responsible investing, ESG engagement is not just about ticking boxes. It is about demonstrating that the firm is actively influencing companies to improve their ESG practices, driving long-term value creation, and mitigating risks. ICSWG reporting supports this goal by offering a clear framework through which these efforts can be communicated to investors. On their website, they offer a free spreadsheet that can be used to fulfill the reporting.

The Problem: Scaling With Spreadsheets

While the benefits of ICSWG reporting are clear, fulfilling these requirements can be labor-intensive. The reality for most asset managers is that ESG reporting is still a largely manual process. Teams are often cobbling together data from different systems, manually filling out templates, and managing engagement information in spreadsheets. This kind of approach is not only inefficient but also leaves room for errors and inconsistencies.

For firms with a global footprint or those managing multiple funds, the scale of ESG reporting quickly becomes a major pain point. Ensuring that all engagement data is captured accurately, across all relevant funds and themes, requires a level of operational efficiency that few teams can manage without the right tools.

As we know, many responsible investing teams are required to do more with less.

The Solution: Automated ESG Reporting

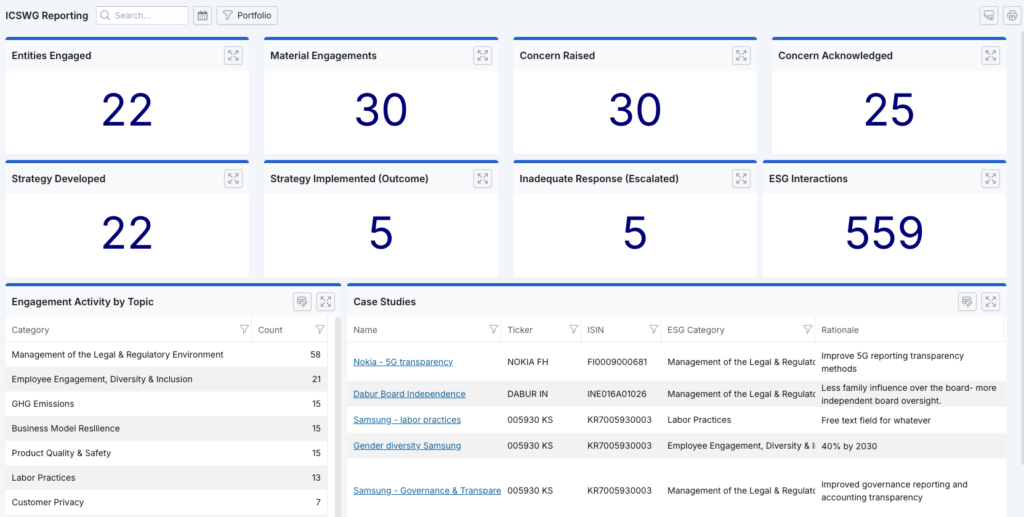

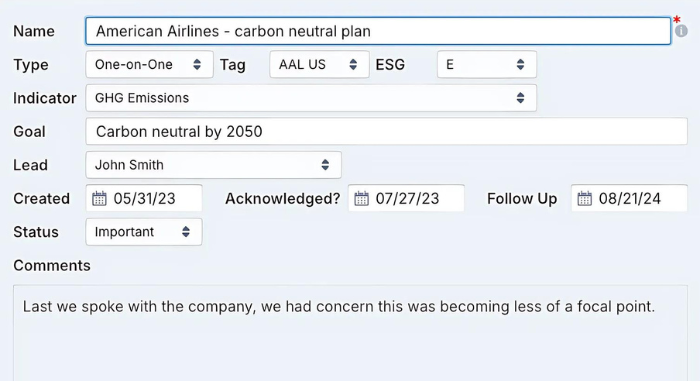

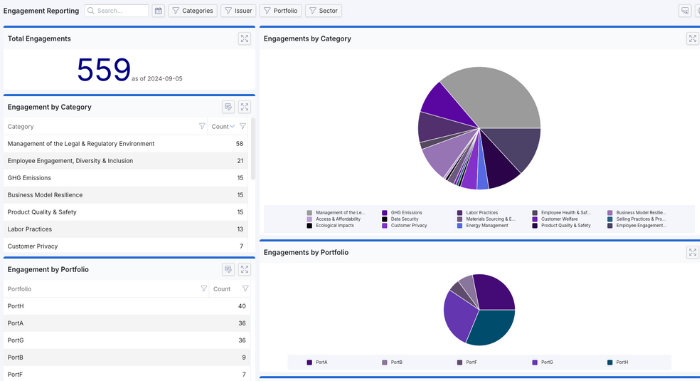

To address the challenges posed by ICSWG reporting, VerityESG provides an efficient, automated, and customizable ESG engagement tracking & reporting platform designed to help asset managers meet ICSWG and other ESG reporting requirements.

How It Works: A U.K. Case Study

VerityESG automates reporting by making it easy to capture engagement data in the first place — from the source. Here’s how an automated process is working for one asset manager based in the U.K.

Before: Trouble With Capture & Reporting

A large UK-based asset manager approached Verity with a problem: Engagement reporting was mostly manual and therefore impossible to report accurately on engagement at fund, strategy, or firm levels.

Investment teams weren’t capturing engagement takeaways during company meetings, so ESG teams often reached out retroactively to capture engagement workflow materiality and talking points.

After: Proving ESG Expertise Automatically

Now with Verity, data capture is done in real-time without extra effort. Reporting is simple and automated based on the ESG indicators, portfolios, and metadata of the firm’s choosing.

They can now prove their ESG expertise, report on outcomes, and drive their engagement narrative to investors confidently.

Bottom Line

In the age of sustainable investing, robust and transparent ESG engagement reporting is no longer optional—it’s a critical aspect of demonstrating your firm’s commitment to responsible stewardship. ICSWG reporting offers a valuable framework for structuring these efforts, but the process can be cumbersome without the right tools in place.

VerityESG provides asset managers with a repeatable, scalable, and automated solution for fulfilling ICSWG and other ESG reporting requirements, allowing your team to focus on what truly matters—driving meaningful change through effective ESG engagement.

For more information on how VerityESG can support your stewardship and responsible investing efforts, visit VerityESG.

Outperformance Starts Here

See how Verity accelerates winning investment decisions for the world's leading asset managers.

Request a Demo