Insider Sentiment ‘Slightly Positive’; Verity Analysts See Signals at $ENPH, $MTD, $VGR

A summary of notable insider trading activities from Verity’s research team.

- Insider sentiment was slightly positive in September as the Wilshire 5000 decreased -4.9%, a shift in sentiment from the neutral stance in August.

- The moderate amount of buying across the market was matched with low insider selling, producing a ratio of sellers-to-buyers that was below the historical norm.

Putting September in Context

Roughly 570 insiders bought shares of their companies in September, slightly higher than the 540 unique buyers in the third month of Q2’23 and also below the approximately 675 insiders who bought in September 2022. The roughly 535 unique non-10b5-1 sellers in September 2023 were below the ~830 insiders who sold in June, the same seasonal month in the prior quarter. About 460 insiders sold in September 2022, leaving the non-10b5-1 seller count higher YoY in September 2023 by 16%.

Taken together, the ratio of non-10b5-1 sellers to buyers ended up at 0.98:1, solidly below the average ratio of monthly sellers to buyers of ~1.582:1 in the last five years. In aggregate, insiders exhibited slightly positive sentiment.

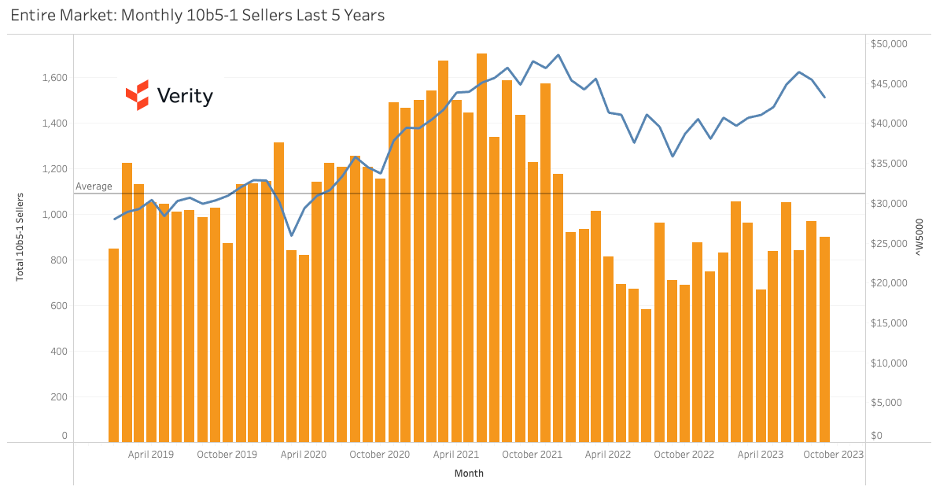

The level of 10b5-1 selling can be particularly insightful on a monthly basis because it’s a subset of insider activity that’s generally not impacted by blackout periods around earnings. The chart below shows the number of 10b5-1 sellers by month over the last five years.

Source: VerityData

Unusual Insider Signals to Note

As always, it’s important to look at company-specific stories where insiders are behaving unusually. Throughout the quarter, we have been alerting clients with real-time coverage of unusual insider behavior. Here is a small selection of that coverage from recent weeks.

+ Enphase Energy (ENPH) – An unusual cessation in selling and a director’s recent $4M buy at $122.76 are behaviors that send a positive valuation message at the solar energy technology company. It’s been nearly four months since an insider sold at ENPH, the longest such stretch since mid-2019, a period that preceded a tremendous multi-year rally for the stock. There have been multiple sellers each quarter since the start of Q3’19, most with at least four. Meanwhile, Director Thurman Rodgers extended his personal buy bias as he bought for the second time this year after he initially spent $5.5M to buy ENPH at ~$167.00 in April before he disclosed a second ~$5M buy that month. CFO Mandy Yang was a buyer at ~$157.00 in early May, supporting Rodgers’ earlier sentiment. (9/21/23)

+ Mettler-Toledo (MTD) – No insider has sold at the precision instruments maker since May, behavior that generated our Extreme Cessation of Selling Event and sends a compelling, undervalued message as it’s the first quarter without a sale since Q3’19. A robust selling culture has been in place at the firm since that time, with no less than three sellers in each quarter, so it’s unusual to see insiders refrain from selling. The cessation so far matches the length of the one from 2019 that lasted from early June through early November. During that span, MTD insiders avoided the stock’s lowest points that year and only returned once shares rallied above $700.00. (9/18/23)

+ Vector Group (VGR) – Purchases by the CFO and COO of the tobacco and real estate holding company at an average of $10.32 send a compelling, undervalued message after shares sold off this quarter. COO Richard Lampen kicked off buying last week when he bought $103K in VGR shares. He was followed by CFO Bryant Kirkland with an identical buy days later. They reverse insider sentiment at VGR, countering a sell bias that’s been in place since last November. Kirkland and Lampen were smart buyers together in 2020 and each has a strong track record for opportunistic purchases, with Lampen’s history dating back to 2006 and Kirkland’s to 2009. Kirkland has a more impressive record, so his return is significant. (9/13/23)

About the Data

Data included in this report is sourced by VerityData | InsiderScore‘s comprehensive databases of insider trades, buybacks, at-the-market offerings, management changes, institutional investor disclosures, and more.