Verity Analysts See Signals at $NKE, $ULTA, $SHW; Macro Sentiment Remains ‘Slightly Positive’

A summary of notable insider trading activities from Verity’s research team.

- Insider sentiment continued to be slightly positive in October as the Wilshire 5000 decreased -2.7%, an extension of sentiment seen in the prior month. The first month of the quarter generally has the lowest volume of insider trades muddying the sentiment picture.

- The relatively moderate amount of buying and unusually low volume of insider selling produced a ratio of sellers-to-buyers that was below the historical norm.

Putting October in Context

Roughly 270 insiders bought shares of their companies in October, solidly higher than the ~185 unique buyers in the first month of Q3’23 and also slightly above the approximately 265 insiders who bought in October 2022. The roughly 170 unique non-10b5-1 sellers in October 2023 were below the ~360 insiders who sold in July, the same seasonal month in the prior quarter. About 265 insiders sold in October 2022, leaving the non-10b5-1 seller count lower YoY in October 2023 by 36%.

Taken together, the ratio of non-10b5-1 sellers to buyers ended up at 0.68:1, solidly below the average ratio of monthly sellers to buyers of ~1.55:1 in the last five years. In aggregate, insiders exhibited slightly positive sentiment.

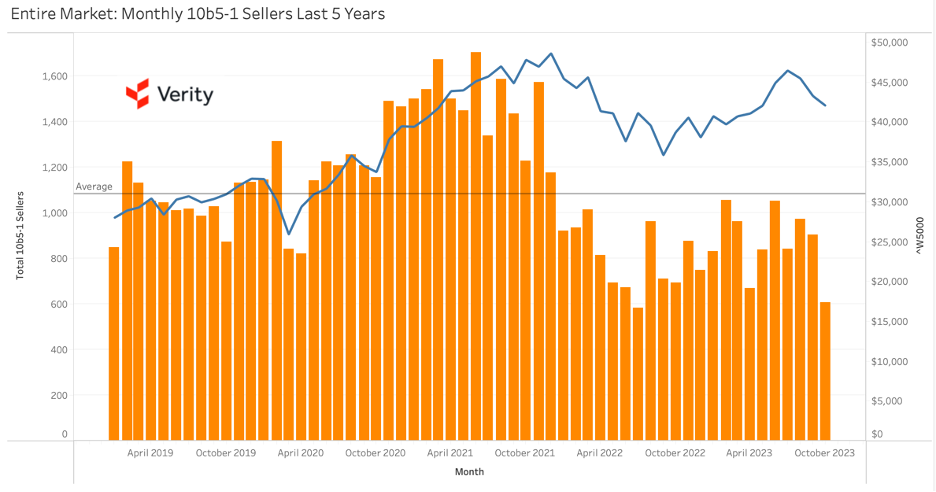

The level of 10b5-1 selling can be particularly insightful on a monthly basis because it’s a subset of insider activity that’s generally not impacted by blackout periods around earnings. The chart below shows the number of 10b5-1 sellers by month over the last five years.

Unusual Insider Signals to Note

As always, it’s important to look at company-specific stories where insiders are behaving unusually. Throughout the quarter, we have been alerting clients with real-time coverage of unusual insider behavior. Here is a small selection of that coverage from recent weeks.

+ Nike (NKE) – A $1.3M purchase at $96.13 by Director and former Intel (INTC) CEO Robert Swan sent an undervalued message at the athletic footwear and apparel maker. Swan’s buy was his first since he joined NKE’s board a little more than a year ago, but his purchase is compelling because he has a strong buying track record as an insider at three other companies. Swan’s buy is the largest by any NKE insider in at least 20 years. Adding to the positive sentiment is a late August exercise-and-hold of options by NKE Director and Apple (AAPL) CEO Tim Cook. (10/4/23)

+ Ulta Beauty (ULTA) – No one has sold at the health and beauty products retailer since mid-June, generating an Extreme Cessation of Selling event that parallels the stock’s fall in value. A director was responsible for the final sale at ULTA when shares traded at $450.00. Since then, ULTA insiders have forgone liquidity generation as the stock has traded lower, nearing last October’s 52-week low of $373.80. Q3’23 was the first quarter without a seller at the firm since Q1’20, when insiders smartly avoided the stock’s sharp collapse amid the pandemic. To see ULTA insiders mimic that earlier behavior sends a message they view the stock’s current valuation uncomfortably and are unwilling to partake in normal liquidity generation. (10/11/23)

+ Sherwin-Williams (SHW) – CEO John Morikis spent $505K to buy at an average of $237.60, reinforcing an undervalued message he’s sent at the paint manufacturer and retailer two other times in the past two years within 10% of his buy price. Morikis will retire from the CEO role at the end of the year and shift to executive chairman. We typically see insiders sell amid such transitions so it’s compelling to see Morikis buy. SHW reported healthy bottom-line and slight top-line Q3’23 earnings beats a day before Morikis bought but investors focused on some headwinds, including softer demand in North America. (10/26/23)

About the Data

Data included in this report is sourced by VerityData | InsiderScore‘s comprehensive databases of insider trades, buybacks, at-the-market offerings, management changes, institutional investor disclosures, and more.