Macro Insider Sentiment ‘Slightly Positive’; Execs at $DPZ, $FITB, $GPC Pick Up Stock

A summary of notable insider trading activities from Verity’s research team.

- The Wilshire 5000 gained 2.5% in March, though it came with plenty of volatility that brought out insider buying and shifted market-wide sentiment to slightly positive. The buying was concentrated in the Financial sector driven by a burst of buying by insiders in the regional bank space in the wake of the SVB Financial (SIVB) bankruptcy.

Putting March in Context

Roughly 1,000 insiders bought shares of their companies in March, far above the ~700 buyers in the third month of Q4’22 and also above the approximately 970 insiders who bought in March 2022. The roughly 990 unique non-10b5-1 sellers in March 2023 were above the 750 in December 2022 but below the 1,080 who sold in March 2022.

Taken together, the ratio of non-10b5-1 sellers to buyers ended up at 1:1, well below the average ratio of monthly sellers to buyers at ~1.65:1. March 2023 was an interesting month to dissect further because the number of buyers in the Financial sector jumped significantly to ~450 and therefore accounted for 45% of market-wide buying. If you remove the Financial sector, the ratio of non-10b5-1 sellers to buyers would be at 1.63:1 which is very close to the norm and would position sentiment in neutral territory.

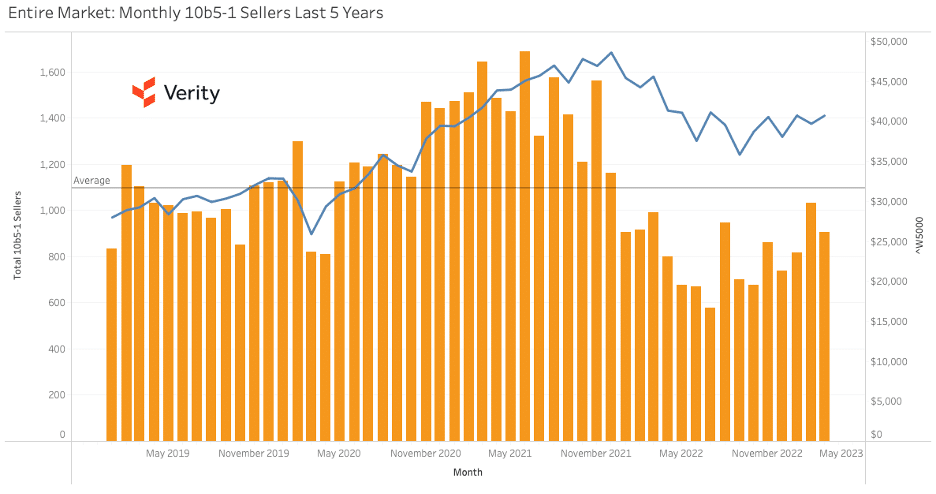

The level of 10b5-1 selling can be particularly insightful on a monthly basis because it’s a subset of insider activity that’s generally not impacted by blackout periods around earnings. The chart below shows the number of 10b5-1 sellers by month over the last five years.

Source: VerityData

Source: VerityData

Unusual Insider Signals to Note

As always, it’s important to look at company-specific stories where insiders are behaving unusually. Throughout the quarter, we have been alerting clients with real-time coverage of unusual insider behavior. Here is a small selection of that coverage from recent weeks.

+ Genuine Parts (GPC) – The CEO of the automotive and industrial parts distributor bought for the first time in 15 years, also ending a year-long drought in insider activity at the company. CEO Paul Donahue’s $250K purchase at $156.08 is compelling and sends an undervalued message based on his lack of previous buying and the fact that he’s never sold stock. The dollar value purchase isn’t what generally grabs headlines, but the change in behavior shouldn’t go unnoticed. (3/30/23)

+ Fifth Third Bancorp (FITB) – A long-time director at the regional bank bought $1.3M at $26.82 on March 13, conviction that already adds to the compelling sentiment that’s been in place since late last year. Director Gary Heminger, the former CEO and chairman of Marathon Petroleum (MPC), has been on FITB’s board since December 2006 and this month’s buy is his only transaction to date at the company. It’s an unexpected shift in behavior to see Heminger take advantage of the rout in bank stocks to buy FITB at prices not seen in roughly two years. (3/15/23)

+ Domino’s Pizza (DPZ) – CEO Russell Weiner emerged for his first buy as a reporting insider and the first buy by any insider company-wide since 2015 by spending $1.0M at $303.58. Given the rare amount of buying at the pizza company and by Weiner, the purchase on March 2 sends an unexpected, undervalued message. DPZ insiders have leaned toward a sell bias and the purchase by Weiner outweighs the lone small sale this quarter. (3/6/23)

About the Data

Data included in this report is sourced by VerityData | InsiderScore‘s comprehensive databases of insider trades, buybacks, at-the-market offerings, management changes, institutional investor disclosures, and more.

For access, request a free trial of VerityData >>

For data inquiries relevant to this report, contact Ben Silverman.

Outperformance Starts Here

See how Verity accelerates winning investment decisions for the world's leading asset managers.

Request a Demo