Insider Sentiment ‘Squarely Neutral’; Verity Analysts See Signals at $ALGN, $DG, $AZO

A summary of notable insider trading activities from Verity’s research team.

- Insider sentiment was positioned squarely neutral in territory in June as the Wilshire 5000 increased 6.7%, a downshift in sentiment from the slight positive stance in May.

- Buy volume, which was elevated and fueled by those in the Financial sector, regressed as banking stocks stabilized. Matched with the moderate selling pace, the ratio of sellers-to-buyers was in line with the historical norm.

Putting June in Context

Roughly 490 insiders bought shares of their companies in May, well below the ~1,025 buyers in the third month of Q1’23 and also below the approximately 800 insiders who bought in June 2022. The roughly 790 unique non-10b5-1 sellers in June 2023 were slightly below the ~1,020 insiders who sold in March, the same seasonal month in the prior quarter. About 590 insiders sold in June 2022, leaving the non-10b5-1 seller count higher YoY in June 2023 by 34.2%.

Taken together, the ratio of non-10b5-1 sellers to buyers ended up at 1.68:1, close to the average ratio of monthly sellers to buyers of ~1.52:1 in the last five years. In aggregate, insiders exhibited neutral sentiment.

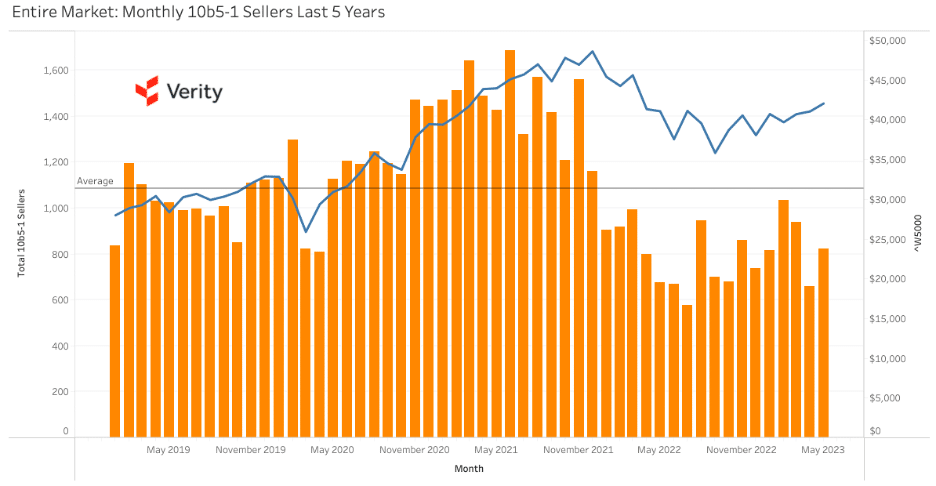

The level of 10b5-1 selling can be particularly insightful on a monthly basis because it’s a subset of insider activity that’s generally not impacted by blackout periods around earnings. The chart below shows the number of 10b5-1 sellers by month.

Unusual Insider Signals to Note

As always, it’s important to look at company-specific stories where insiders are behaving unusually. Throughout the quarter, we have been alerting clients with real-time coverage of unusual insider behavior. Here is a small selection of that coverage from recent weeks.

+ Align Technology (ALGN) – Director Kevin Dallas extended the compelling positive sentiment at the orthodontics technology company with a $2.0M buy at $285.26. Dallas has a deep background in the technology space and his deviation to buy stands out. Other insiders have exhibited positive sentiment in recent quarters by buying, including the CEO and CFO in February, while others have refrained from regular selling. (6/1/23)

+ Dollar General (DG) – A $237K purchase by CEO Jeffrey Owen and $1.3M purchase by Chairman Michael Calbert at $155.76 sent a compelling positive valuation message after shares of the discount retailer cratered on poor earnings and guidance. Owen picked up shares for the first time during his tenure as a reporting insider and Calbert bought for the first time since 2016. The latest buys strengthen positive sentiment in place after Director Timothy McGuire spent $717.1K at $202.00 in March to pick up shares on a pullback. Shares briefly rebounded after McGuire’s buy but ultimately were hammered on earnings, bringing out Owen, Calbert and one other director for a rare round of multi-insider buying. (6/13/23)

+ AutoZone (AZO) – A convicted purchase by Chief Information Officer Michelle Borninkhof sent an undervalued message at the auto parts retailer and extended her personal buy bias established with her only other buy in March 2022. CIO Borninkhof poured $1.1M into AZO in June at $2,406.65 as shares pulled back from the all-time high set in May. Last March, she spent ~$500K to purchase shares at ~$1,945.00 alongside a director, which proved timely. She became a reporting insider in April 2021 and has no other reporting history in our database. (6/15/23)

About the Data

Data included in this report is sourced by VerityData | InsiderScore‘s comprehensive databases of insider trades, buybacks, at-the-market offerings, management changes, institutional investor disclosures, and more.