Insider Sentiment ‘Slightly Positive’; Analysts Spot Unusual Signals at $CVS, $TSN, $USB

A summary of notable insider trading activities from Verity’s research team.

- In aggregate, insiders exhibited a strong buy bias in May, though the strong positive sentiment was driven by those in the Financial sector and, especially, insiders at regional banks whose stocks were pummeled during the month.

- Even when removing the Financial sector, market-wide sentiment was slightly positive in May through a combination of elevated buying and tepid selling.

Putting May in Context

Roughly 1,493 insiders bought shares of their companies in May, far above the ~1,025 buyers in the second month of Q1’23 and also above the approximately 1,400 insiders who bought in May 2022. The roughly 1,060 unique non-10b5-1 sellers in May 2023 were slightly above the 1,050 insiders who sold in February, the same seasonal month in the prior quarter. Nearly 920 insiders sold in May 2022, leaving the non-10b5-1 seller count higher YoY in May 2023 by 15.5%.

Taken together, the ratio of non-10b5-1 sellers to buyers ended up at 0.72:1, well below the average ratio of monthly sellers to buyers of ~1.55:1 in the last five years. In aggregate, insiders displayed a strong buy bias. However, much of the buying continues to be driven by those in the Financial sector. 777 insiders in the Financial sector bought shares of their companies in May, representing a little more than half of the market-wide count. If you remove the Financial sector, the ratio of non-10b5-1 sellers to buyers would be at 1.34:1 which is still under the five-year average but nearly as depressed as the aggregate figure.

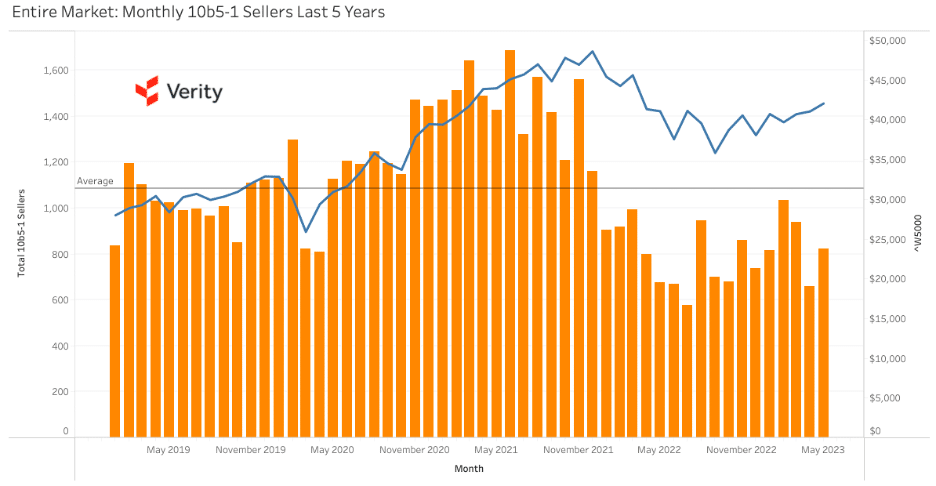

The level of 10b5-1 selling can be particularly insightful on a monthly basis because it’s a subset of insider activity that’s generally not impacted by blackout periods around earnings. The chart below shows the number of 10b5-1 sellers by month over the last five years.

Unusual Insider Signals to Note

As always, it’s important to look at company-specific stories where insiders are behaving unusually. Throughout the quarter, we have been alerting clients with real-time coverage of unusual insider behavior. Here is a small selection of that coverage from recent weeks.

+ Tyson Foods (TSN) – Five insiders stepped up to buy at $48.67 after shares sold off in reaction to earnings released on May 8, sending a strong undervalued message at the meat processor. There’s not been a buy at TSN since 2018 and the burst of five buyers at once stands out. TSN insiders have historically exhibited a sell bias and the group-think behavior to shift toward buying as shares traded below $50.00 for the first time since March 2020 is opportunistic behavior that stands out. The activity features the CEO’s first buy at TSN after a long history as a reporting insider. (5/15/23)

+ CVS (CVS) – CEO Karen Lynch, who joined the healthcare company via its acquisition of Aetna (former AET) in 2018 and was named CEO 2021, bought for the first time, picking up a healthy $977K at $69.75. The purchase is the first by any insider at the company in over a year and the largest by any insider since 2018. Given Lynch’s significant stock-based compensation, including recent performance share vestings and large option tranches struck near her buy price, it is unexpected to see her dip into her own cash to buy here, even with shares trading at their lowest level since early 2021. We think Lynch is sending an undervalued message by buying. (5/5/23)

+ US Bankcorp (USB) – Three directors and a director vice chair spent a combined $2.5M to buy at $31.89 since April 21, rare buying at the financial services firm that sends a compelling undervalued message. The buys are the first at USB since 2013 while it’s the first instance of more than one buyer in a quarter since Q1’09. Vice Chair, Corporate and Commercial Banking James Kelligrew capped activity on May 8 and he’s slated to leave the company next month. It’s unusual to see insiders buy as they step away and lose their information advantage. (5/2/23)

About the Data

Data included in this report is sourced by VerityData | InsiderScore‘s comprehensive databases of insider trades, buybacks, at-the-market offerings, management changes, institutional investor disclosures, and more.