Insider Sentiment Shifts Negative While CEOs at $COP, $TWLO, $CTVA Send Signals

A summary of notable insider trading activities from Verity’s research team.

With the S&P 500 up as much as ~9% year to date during the month of February, insider sentiment was quick to shift negative as insiders took advantage of the rally. Selling volume was slightly elevated, while buying volume was very low, and the result was overall sentiment that tilted solidly negative.

Putting February in Context

Roughly 360 insiders bought shares of their companies in January, far below the over 800 buyers in the second month of Q4’22 and also below the approximately 550 insiders who bought in February 2022. The roughly 1,040 unique non-10b5-1 sellers in February 2023 was below the 1,260 in November 2022 but well above the 714 who sold in February 2022.

Taken together, the ratio of non-10b5-1 sellers to buyers ended up at 3.02:1, well above the average ratio of monthly sellers to buyers at ~1.65:1.

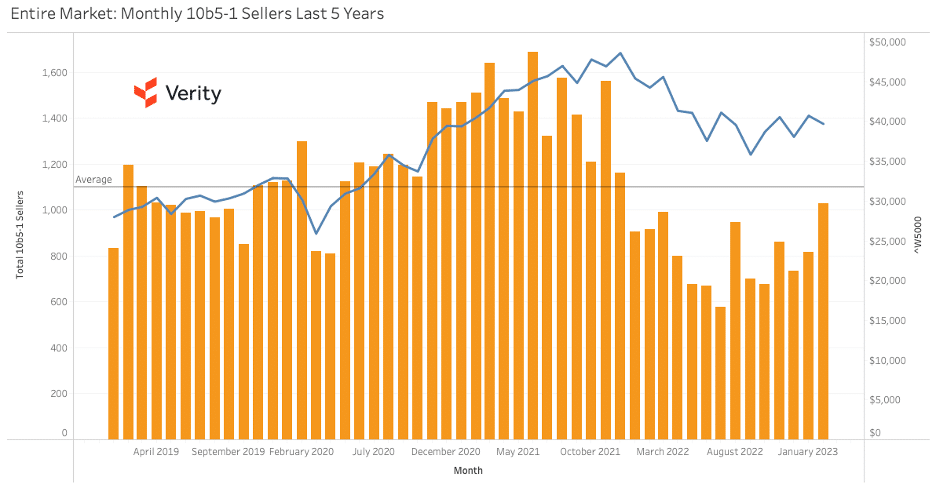

The level of 10b5-1 selling can be particularly insightful on a monthly basis because it’s a subset of insider activity that’s generally not impacted by blackout periods around earnings. The chart below shows the number of 10b5-1 sellers by month over the last five years.

Unusual Insider Signals to Note

As always, it’s important to look at company-specific stories where insiders are behaving unusually. Throughout the quarter, we have been alerting clients with real-time coverage of unusual insider behavior. Here is a small selection of that coverage from recent weeks.

+ ConocoPhillips (COP) and Devon Energy (DVN) – Energy names were strong for much of 2022, and when shares in the sector consolidated to start 2023, the action brough out some buyers. At COP, it was Director R.A Walker buying over $1.2M across two buys. At DVN, CEO Richard Muncrief bought about $800K and Director John Bethancourt bought $250K. (2/22/23 and 2/24/23)

+ Corteva (CTVA) – A $2.4M purchase at $60.64 by CEO Charles Magro sent a strong undervalued message at the agritech firm. Magro, who joined the company in November 2021, also bought $2.6M at $51.14 a year ago. The purchase came about two weeks prior to his annual stock-based compensation award, including options, and it was impressive that he would add equity exposure at a price where he was about to get a new slug of options and at a price almost 20% above where he bought last year. (2/9/23)

+ Twilio (TWLO) – A $10.0M purchase at $63.26 by Chairman and CEO Jeff Lawson and a smaller purchase by Director Donna Dubinsky aligned with the customer engagement software firm’s first ever buyback plan authorization, delivering a convicted undervalued message. The purchases by Lawson and Dubinsky represented sentiment reversals for each. The insider buys and the buyback plan authorization followed a better-than-expected February 15 Q4’22 earnings announcement, at which time Lawson indicated he would be buying once the company’s quarterly insider trading window opened. TWLO shares rallied on the earnings and buyback news but had given up much of those gains by the time Lawson bought. (2/28/23)

About the Data

Data included in this report is sourced by VerityData | InsiderScore‘s comprehensive databases of insider trades, buybacks, at-the-market offerings, management changes, institutional investor disclosures, and more.

For access, request a free trial of VerityData >>

For data inquiries relevant to this report, contact Ben Silverman.

Outperformance Starts Here

See how Verity accelerates winning investment decisions for the world's leading asset managers.

Request a Demo