Insider Sentiment ‘Solidly Positive’; Execs at $MOH, $PANW, $DXCM Make Moves

A summary of notable insider trading activities from Verity’s research team.

- We expected insider activity to be seasonally low in April: Most insiders were restricted from trading due to closed trading windows ahead of company earnings report. However, even by that standard, selling participation was unusually low.

- Buying was closer in line with seasonal trends.

- May is shaping up to be a more active and unusual month, particularly in financials, as insiders take advantage of turmoil at regional banks.

Putting April in Context

Roughly 275 insiders bought shares of their companies in January, below the 365 buyers in the second month of Q1’23 and also below the approximately 310 insiders who bought in April 2022. The roughly 172 unique non-10b5-1 sellers in April 2023 was the lowest for any calendar month since the start of 2019, below the 283 in November 2022 and the 229 who sold in April 2022.

Taken together, the ratio of non-10b5-1 sellers to buyers ended up at 0.67:1, with sentiment solidly positive compared to an average ratio of monthly sellers to buyers at ~1.58:1, with the caveat that volumes were low.

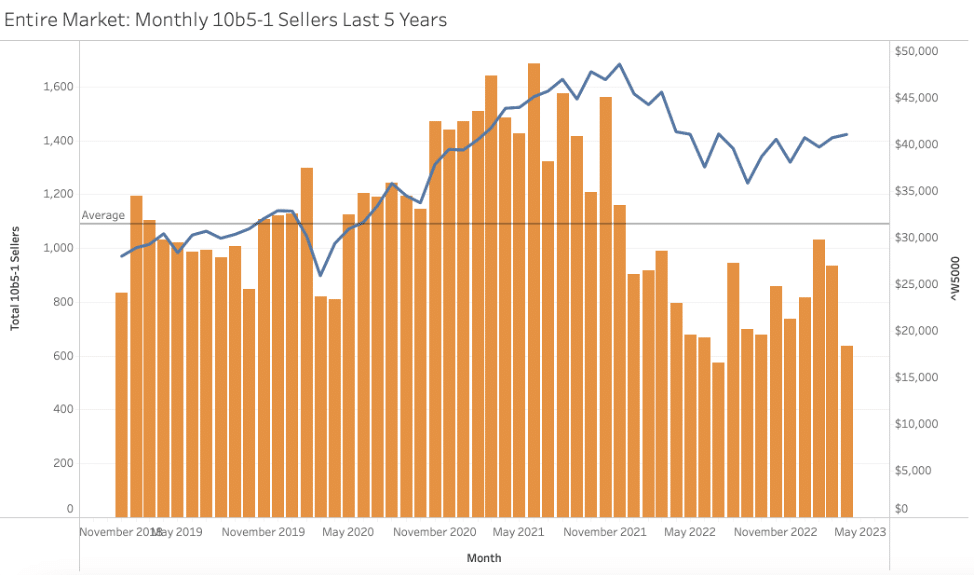

The level of 10b5-1 selling can be particularly insightful on a monthly basis because it’s a subset of insider activity that’s generally not impacted by blackout periods around earnings. The chart below shows the number of 10b5-1 sellers by month over the last five years.

Source: VerityData

Source: VerityData

Unusual Insider Signals to Note

As always, it’s important to look at company-specific stories where insiders are behaving unusually. Throughout the quarter, we have been alerting clients with real-time coverage of unusual insider behavior. Here is a small selection of that coverage from recent weeks.

+ Molina Healthcare (MOH) – Q1’23 was the first quarter without insider sales since 2010 , sending a compelling valuation message as shares pulled back from October’s all-time high of $374.00. The pause followed a period of elevated selling that began in Q3’22, led by CEO Joseph Zubretsky, whose sale of 196.1K shares targeting $330.00 drove quarterly sales volume to its highest levels on record. Zubretsky returned to sell another 178.9K shares near $344.00 as shares trended higher in Q4’22 and was joined later by EVP, Medicaid Marc Russo and Director Dale Wolf who also captured prices near $351.00 and $340.00, respectively. Seven sellers in Q3’22 were followed by five in Q4’22, a notably high level of participation, which makes the cessation of selling in Q1’23 stand out as an abrupt shift. (4/10/23)

+ Palo Alto Networks (PANW) – The CEO of the cybersecurity vendor extended the negative sentiment at the firm when he targeted $200.00 for 10b5-1 sales as shares of PANW recovered from January’s lows. Nikesh Arora was appointed as CEO of PANW in June 2018, where until his initial sale in November 2021, he only bought. Those purchases at an average price of $70.57 proved timely. Arora first sold at $181.46 and his sales from Q4’21 – Q3’22 mostly captured near-term price peaks for the stock. He stepped to the sidelines as shares faltered throughout Q4’22, and it was interesting to see him return to target $200.00 for sales after shares recovered. (2/9/23)

+ DexCom (DXCM) – Broad-based selling emerged at the glucose monitoring company as sellers targeted prices up to $126.00 through 10b5-1 plans, a negative development. CTO Jacob Leach led the round and was joined by CIO Shelly Selvaraj and EVP, Operations Barry Regan who targeted $125.00 and $124.50 respectively. EVP, Global Revenue Paul Flynn’s plan sold up to $120.00. A high breadth of participation has been common at DXCM, though insiders did remain largely on the sidelines from Q2’22 through Q4’22 as shares reached a multi-year low of $66.89 in May, and the return to broad-based selling is notable. (2/28/23)

About the Data

Data included in this report is sourced by VerityData | InsiderScore‘s comprehensive databases of insider trades, buybacks, at-the-market offerings, management changes, institutional investor disclosures, and more.

For access, request a free trial of VerityData >>

For data inquiries relevant to this report, contact Ben Silverman.

Outperformance Starts Here

See how Verity accelerates winning investment decisions for the world's leading asset managers.

Request a Demo