Insiders Show Conviction at CHTR, VRE, THC As Selling Remains ‘Unusually Low’

A summary of notable insider trading activities from Verity’s research team.

In Brief

- October insider buying and selling was low, but that’s normal and aligns with the seasonal flow. Relative to buying, however, selling continues to be unusually low, tilting sentiment in the positive direction.

- With most companies reporting earnings in late October and early November, the majority of insiders were prohibited from trading without 10b5-1 plans. Those who used 10b5-1 plans were relatively modest sellers (insiders rarely use 10b5-1 plans for buys).

Putting October in Context

The first month of each quarter is typically the least active as trading windows are largely closed. Roughly 250 insiders bought shares of their companies in October, slightly higher than the first month of Q3’22 and but a little less than the 265 insiders who bought in October 2021. Similarly, the ~240 unique non-10b5-1 sellers in October 2022 was slightly higher than July 2022 but meaningfully less than the ~350 who sold October 2021.

Taken together, sellers and buyers were matched almost 1:1, which is solidly below the average ratio of monthly sellers to buyers.

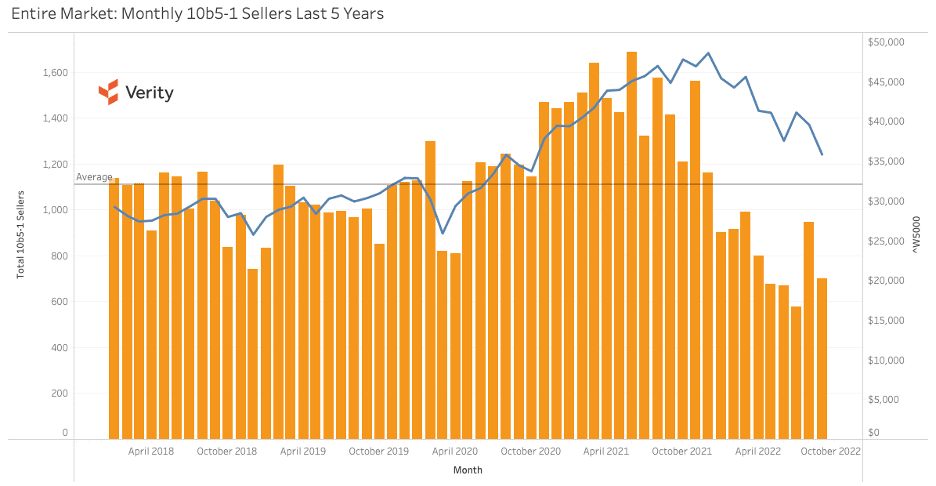

The level of 10b5-1 selling can be particularly insightful on a monthly basis because it’s a subset of insider activity that’s generally not impacted by blackout periods around earnings. The chart below shows the number of 10b5-1 sellers by month over the last five years.

Unusual Insider Signals to Note

As always, it’s important to look at company-specific stories where insiders are behaving unusually. Throughout the quarter, we have been alerting clients with real-time coverage of unusual insider behavior. Here is a small selection of that coverage from recent weeks.

+ Charter Communications (CHTR) – Director Eric Zinterhofer showed strong conviction with his purchase of $10.2M at $374.04 to kick off November. He’s been on the board since 2010 without ever buying before so the decision to buy after this year’s slide is a meaningful deviation in behavior. Zinterhofer is co-founder of private equity firmer Searchlight Capital. (11/4/22)

+ Veris Residential (VRE) – CEO Mahbod Nia bought shares for the first time at VRE since taking the helm in March 2021. Nia added to his equity exposure that included options that were underwater, which was already an incentive to guide the stock higher. The October 11 buy of nearly $1M at $11.51 quickly proved timely as Kushner Companies sent an unsolicited bid on October 21 to acquire VRE for $16.00 per share. (10/13/22)

+ Tent Healthcare (THC) – CFO Daniel Cancelmi became the first buyer at THC in over two years by spending $473.8K on shares at $43.07. Cancelmi’s only other buy was in March 2020 and proved timely as he sold a year later for a ~250% gain. The latest buy was also meaningful as he put cash behind his statement when discussing the newly approved $1B buyback plan in which Cancelmi talked about “the belief in the upside in [THC] equity value.” (10/28/22)

About the Data

Data included in this report is sourced by VerityData | InsiderScore‘s comprehensive databases of insider trades, buybacks, at-the-market offerings, management changes, institutional investor disclosures, and more.

For access, request a free trial of VerityData >>

For data inquiries relevant to this report, contact Ben Silverman.

Outperformance Starts Here

See how Verity accelerates winning investment decisions for the world's leading asset managers.

Request a Demo