Alpha Patterns: How VerityData Helps Investors Identify Opportunistic Insider Activity

Explore examples showing how differentiated insider trading analysis is helping investors gain an edge.

For portfolio managers and analysts, identifying meaningful insider trading behavior requires much more than just reviewing the Form 4 filings. While many investors track basic insider activity, VerityData | InsiderScore customers gain crucial context around company selling cultures, insider-specific histories, 10b5-1 plan valuation signaling, unusual compensation incentives, and more.

In this article, we’ll examine a few examples of the kinds of differentiated insider analysis that VerityData clients receive. From Snowflake to Levi’s to Under Armour, these examples highlight how, with smart insider context, investors can gain an edge in their investment process.

Snowflake (SNOW): Sharing Context Beyond Dollar Values

VerityData analysis highlighted a series of insider transactions throughout 2024 that revealed significant insider activity levels at key price points.

- As with most tech companies, SNOW insiders have had a strong sell bias over the years. In Q1’24, however, VerityData noted both an acceleration and wider breadth of insider selling. Insiders, including then-CEO Slootman, executed 10b5-1 plan sales with price triggers up to $230.00. The stock reached $237.72 that month.

- Insider buying in tech is rare, and a $5M purchase even rarer. New CEO Sridhar Ramaswamy’s $158.52 buy in March could seem like a strong signal. But, after researching Ramasway’s employment agreement, VerityData added meaningful context: it was part of a one-for-one share match program, making the purchase less meaningful.

- A more positive signal came in June when Director and founding CEO Michael Speiser bought $10M at $131.09. What stood out beyond the outsized amount? The sentiment reversal. VerityData noted that Speiser had previously sold at $177.67 a year earlier.

- The stock rose substantially in Q4’24 following strong earnings.

Myriad Genetics (MYGN): Detecting Notable Behavior Shifts

VerityData alerted investors to a shift from first-time selling to consensus selling, which preceded a significant pullback in stock price.

- In May 2024, VerityData identified CEO Paul Diaz’s first-ever sale, breaking a long period of inactivity.

- In September 2024, when shares reached new highs, VerityData identified an unusual wave of six concurrent sellers – including CEO Diaz’s return to selling.

Ultra Clean Holdings (UCTT): Highlighting Company Cultures With Attuned Valuation Signaling

VerityData analysis revealed insiders attuned to valuation as they sold at highs and stayed on the sidelines at lows.

- In October 2023, after a long period of steady insider selling, VerityData highlighted an unusual absence of insider selling as shares traded near $22.15. A positive behavior change.

- In mid-2024, as shares moved toward $56.47, VerityData identified several more notable changes. An unusual number of insiders (9) sold, including the CEO and CFO at prices up to $55.87. Also, several insiders opportunistically employed price triggers via their 10b5-1 selling plans. (Price triggers are an important, valuation-signaling behavior that VerityData captures.)

- In late 2024, after shares retreated from highs, VerityData highlighted COO Harjinder Bajwa’s $943K purchase at $34.30, along with a marked reduction in selling activity. Yet again indicating UCTT insider focus on valuation.

Levi Strauss (LEVI): When 10b5-1 Rule Changes Made a Sale Stand Out

A senior executive’s first major sale in years occurred at a specific price point following a mandated cooling-off period.

- In May 2024, VerityData identified notable changes in selling behavior at Levi Strauss & Co. Chief Financial and Growth Officer Harmit Singh executed his largest sale to date, disposing of 629K shares at $22.10.

Singh’s sale at Levi stood out because he sold the maximum amount of shares his 10b5-1 plan allowed as soon as he could, suggesting opportunistic timing — especially since other insiders and major shareholders were selling at the same time.

Note: Changes to 10b5-1 plan disclosure rules have added to the richness of VerityData’s insider activity database and analysis.

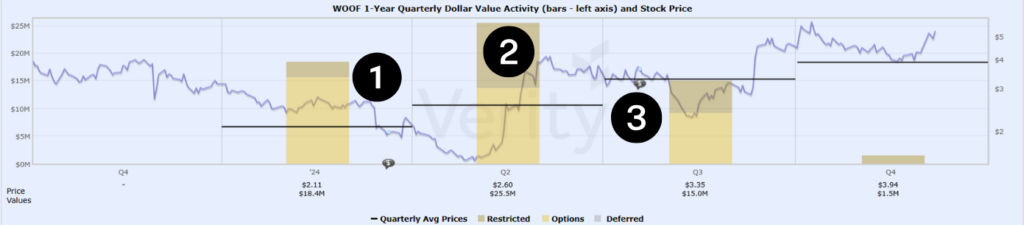

Petco (WOOF): Understanding Stock Price Incentive Structures

Multiple executives received premium-priced option grants indicating management alignment around specific price targets.

Companies rarely hand out equity compensation that vests when shares hit price targets. When companies offer it, they can reveal two things: price levels the board believes are achievable, and what might motivate executives. At Petco, a series of compensation, which included price-based vesting targets, preceded notable upside.

- In March 2024, VerityData highlighted interim CEO Michael Mohan’s compensation package, including 7.4M options struck at $5.00 – representing a 250% premium to the stock price at the time of the award.

- In May 2024, VerityData customers received intel about new Executive Chairman Glenn Murphy’s $2.5M purchase at $1.70 and his options with out-of-the-money strike prices up to $10.00.

- In July 2024, VerityData analysis showed how incoming CEO Joel Anderson’s package, with premium-priced options at $5.00 and $7.50, aligned with the earlier grants.

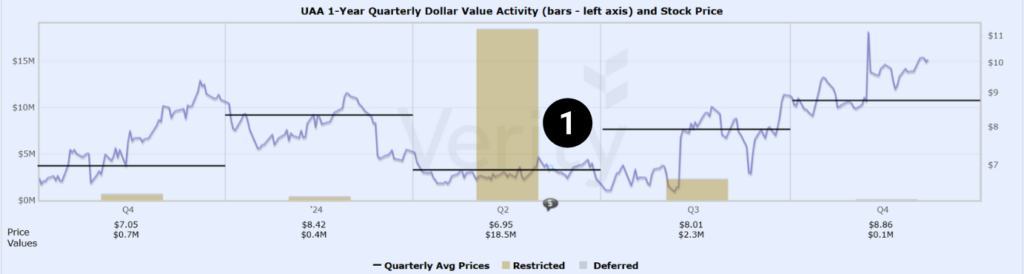

Under Armour (UAA): History Matters in Founder Returns

VerityData highlighted that returning founder-CEO Kevin Plank’s compensation structure showed notable differences from historical patterns.

- In April 2024, VerityData analysis highlighted how a new 2.1M restricted stock grant to CEO Kevin Plank would only vest when Under Armour’s stock hit $13.00, marking a change from their previous performance incentives.

Bottom Line

These examples show how investors using VerityData’s multi-dataset analysis can spot signals that may be overlooked through traditional insider analysis. Customers receive context and pattern recognition that can help inform their investment decisions. While many investors track basic insider moves, VerityData customers gain additional insights to help evaluate insider behavior patterns.

Take the VerityData Challenge

See for yourself why investors value VerityData’s high-quality, structured data — with history going back nearly 20 years. Includes insider activity, stock buyback initiations & quarterly repurchases, lockups, ATMs, 13F/D/Gs, management changes, and more.

Outperformance Starts Here

See how Verity accelerates winning investment decisions for the world's leading asset managers.

Request a Demo