New Insider Insights at $NFLX, $WW, Others Are Result of Sweeping 10b5-1 Update

Earlier this year, the SEC made big changes to Rule 10b5-1 that require companies to disclose more insider activity than ever before. The changes are showing up in 10-Ks & 10-Qs, providing new insights to investors.

For the first time ever, when U.S. companies filed their 10-Qs or 10-Ks this quarter they were required to disclose whether any officer or director adopted a Rule 10b5-1 plan during the quarter covered by the filing. This was one of the many changes adopted by the Securities and Exchange Commission earlier this year and it’s proving to be one that generates edge for investors.

Below, three excerpts from recent VerityData research briefs that highlight how our analysts are extracting valuable insights for our clients from new Rule 10b5-1 disclosures

NFLX

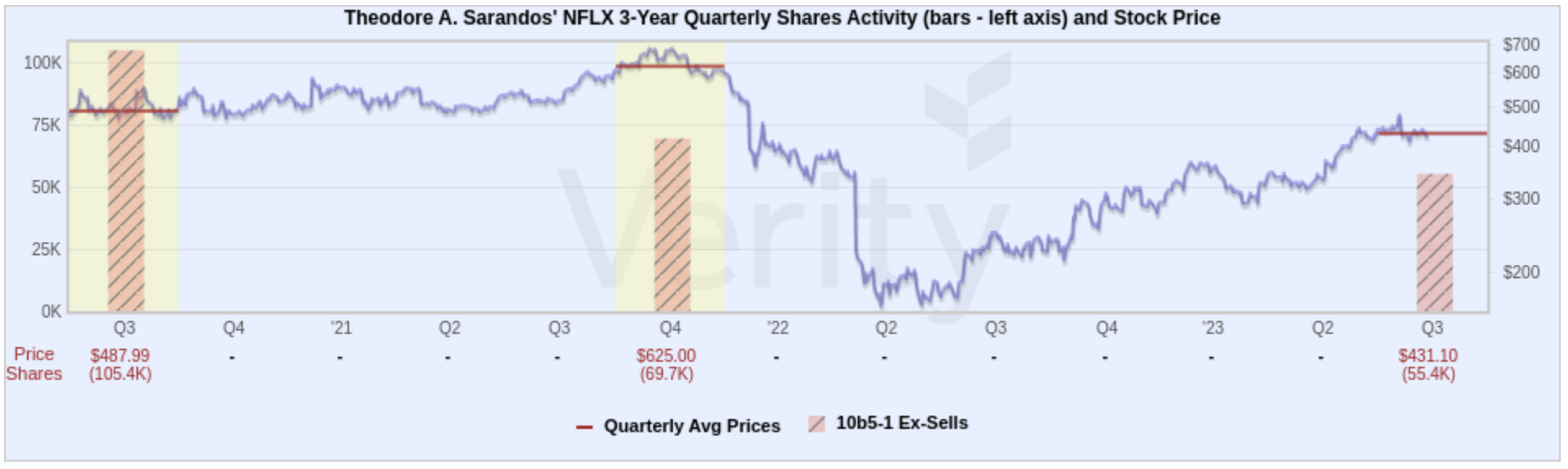

Co-CEO, With a History of Opportunistic Insider Sales, Discloses New 10b5-1 Plan to Sell Options

The streaming entertainment giant disclosed in its most recent 10-Q that Co-CEO Ted Sarandos adopted a new Rule 10b5-1 plan in early May to exercise-and-sell stock options beginning in early August 2023 and up through August 2024.

The new Rule 10b5-1 plan adoption by Sarandos follows NFLX’s recovery from multi-year lows reached in Q2’22 when a disappointing earnings announcement sent shares tumbling to their lowest levels since the pandemic roiled markets in March 2020.

Sarandos last sold in October 2021 and has a history of using Rule 10b5-1 plans to sell at trigger prices (targeted prices the stock has not previously achieved or not traded at in recent months). Saranados’ selling via a 10b5-1 plan has not always been predictive but his use of the plans to target specific prices is opportunistic behavior and some of his sales have come at highs and ahead of steep drops or retrenchments for the stock.

APLS

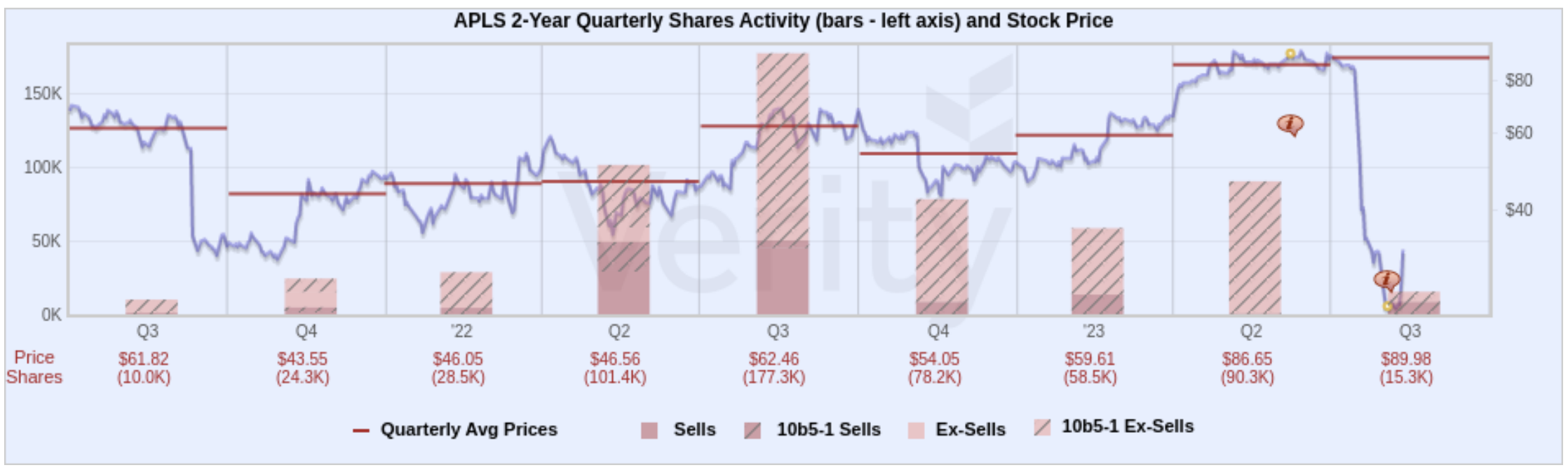

Multiple 10b5-1 Plan Disclosures in Latest 10-Q Shed Light on M&A Chatter, What Insiders Knew Ahead of Stock’s Plunge

The pharmaceutical company became the focus of M&A rumors in April when a financial media outlet reported that APLS was in discussions with advisors regarding a potential sale. But according to the company’s recent 10-Q, CEO Cedric Francois and nine other insiders adopted new Rule 10b5-1 plans from late May to late June, meaning that the executives and directors were not in possession of material nonpublic information during that period. The disclosure of the plan adoption dates throws cold water on the idea that APLS was actively seeking a sale.

The 10-Q disclosures also came two weeks after a group of doctors released a letter saying they believed that APLS’ drug to treat advanced eye disease geographic atrophy has been associated with rare but severe side effects. The stock lost nearly 60% of its value within four days of the letter being made public.

Insiders typically embed minimum sale price thresholds into their Rule 10b5-1 plans so it will be important to monitor APLS to see if, after the stock’s big sell off, sales under the new Rule 10b5-1 plans actually commence.

WW International

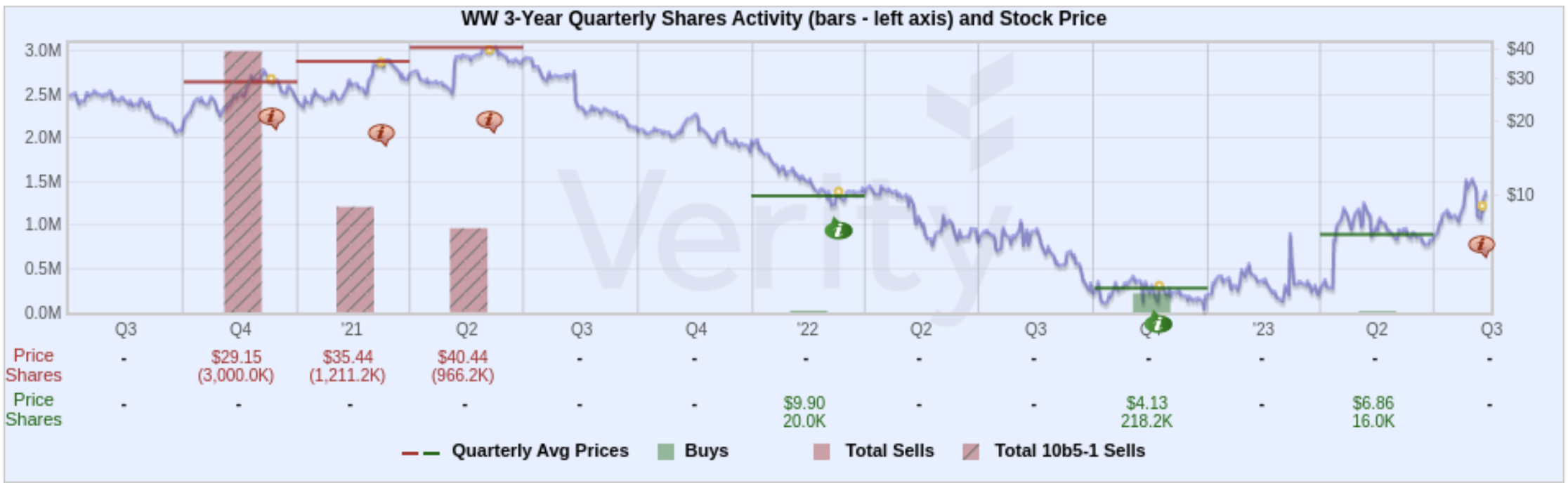

Director Oprah Winfrey Discloses New 10b5-1 Plan to Sell; Sales Would Be First at Co. Since 2021

The weight management services provider disclosed in its most recent 10-Q that Director Oprah Winfrey adopted a new Rule 10b5-1 in May to sell stock and options from August 2023 through March 2025. Winfrey, a board member since 2015, replaced a plan that was set to expire in December 2023.

Winfrey last sold in June 2021 at ~$40.00, a price the stock hasn’t seen since then. The issue traded under $5.00 as recently as April before recently trading back above $10.00. It will thus be important to recognize at what price Winfrey begins selling at again. She likely cancelled her old Rule 10b5-1 plan because the stock had fallen under her minimum sale price threshold.

Sales under the new Rule 10b5-1 plan will give us an idea of the prices that Winfrey is now comfortable selling at following the significant revaluation of the stock. Winfrey has been an opportunistic seller in the past so she’s an important insider to track.

Bottom Line

We predicted in March that these sweeping Rule 10b5-1 rule changes would have meaningful impacts both on the level of disclosure around 10b5-1 plans and with regards to actual insider selling behavior. Our predictions have been confirmed by the flurry of insights identified by VerityData analysts this 10-Q season.

Is It Time to Upgrade Your Insider Intel?

Generate differentiated ideas and manage risk with access to regular research reports and powerful insider data & analytics from VerityData | InsiderScore.

Outperformance Starts Here

See how Verity accelerates winning investment decisions for the world's leading asset managers.

Request a Demo