Tracking SPACs? Search 150+ Datapoints With New SPAC Database From Verity

Advanced new SPAC database from Verity puts insights into the minds of institutional investors.

In Brief

- SPACs increased by 386% from 2020 to 2021.

- Volume of data challenges ability to glean insights quickly.

- Advanced SPAC database brings needed structure, integrity.

- Tracks 150+ data points throughout the SPAC lifecycle.

Investor interest in Special Purpose Acquisition Companies (SPACs) has exploded over the last two years. But as SPACs have surged (from 247 in 2020 to almost 1,100 YTD in 2021), so have challenges around data collection and analysis. More data often means more diving, more deciphering.

That’s why we’ve developed a comprehensive SPAC database. This dataset — powered by VerityData and part of the Verity Platform — is the most advanced SPAC database designed specifically for institutional investors.

About the Advanced SPAC Database

With the SPAC database, thousands of filings are consolidated and structured so that institutional investors can easily monitor movements and quickly generate differentiated ideas.

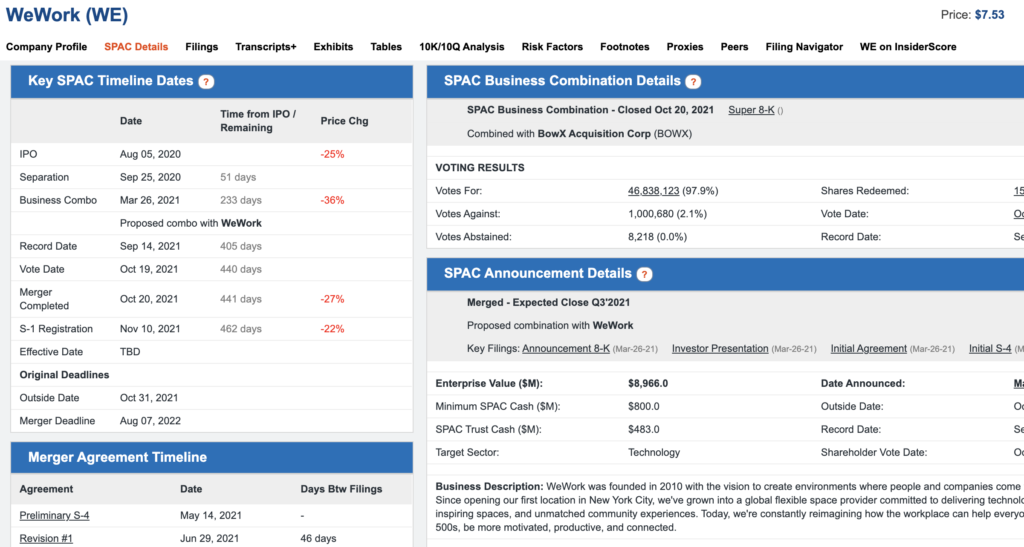

The VerityData team has made available every critical datapoint (typically more than 100 per transaction) throughout the entire lifecycle of a SPAC — from the IPO listing, through the target search and all the way to merger closing, target listing, and beyond.

Streamline company-specific research with key dates, transaction details, and other key datapoints.

Powerful SPAC Screening & Reporting Tools

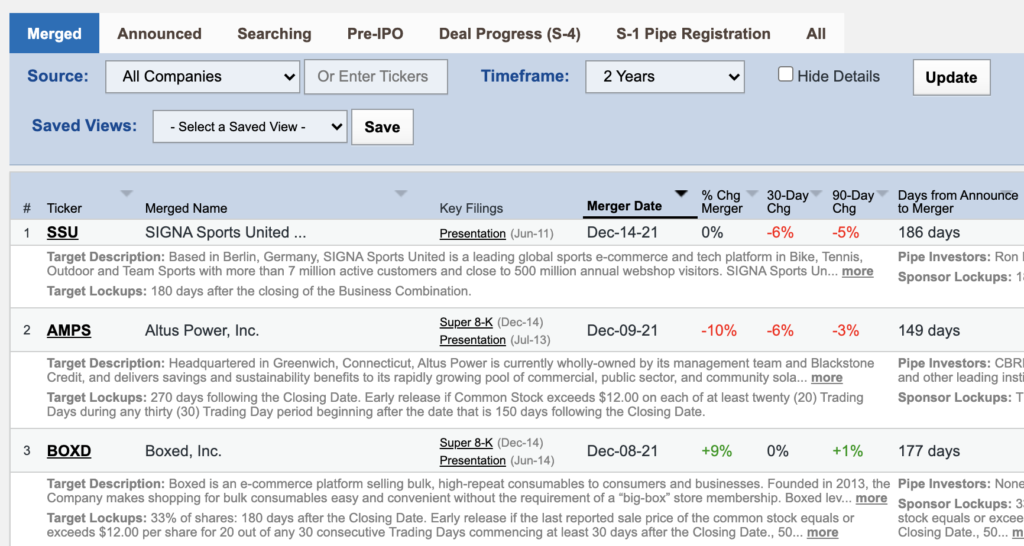

The data comes with powerful tools to help investors search, track, and monitor the SPACs that matter. Analysts can screen the data, view comprehensive company profiles, and receive alerts and custom reports via email or feed.

Screen the most important fields by SPAC stage. For example, compare redemption rate, approval rate, and more across merged SPACs.

Bottom Line

At Verity, we believe data can be the difference between a little early and too late, between a good decision and a great one. We’re excited about this new SPAC database and what it means for institutional investors who are paying close attention to SPACs.

Demo the SPAC Database

Contact us for a demo of the SPAC database offered through VerityData. After your short demo, you’ll get access to all the SPAC data that matters to you.

Outperformance Starts Here

See how Verity accelerates winning investment decisions for the world's leading asset managers.

Request a Demo