SEC Throws In the Towel (For Now) on Revised Buyback Disclosures

What happened? Get the answers and find out how VerityData clients are gleaning buyback insights.

On February 9, 2024, the SEC announced it would not be going forward with the buyback modernization rules that were adopted in May of 2023 and set to go into effect this year. The SEC announced with a simple notice pointing out the U.S. Court of Appeals vacated its modernization rule: “As a result of the vacatur, the disclosure requirements revert to those in effect prior to the Final Rule’s effective date.”

What happened? How should investors be looking at buybacks this year? In this blog, I’ll answer those questions and show how we’re gleaning buyback insights in VerityData | InsiderScore.

What Was the Proposed Buyback Modernization Rule?

The proposed modernization rule by the SEC sought to enhance the transparency of corporate stock buybacks through detailed, daily disclosures in quarterly filings. This amendment required companies to report a comprehensive table, which was to include the class of shares, average price paid per share, total number of shares purchased, and the remaining value of the buyback plan.

Notably, the amendment introduced the requirement to separately report purchases made on the open market and those executed through 10b5-1 plans. Additionally, companies were to disclose their rationale for buybacks, detailing objectives and criteria used in decision-making processes, alongside the adoption and termination of 10b5-1 plans. This move was aimed at providing investors with more granular data to better analyze corporate buyback activities.

What Happened? Why Was the Rule Change Challenged?

The Chamber of Commerce of the USA sued the SEC, challenging the Share Repurchase Disclosure Modernization rule on grounds that it violated the Administrative Procedure Act.

The Court of Appeals for the Fifth Circuit ruled on October 31, 2023, that the SEC did not adequately analyze the economic implications of the rule nor respond effectively to concerns about its economic impact.

Consequently, on December 19, 2023, the court vacated the rule, emphasizing the need for a more thorough cost-benefit analysis by the SEC. This decision underscored significant concerns regarding the regulatory process and the balance between transparency and the regulatory burden on companies.

It’s unclear if the SEC will make another attempt to increase disclosures around buybacks. The commission has its hands full with other agenda items and if the White House changes parties next year there would likely be little to no appetite for a revisiting of the rules. Regardless, any rule change and accompanying implementation would not happen in the near-term.

Gaining Insight on Buyback Execution With VerityData

Many investors don’t realize that the actual price per share that companies repurchase stock is disclosed in the SEC’s current filings through 10-Ks and 10-Qs. Even though the current disclosures aren’t as granular as the modernization amendments the SEC sought, important valuation signals can be gleaned from buyback execution.

At VerityData, we’ve historically focused on execution-level data to understand valuation signals from top management and figure out which management teams are opportunistic or instead more programmatic. Some management teams are price agnostic with buybacks, focusing more on returning excess capital, while some are savvy at picking spots to buy back stock.

An Example at Arista Networks

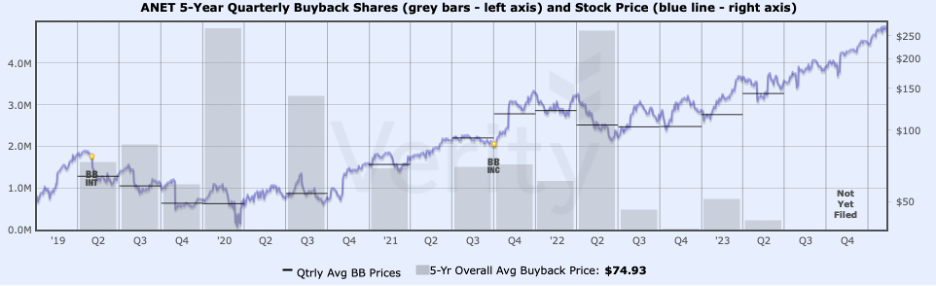

The chart below highlights Arista Networks (ANET) buyback execution and stock price over the last five years, showcasing how a management team strategically deployed capital to retire shares when it was most advantageous. Notice how buyback volume spiked during pullbacks, with the largest periods for repurchases in Q1’20 and Q2’22 ahead of significant upside.

Bottom Line

While investors won’t benefit from the increased transparency and datapoints that the buyback modernization efforts would have yielded, there is still material data in current disclosures for those who are paying attention.

Could Better Buyback Intel Strengthen Your Analysis?

With over 20 years of structured and accurate buyback data, VerityData helps investors decipher who the smart capital allocators are. The award-winning VerityData platform includes data, analysis, and expert research on buybacks, insider trades, at-the-market offerings, management changes, institutional investor disclosures, and more.