Seeing Investment Signals in Management Changes: 3 Examples

A Verity analyst highlights recent examples of notable management changes at WWW, CIVI, & BLCO.

Management changes are another solid input outside of company fundamentals that can help analysts build a stronger, more diverse mosaic. Data around management changes — who’s hired or promoted, their background and experience — can help investment teams generate new ideas or build conviction on existing ones.

In this article, I’ve gathered three examples to illustrate nuances and insights available to investment teams.

- A battle-tempered internal hire laces up as CEO at a struggling footwear company.

- A highly strategic CTO is hired as a regional energy producer expands its horizons.

- A new CEO at a global eyecare pharmaceutical company builds out an executive team to match the company’s ambition.

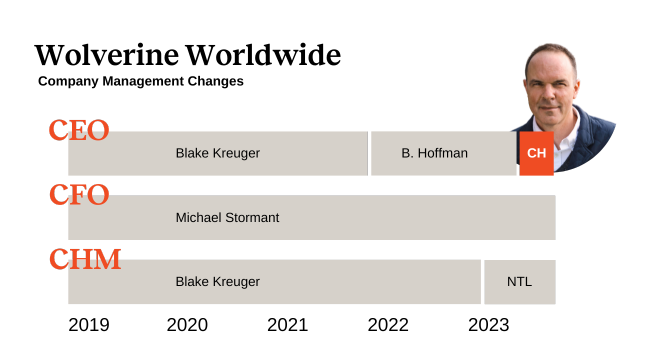

WWW — Wolverine Worldwide

CEO Terminated Without Cause, the Latest in a Year of Reshuffling

Wolverine Worldwide, the footwear manufacturing company, quietly announced the termination of Brendan Hoffman as CEO without cause on August 10. Christopher Hufnagel was promoted to CEO and retains the president title he’s held for under three months.

Hoffman, who was also president at Wolverine before he served as CEO for a little more than 1.5 years, inherited a company already facing slowing sales and supply chain issues. In 2022, Hoffman reorganized the firm’s brands under three core groups, Active, Work, and Lifestyle, and announced layoffs in December of that year. This February, he oversaw the sale of the firm’s Keds line and announced in May that Wolverine is seeking “strategic alternatives” for its Sperry lifestyle brand.

New CEO, Hired Internally, Has Strong Track Record

Before Hufnagel became president in June, he led Wolverine’s Active Group from November 2022 while also leading the firm’s Merrell unit since September 2019, Wolverine’s best-performing brand since at least 2020. He led Wolverine’s CAT Footwear brand from 2013 through mid-2019.

Hufnagel now leads the retailer whose stock hit a ~14.5-year low of $7.90 on August 24. Though a sustained turnaround escaped Hoffman’s efforts, Wolverine’s board still thinks an internal candidate offers the best route for improved prospects. To its credit, Hufnagel has a solid record of accomplishment with Merrell and is a seasoned company vet who has seen market extremes. Those looking to take measured bets may view Hufnagel’s attributes as key for Wolverine’s prospects.

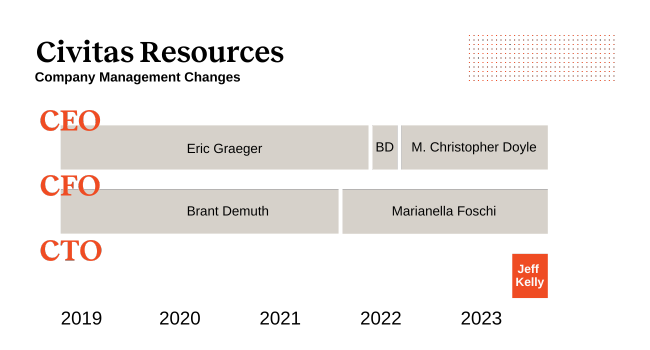

CIVI — Civitas Resources

Chief Transformation Officer Hired, Highlighting Bold New Strategy

Civitas, a Colorado-based energy producer, announced on August 8 the hire of Jeff Kelly from Blackstone to become chief transformation officer.

The company plans to enter the Permian Basin for the first time, expanding its primary operations in Colorado into the Southwest through the acquisition of two companies for consideration of ~$4.7B.

Civitas intends to maintain its dividend and will offset it and a portion of its acquisition costs by cutting its buyback program in half — from an authorized $1B down to $500M — and sell an estimated $300M in “non-core” assets by next year. All as the company undergoes a historic expansion.

Position Designed for Kelly

The CTO role was designed with Kelly, or someone very similar, in mind. Kelly guided Blackstone’s private equity energy portfolio for 4.5 years and spent a nearly eight-year stint at Anadarko. During Kelly’s later years there, per his LinkedIn page, he drove ROI initiatives in Ghana projects and led Western Energy’s restructuring before Oxy acquired Anadarko in 2019.

Along with Kelly’s Anadarko experience, he was a director of ops and cost consulting at IHS (2007 – 2011) where he founded the IHS CERA Upstream Operating Cost Forum and the IHS CERA Upstream Operating Cost Index (“UOCI”).

A Winning Hire?

Given Kelly’s background, and his extensive Blackstone Rolodex, analysts may feel his hire is a winning choice for Civitas. The company is making a bold move into the most oil-rich region of the US as recession fears linger and China’s economic slowdown continues, possibly spurring a drop in energy prices that layer risk on top of the integration.

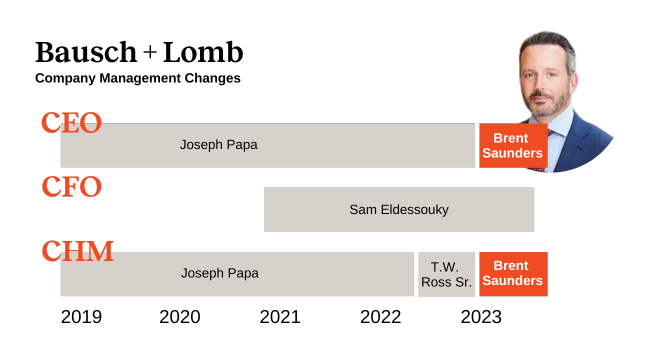

BLCO – Bausch + Lomb

New CEO Makes Multiple Strategic Hires in Support of Aggressive M&A Activity

The eyecare pharmaceutical firm hired Brent Saunders as CEO in Q1’23, who was CEO of the predecessor Bausch + Lomb until it was acquired by Valeant/BHC in 2013.

CEO Building Out Solid Executive Team

A key goal since his return was to build out the executive team and several new hires went into effect Aug. 1. One hire was Chief Compliance Officer Jon Kellerman. Another was CHRO Asli Gevgilili. Both worked with Saunders during their time together at Allergan (2014 — 2020). Bausch + Lomb also hired Al Waterhouse as the firm’s Chief Supply Chain & Operations Officer. He has an extensive background not only in operations but within eyecare. He is the former CEO of eyecare biotech AcuFocus (2015 – 2023) and led Abbott’s Medical Optics (now J&J Vision) worldwide operations.

New roles of chief global manufacturing and supply chain officer were also created. All these changes were announced after Bausch + Lomb agreed at the end of June to buy dry eye treatment XIIDRA and two other ocular treatments from Novartis for an upfront $1.75B in cash plus $750M in potential milestone payments. The next month, Bausch + Lomb purchased an eye treatment line from J&J for ~$100M. BLCO is only valued at ~$6.7B so there is a definitive push to create a much larger eyecare company.

CEO Has Reputation for Splashy Deals

Saunders has a reputation for splashy deals. He was CEO of Forest Labs when it was acquired by Actavis in 2014 for ~$28B. Through that deal, he became CEO of Actavis and guided its $70B acquisition of predecessor Allergan in 2015, rebranding the combined company under the Allergan name. In January 2016, Pfizer and Allergan agreed to a stock-and-cash deal valued at $160B, but both walked away three months later. Allergan was eventually acquired by AbbVie in May 2020 for $63B.

Bausch + Lomb’s move to buy Novartis’ treatments is transformative, and that plays right into Saunders’ wheelhouse. He has assembled his past lieutenants to bolster the firm’s footing. Altogether, the transformation points toward a potential opportunity for analysts to latch onto what may become a greater player within the eyecare space.

Bottom Line

Management changes provide analysts with another avenue to uncover fresh investment ideas or paint a more vivid picture of your current theses. Knowing key leadership changes — matched with compensation — as well as insider trading can combine to illuminate either a culture invested in a company’s vision or discord that can lead to volatility. Staying abreast of all these events can help analysts take advantage of either of these outcomes.

Is It Time to Upgrade Your Insider Intel?

Generate differentiated ideas and manage risk with access to regular research reports and powerful insider data & analytics from VerityData | InsiderScore.