How Investors Take Advantage of Sentiment Analysis in VerityData’s GenAI Earnings Summaries, Backed by Research

Sentiment analysis offers meaningful context as part of your broader mosaic. Find out how VerityData’s GenAI Earnings Transcript Summaries help investors get a faster and deeper understanding of earnings conference calls.

By now, you may have seen VerityData’s GenAI Earnings Transcript Summaries, one of two new GenAI-enhanced reports available. The GenAI Earnings Call Summaries include two sections. One, an analyst-engineered GenAI summary of the contents of the earnings conference call. Two, a GenAI-powered sentiment analysis of that same call, measuring the use of positive or negative words.

We’ll explore the sentiment portion of the report in this article. Specifically:

- When should investment teams use conference call sentiment?

- How should investors interpret that sentiment when leadership teams are incentivized to frame results as positive?

- What does it mean when conference call sentiment is at odds with the market’s reaction to company earnings?

We’ll take these questions one at a time. But first some important caveats: When we refer to conference call sentiment, we are talking about textual sentiment. The text transcript, not the audio, is being reviewed by AI. Also, the VerityData AI sentiment analysis is based only on the content of the transcript — with no outside context from other filings, analyst estimates, or market data.

Why Worry About Sentiment of an Earnings Call?

Extra Focus & Efficiency

In addition to gauging the overall sentiment of the call, you can quickly drill down to which topics have outlier or negative sentiment within the call, leading to a more efficient earnings process. We’ve combined sentiment analysis with the call summary into a single report to make this process even more efficient. You get a comprehensive overview of the call. (We are continuing to iterate and add AI-driven features to our reports, so stay tuned.)

Meaningful Context

Sentiment also gives you a lens to consider management temperament and credibility. Is management conservative, keeping the tone neutral even when results are strong? In the opposite direction, is management’s credibility in question because they are overly rosy in framing disappointing results? There is academic research adjacent to this topic as well.

How VerityData Scores Sentiment

An excerpt of VerityData’s GenAI Earnings Transcript Summary showing overall sentiment as well as sentiment by topics discussed in the recent SBUX conference call. Source: VerityData

Our analysts have developed an AI-powered system that reviews structured conference call transcripts topic by topic and assesses the word choices used by executives and analysts.

Those word choices then map to one of our five possible sentiments for each topic:

Positive | Slightly Positive | Neutral | Slightly Negative | Negative

We then average the topic sentiments to come up with an overall sentiment for the conference call.

‘Normal’ Sentiment = Slightly Positive

How should investors interpret the sentiment? What is “normal”? Numerous academic studies have examined conference call sentiment over the last couple of decades. From those we see a clear trend: conference call sentiment leans positive. This makes sense. Even when results are negative, management are strongly incentivized to accentuate the positive, whether this be pure spin or a legitimate reframing of the story.

We see this trend in our own data as well.

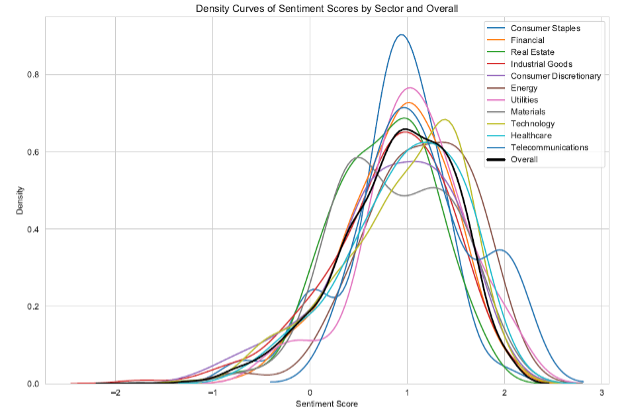

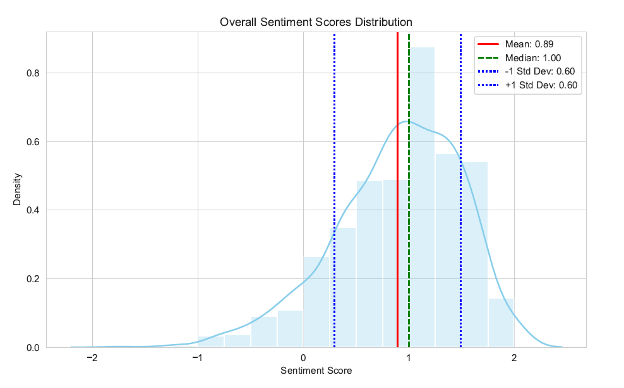

The histogram below shows the distribution of VerityData’s AI-generated sentiment scores for conference calls held from the start of January 2024 through mid-February.

Consistent with academic research in the field, VerityData data shows sentiment in earnings conference calls has a slightly positive bias. Source: VerityData

You can see that the median sentiment is well above the “0” Neutral score, that negative sentiment scores are quite rare and should stand out, and that the typical overall sentiment score is “1”, which maps to Slightly Positive in our reports. (We calculate overall sentiment score per company by averaging the sentiment given for each topic surfaced by the AI.)

‘Normal’ Sentiment Can Vary By Sector

Sentiment also varies by sector, another important context that can impact your interpretation. As shown in the chart below, our macro data of sentiment analysis shows:

- Technology and Energy have leaned a bit positive.

- Real Estate and Materials have leaned a bit negative.

- The rest are clustered around the mean.

Sometimes Sentiment Is at Odds With the Market

One question we’ve received from users is how to interpret the sentiment analysis when it is at odds with the market’s reaction to company earnings.

A 2011 paper called “Earnings conference calls and stock returns: The incremental informativeness of textual tone” that appeared in the Journal of Banking & Finance provides some insight.

Aligned? Stock Tends to Behave as Expected: What the study found was that when earnings surprise and conference call sentiment are aligned, the stock behaves as expected: the stock rose on positive alignment and declined on negative alignment.

In Conflict? Worth a Closer Look: When the earnings surprise and the sentiment of the conference call are in conflict, the study found that the stock does not behave as might be expected from considering the earnings surprise alone.

When the sentiment reading shown in VerityData’s AI sentiment analysis conflicts with the initial market reaction to the earnings report, that might be an indication that the situation merits a closer look.

One angle to consider is whether management’s tone is appropriate given the information they disseminated and given the market’s reaction to it. An overly optimistic tone at a time of execution failures can be telling.

Recent Examples of Sentiment/Market Conflict

We’ve already seen a number of instances where leadership sentiment has conflicted with the market’s reaction. The tables below show several year-to-date examples. The Sentiment value is the simple average of the sentiment’s assigned to the topics within the conference calls by the AI. A “Sentiment” of 2 is the highest – all positive – which a sentiment of -2 would be all negative.

| Ticker | Company | 1-Day Earnings Price Change % | Score | Sentiment |

|---|---|---|---|---|

| TSLA | Tesla Inc | -12.1% | 1.83 | Positive |

| SHOP | Shopify Inc. | -13.4% | 1.71 | Positive |

| PERI | Perion Network | -20.1% | 1.71 | Positive |

| RMBS | Rambus | -19.2% | 1.67 | Positive |

| WOLF | Wolfspeed | -13.6% | 1.67 | Positive |

| SYM | Symbotic Inc | -23.6% | 1.57 | Positive |

| CTS | CTS | 10.4% | -0.83 | Sl. Negative |

| MPWR | Monolithic Power Systems | 14.2% | -0.40 | Neutral |

| ZBRA | Zebra Technologies | 12.2% | -0.20 | Neutral |

| VKTX | Viking Therapeutics | 18.0% | -0.20 | Neutral |

| PRAA | PRA Group | 14.2% | -0.17 | Neutral |

| CRL | Charles River Labs Intl | 11.3% | -0.14 | Neutral |

Bottom Line

Sentiment analysis can be an extremely useful data point as part of your broader mosaic. It’s why we’ve included the feature as part of VerityData’s GenAI Earnings Transcript Summaries, which can help investors quickly triage the companies they’re watching for a faster and deeper understanding of the full context of the earnings conference call.

Is It Time to Modernize Your Earnings Workflow?

Accelerate your earnings analysis with GenAI assistance engineered by analysts and powered by clean, structured, and exclusive data available through VerityData | inFilings.