Tracking Spinoffs? Here’s Why You Should & How to Screen Spinoffs Quickly With VerityData

Spinoffs have gained momentum in recent months, with major companies executing transformational spinoffs. The latest release from VerityData lets institutional investors track and screen spinoffs to identify companies with potential valuation mismatches.

Spinoffs have picked up steam.

General Electric (GE) completed the first of two transformational spinoffs earlier this year, while Johnson & Johnson (JNJ) has a transformational spinoff of its own on tap for later this year.

Verity has made it simpler for institutional investors to track spinoffs by adding them to our award-winning library of databases. By doing so, investors can now easily screen for recently spun-off companies to quickly identify under-covered companies with potential valuation mismatches.

In this article, I’ll cover why spinoffs are a compelling data point for investors as well as show how to screen spinoffs within VerityData | inFilings.

By screening for recently spun-off companies, investors can potentially increase their investment returns.

Studies: Spinoffs Have Outperformed

Shares of spinoffs have consistently performed better than broader market indexes. This finding dates back to some of the earliest academic studies, conducted by Patrick Cusatis, James Miles, and Randall Woolridge, who co-authored a paper titled “Restructuring” in 1993. Their study examined spinoffs from 1965 to 1988. Since then, there have been more recent studies since then confirming the outperformance of spinoffs.

The key drivers for spinoffs are their ability to unlock sum-of-parts value, increase operational focus, and improve capital allocation. Often, non-core divisions don’t get the appropriate reinvestment they need. By increasing transparency in financial results, the division can generate better returns as an independent company.

Companies can execute spinoffs in a handful of ways:

- A standard spinoff simply means investors of the parent get a pro-rata distribution of the spinoff.

- In the case of large companies, they can use a reverse-Morris trust transaction to spin off and merge a business with another publicly traded company. This method is used when the spinoff is larger than the business it’s acquiring.

- Another method is a carve out, which involves the spinoff being taken public through an initial public offering (IPO), followed by the eventual distribution of shares. It’s important to note that a carve out is a two-part process. Initially, the spinoff is floated on the public market, providing investors with transparency. However, the spinoff is still controlled by the parent company until the parent decides to distribute its majority ownership.

How to Screen on Spinoff Attributes & Performance With VerityData

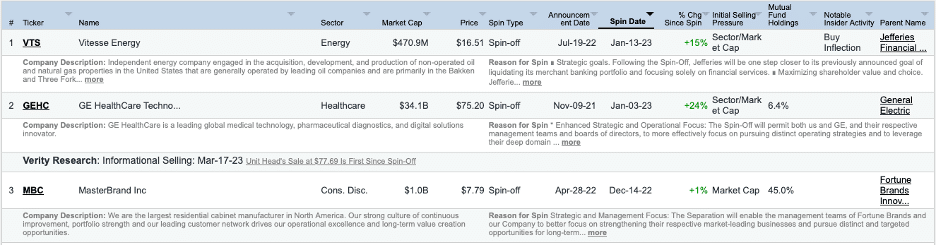

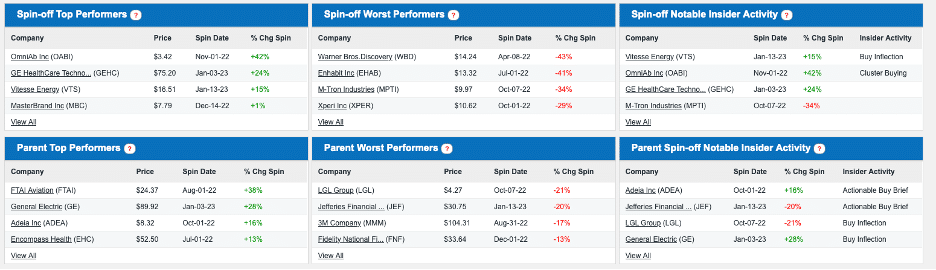

In VerityData’s inFilings platform, the Spinoff Overview tab contains pre-set screens that allow you to analyze the best and worst stock performance of both spinoffs and parent companies since the spinoff date. There are also pre-set screens focused on looking at notable insider activity, including VerityData’s proprietary Unusual Events and Research Briefs.

Pre-set screens in the Spinoffs Overview tab help speed analysis. Click image to open full-size version in another tab.

The screener also lets you sort by spinoff type, size, completion date, and initial selling pressure. The latter is defined as a difference in sector or market-cap group for the spinoff and parent company. This is important because funds with specific mandates — such as large-cap-focused funds invested in a $50 billion parent company receiving shares of an $800 million spinoff — may experience increased selling pressure.

Bottom Line

The Spinoffs database is the latest addition to the award-winning VerityData platform. In 2022, VerityData launched databases covering initial public offerings (IPOs) and special purpose acquisition companies (SPACs). Institutional investors can benefit from tracking spinoffs as a data point in their strategy. By screening for recently spun-off companies, investors can potentially increase their investment returns.

Want to Track Spinoffs Easily?

Request access to VerityData >>

Current Clients: Please reach out to your customer success team.

Outperformance Starts Here

See how Verity accelerates winning investment decisions for the world's leading asset managers.

Request a Demo