Insider Buys at SBUX Extend Positive Sentiment, Show Vote of Confidence in Its Reinvention Plan

Purchases by Chair Mellody Hobson and Director Richard Allison at $92.57 extend the strong positive sentiment at the coffee giant, where insider selling has effectively ceased this year.

One of 2,500 annual insider research briefs from the VerityData analysts. Originally published 09/19/2022 and distributed to InsiderScore customers.

Purchases by Chair Mellody Hobson and Director Richard Allison at $92.57 extended the strong positive sentiment at the coffee giant, where insider selling has effectively ceased this year.

There had been a sell bias at SBUX in recent years and that shifted to a buy bias this year, initially sparked by founder and interim CEO Howard Schultz’s buys in May at $71.35.

After shares peaked at $126.32 in July 2021, the stock bottomed at $68.39 in May, about a month after Schultz returned to the fold. No insider has sold during this year’s drawdown, when excluding the sale of expiring options.

Schultz nearly picked the bottom with his buy while Hobson and Allison bought on a rebound. The buying bookends the selection announcement of a new CEO and raised long- term guidance as part of the company’s Reinvention Plan. Hobson and Allison are showing confidence in the incoming CEO and strategic initiatives in activity that sends an undervalued message.

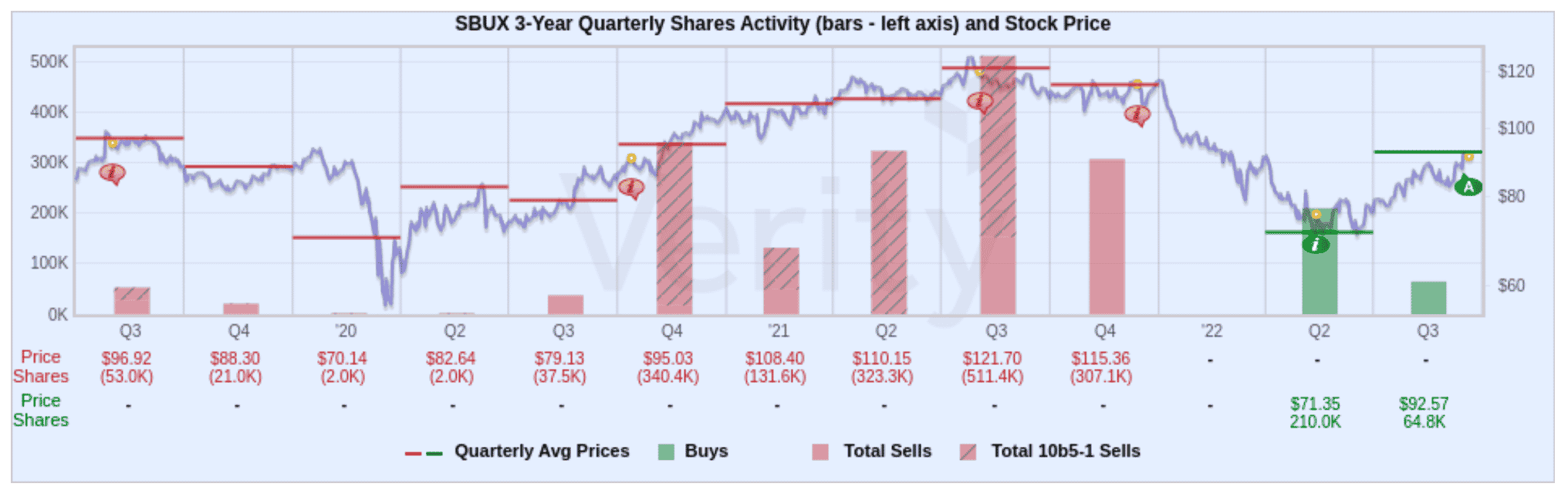

SBUX 3-Year Quarterly Shares Activity

Click to enlarge. After several quarters of sell bias at SBUX, insiders have bought in Q2 & Q3 2022. Source: InsiderScore

Two Directors Bought on Rebound

Board members Mellody Hobson and Richard Allison spent a combined $6.0M on shares at $92.57. Hobson has been on the board since 2005 and was elevated to chair in March 2021. She’s the president and co-CEO of value-focused Ariel Investments, which did not hold any shares of SBUX as of June 30, 2022. She previously bought seven times from 2006 – 2013. Most buys were small at $100K and less until a $10M buy in 2013 so the latest purchase showed good conviction compared to her overall buying record. Shares experienced positive returns after five of seven buys; the average three-month return is 10.9% while returns moderated at the six and 12-month mark. Allison, conversely, emerged for his first buy at SBUX. He’s been on the board since 2019 and was former CEO of Domino’s Pizza (DPZ). During his eight years as a reporting insider at DPZ, he never bought there either so the SBUX purchase is a deviation in behavior. The $925.3K he spent compares to $47.5M in pre-tax proceeds he generated from sales at DPZ.

CEO Schultz Reversed Sentiment With May Buying, Selling Ceased

Founder and interim CEO Howard Schultz spent $15M to buy at an average price of $71.35 on May 10/12. The buy also represented a significant deviation in behavior as it was his first buy since our dataset began in 2004 and the first insider buy at the company since August 2018. Before Schultz stepped up for the buy, selling was the norm at SBUX though that’s faded this year on weakness. Every quarter from Q1’19 through Q4’21 had at least one seller. While $10M is a hefty sum, the buy only increased Schultz’s holdings by 0.6%, doing little to alter Schultz’s risk-profile as he already held a $1.57B stake. It’s also worth noting that between the time of Schultz’s retirement in June 2018 and his return in April of this year, his holdings decreased nearly -38% and he likely banked at least $350M by liquidating the stock options he held when he retired.

Buys Are Vote of Confidence in New CEO, Reinvention Plan

SBUX announced on September 1 the hire of Laxman Narasimhan as CEO. He was most recently CEO of UK-based Reckitt (RKT-GB). Before that he was with PepsiCo (PEP) where he was a reporting insider for five years (he sold three times and never bought). His SBUX salary will be $1.3M with a cash bonus opportunity equal to 200% of his salary and annual equity awards with value targeted at $13.6M. He’s also slated to receive a $1.6M cash signing bonus and $9.25M in replacement equity for equity being forfeited at his former employer. Then on September 14, SBUX provided new growth targets as part of its Reinvention Plan, which featured a three-year financial roadmap and annual comparable store growth of 7-9%.

About the Research Brief

Data included in this report is sourced by VerityData | InsiderScore‘s comprehensive databases of insider trades, buybacks, at-the-market offerings, management changes, institutional investor disclosures, and more.

Outperformance Starts Here

See how Verity accelerates winning investment decisions for the world's leading asset managers.

Request a Demo