The Delta of Better Data: 8 Moments When Investors Realized VerityData Outperformed Other Providers

For investors, data integrity is more than a buzzword. Here's what happens when investors compared VerityData to other data providers.

In the world of financial data, accuracy is more than a buzzword — it’s the difference between making informed decisions and being misled by false signals. While every data vendor claims to provide high-quality data, the real test comes when users compare data points side by side.

Time and again, portfolio managers, quant researchers, and data scientists respond to VerityData with the same observation: “You have it right. Our other sources have it wrong.” Rather than just making claims about accuracy, here are real-world examples that demonstrate how VerityData’s accuracy and attention to detail can make a difference.

Quant? Explore VerityData Feeds >>

1. Flagging a Lockup Release That Never Happened

Don’t assume lockup releases follow a simple calendar — you must track multiple triggering conditions.

The Comparison

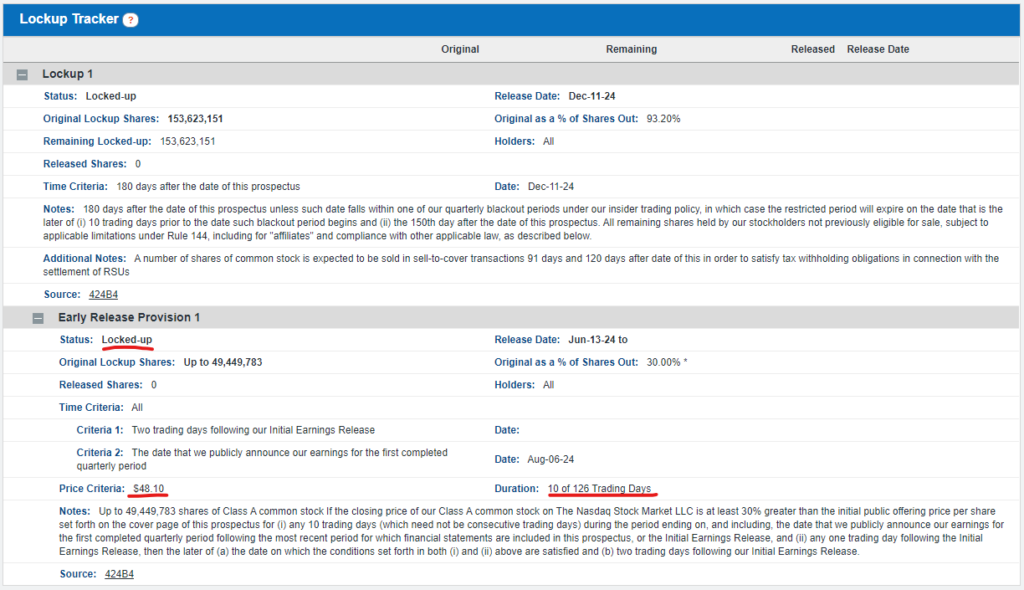

When some data providers were reporting a lockup expiration for Tempus AI (TEM), a healthcare technology company, following earnings, VerityData correctly identified that the early release provision hadn’t been triggered. Why? While the time criteria had been met, the stock hadn’t maintained the required price level ($48.10) for the necessary 10 trading days.

As one client noted: “Happy VerityData got it right — some brokers were saying unlock after earnings!”

VerityData’s Lockup Tracker correctly identified that TEM’s early release provision had not been triggered because the stock hadn’t maintained the required price level ($48.10) for the necessary 10 trading days (underlined in red). Click for full size.

Why It Matters

If you jump the gun on lockup expiration dates, you could mistime your trades and get caught off guard by unexpected changes in market supply.

About the VerityData Lockup Database: The lockup database covers all IPOs and SPACs that merged after Jan 1, 2021. The dataset includes fields related to conditional dates and early release provisions that can be used to determine upcoming release dates. We account for earnings dates, blackout periods undetermined at IPO, and release dates dependent on the share price hitting a certain percentage over IPO for a given length of time among other things.

2. Catching Spin-offs That Don’t Spin

You can’t just track spinoff announcements — you need to know when companies cancel or change their plans quickly.

The Comparison

A firm that was validating VerityData’s spinoff database against competitors noticed a meaningful difference in the case of CVR Energy (CVI). When CVR Energy announced it wouldn’t proceed with spinning off its nitrogen fertilizer business, VerityData’s database reflected this change immediately. Other data vendors lagged behind. This real-time accuracy prevents firms from acting on outdated information, such as about corporate actions that are no longer proceeding.

Why It Matters

If you build your strategy around a spinoff that never happens, you can waste resources and miss other opportunities while competitors move on to real deals.

About VerityData’s Spinoff Database: The spinoff database includes all domestic spinoffs going back to the start of 2020. We monitor 10-12Bs, S-4s, 8-Ks, and other filing types to stay on top of the latest updates, dates, and more.

3. Resolving Conflicted Reporting on Insider Transactions

Look closely at insider transactions — what appear as separate buys and sells might actually be one coordinated move.

The Comparison

Consider this scenario involving Uber’s CEO: While some sources reported conflicting buy and sell transactions on the same day, VerityData correctly classified this as an “Exercise-and-Sell” transaction.

The CEO exercised 1,000,000 options at $33.65 and sold the underlying 1,000,000 shares at $70.42 on June 17. The options were set to expire in September and the sale was transacted via a Rule 10b5-1 plan adopted in February. VerityData identify these transactions as an Exercise-and-Sell whereas other data providers often report these transactions as an Acquisition of 1,000,000 shares followed by a Disposition of 1,000,000 shares, which can be confusing.

Why It Matters

If you misread an exercise-and-sell as separate transactions, you can draw wrong conclusions about insider sentiment and potentially make moves based on false signals.

About the Insider Transaction Database: VerityData’s Insider Transaction database provides access to detailed Buy, Sell, and Ex-Sell transactions disclosed on SEC Form 4 for Section 16 Insiders. We combine proprietary software with specialized analyst review to tag 10b5-1 disclosures, options related sales, margin related sales and more.

4. Distinguishing Insider Selling That Wasn’t Selling

Before you react to insider ‘selling,’ make sure you know if it’s really a discretionary sale.

The Comparison

When a major data portal displayed an insider transaction for Compass’s (COMP) CFO as a standard event, VerityData correctly identified it as a restricted stock vesting with associated tax withholdings. They were non-discretionary, cashless transactions – not sales.

This kind of distinction is crucial for analysts trying to identify meaningful insider sentiment signals. VerityData weeds out transactions that don’t meet open market criteria whereas major providers often display these transactions in the same manner they display sales.

Why It Matters

If you treat every share disposition as a true sale, you can mistake routine tax withholdings for negative insider sentiment and make unnecessary portfolio adjustments.

Relevant Database: Insider Transactions

5. Catching Erroneous Disclosures

Be careful of putting too much trust in a single filing. It’s important to cross-reference ownership data across multiple SEC documents.

The Comparison

Did a Verrica Pharmaceuticals (VRCA) board member actually reduce their shares by 238,000? A major data provider reported it, but the incorrect figure was taken from the company’s 2024 proxy statement. The figure had erroneously reverted to a position held by the board member in 2022. VerityData’s rigorous verification process caught the discrepancy.

Why It Matters

If we base decisions on incorrect ownership figures, you can misunderstand the power dynamics at play and make governance-based investment calls using faulty information.

Relevant Database: Insider Transactions

6. Detecting Tax-Related Insider Sales

To spot real insider selling signals, you must understand why insiders are selling in the first place.

The Comparison

An investor believed the last open market sale for Deciphera Pharmaceuticals (DCPH), a biotechnology company, was Nov 30th, 2023, but a major data provider showed sales in February 2024, January 2024, and December 2023. Unfortunately, some data providers group all insider sales together, whereas VerityData distinguishes between standard open market sales, tax-related sales, and other technical transactions. This granularity helps analysts identify truly meaningful insider activity versus routine administrative transactions.

Why It Matters

If you lump all insider sales together, your team or model can overreact to routine transactions or miss the truly significant selling patterns that could save you from losses.

Relevant Database: Insider Transactions

7. Adding Context to ATM Sales

To properly assess a company’s capital raising strategy, you need to track not just how much they’re selling, but through which ATM programs and when.

The Comparison

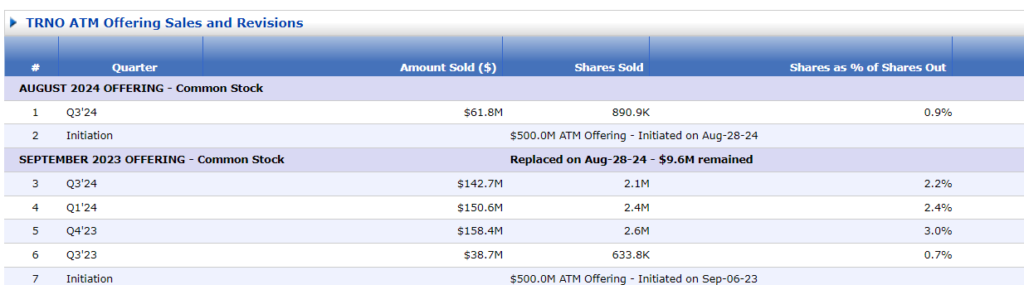

When Terrano Realty (TRNO), a public real estate investment trust, announced their ATM sales of $204.5 million, one firm noticed that VerityData was offering important context by breaking up the sale into two figures. One was a $142.7 million sale from the previous plan and the other a $61.8 million sale on the current plan. While other sources reported only the aggregate quarterly figure, VerityData distinguished between separate ATM programs, tracked mid-quarter program transitions, and maintained accurate attribution of sales to specific plans.

Notice two entries for Q3’24 in the table in VerityData; $142.7 million from the previous plan and $61.8 million on the current plan. Together they account for the total selling of $204.5 million during the quarter.

Why It Matters

If you miss the transition between ATM programs or lump all sales together, you might misread the company’s capital raising pace and potentially misjudge their urgency to raise funds — a critical factor in predicting future dilution and price pressure.

About the ATM Database: The VerityData ATM database comprises all open market at-the-market offerings initiated since at least 2015 and their corresponding sales updates. It includes ATM activity disclosed within 10-Ks, 10-Qs, as well as updates provided in 8-Ks and prospectus filings.

8. Identifying an IPO That Wasn’t Really an IPO

When you’re analyzing IPOs, you need to know exactly what kind of listing you’re dealing with. But that’s not always the case.

The Comparison

When validating VerityData’s IPO listings, one firm called out a significant difference in how their existing data providers classify corporate events. While some providers broadly label any new listing as an “IPO,” VerityData maintains crucial distinctions between:

- True initial public offerings.

- Relistings (like in the example of Diamond Offshore Drilling).

- New exchange listings (such as Noble Corp).

- Reorganizations (like Summit Midstream Corp).

Why It Matters

Each of these events has different implications for investors and models alike, and requires different analysis. To classify them all generally as IPOs could introduce unknown amounts of risk into your investment process. Precision matters.

About the IPO Database: VerityData’s IPO database includes all domestic IPOs over $50M back to the start of 2021. We monitor S-1s, 424B4s, 8-Ks, and other filing types to stay on top of the latest updates, dates, and more.

Bottom Line

False signals, inaccurate context, and errors compromise good investment decisions. Sometimes it’s a single data point that’s off. More often, it’s the accumulation of many small, but not-right details that can dull investment edge. At VerityData, our combination of proprietary technology, specialized analyst review, and real-time monitoring of filings help investors get the right data as quickly as possible.

Take the VerityData Challenge

Contact us for a free trial or to get sample data. See for yourself why investors value VerityData’s high-quality, structured data — with history going back nearly 20 years. Includes:

- Insider Activity

- Stock Buyback Initiations & Quarterly Repurchases

- Lockups

- At-The-Market Offerings

- 13F/D/Gs

- Management Changes

- And more.

Outperformance Starts Here

See how Verity accelerates winning investment decisions for the world's leading asset managers.

Request a Demo