The Insider Review | August 2022

A monthly summary of notable insider trading activities from Verity’s Director of Research.

In Brief

- July was slow, but normal.

- Two factors contributed to a overall positive sentiment in Q2 this year.

- Interesting start for August and ahead.

July Was Seasonally Slow

Insider trading volume in July 2022 was seasonally low as most insiders were prohibited from buying or selling outside of Rule 10b5-1 plans as their companies reported earnings. This is normal seasonality. The first month is the low point for transactional volume every quarter and it’s rare we get any type of sentiment from tell from insiders during that period.

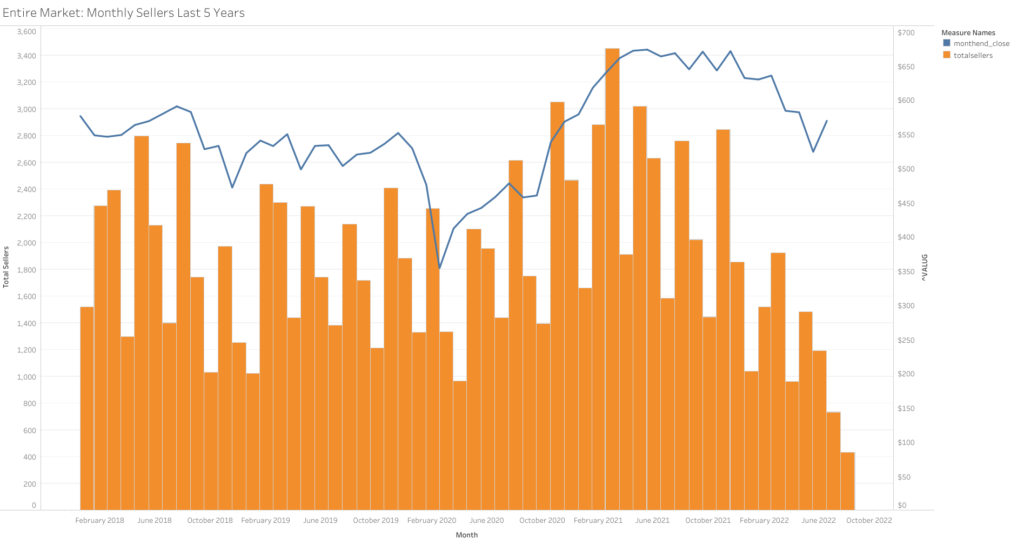

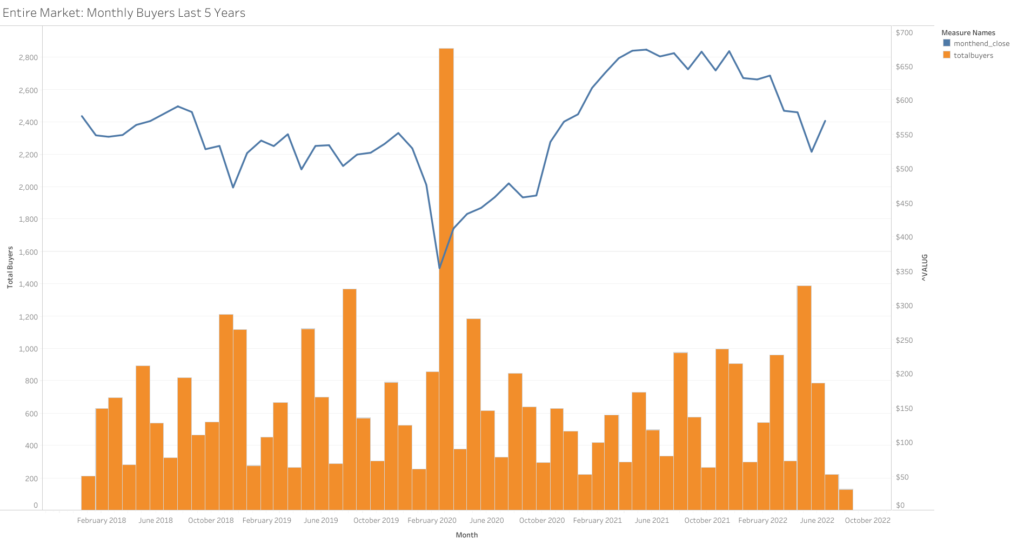

The charts below show monthly totals of unique buyers and unique sellers for the past five years. July 2022 was the low-point for each and less than mid-way through August we’re on track to easily surpass the July totals.

Monthly Sellers Over the Last 5 Years

Source: VerityData | InsiderScore

Monthly Buyers Over the Last 5 Years

Source: VerityData | InsiderScore

Recapping Q2

Let’s quickly recap Q2’22 so as August rolls on we have an understanding of how insiders behaved last quarter.

Overall, Positive Insider Sentiment

Insider sentiment was very positive in Q2’22 due to two factors: a burst of buying in May and historically low sell breadth throughout the quarter.

May Was Busy With Buyers

The ~1,400 unique insider buyers in May 2022 was the 12th most in any month since our data set began (January 2004) and the 1.08-to-1.0 sellers-to-buyers was the 8th best on record (note that unique monthly buyers have only outnumbered unique monthly sellers seven times).

Buying Breadth Declined in June

Buying breadth declined significantly in June and for the quarter didn’t compare to other periods when the market fell sharply and insiders rushed into buy (November 2008 False Bottom, March 2009 Great Financial Crisis Bottom, August 2011 U.S. Debt Downgrade Bottom, March 2020 Pandemic Bottom).

Overall, 3rd-Fewest Number of Unique Sellers

The ~2,800 unique insiders who sold during Q2’22 was the third-lowest figure on record, trailing only the ~1,900 unique insider sellers in Q1’09 and the ~2,300 in Q4’08. Sellers-to-buyers ratio of 1.30-to-1.0 for Q2’22 compared to a historical average of 2.87-to-1.0.

Interesting Start for August

Looking at August and ahead for the moment, while we’d like to see buyers emerge (and we’re seeing signs of that now) and see selling volume remain depressed.

Insider selling is normal at many companies, so a lack of selling is just an important as actual buying is in terms of a valuation signal. Why? Because if generating liquidity is normal behavior, changing that behavior is an indicator that insiders are unwilling to sell at and accept current valuations.

About the Data

Data included in this report is sourced by VerityData | InsiderScore‘s comprehensive databases of insider trades, buybacks, at-the-market offerings, management changes, institutional investor disclosures, and more.

For access, request a free trial of VerityData >>

For data inquiries relevant to this report, contact Ben Silverman.

Outperformance Starts Here

See how Verity accelerates winning investment decisions for the world's leading asset managers.

Request a Demo