The New Fundamentals of ESG Engagement Tracking

There's a not-so-polished process behind glossy client-facing engagement reports. Learn takeaways gleaned from leading asset managers as they streamline ESG engagement tracking and reporting.

If we looked at the client-facing ESG engagement materials from a random sample of ten of the world’s leading asset managers, we’d see from all of them: polished reports with glossy visuals providing insight into the engagement story.

Ironically, if we pulled back the curtain to see how that data was compiled, we’d get an altogether different impression.

Eight of ten would be scrambling together their story with last minute emails and “circling back” messages as they manually gather, copy, and paste into any number of spreadsheets. I venture the other two would be leveraging a CRM or similar system.

I say this with confidence.

When front-office teams — including those from the top 100 asset managers — come speak with us, this scenario is overwhelmingly what they describe.

More and more, asset managers are recognizing that the status quo is not sustainable. They need to refine, overhaul, and/or automate their engagement processes so they can meet heightening expectations from investors and regulators.

What do we tell them? In this article, I’ll walk through the more practical challenges to engagement and ESG processes, offering takeaways and best practices along the way.

A global fund manager approached us a couple years ago to integrate their engagement workflow. They had been using spreadsheets and CRM for years, and it just wasn’t working anymore.

Trouble Starts With Disconnected Systems

One of the first step(s) in achieving this cohesion of fundamentals and engagement is with systems and datasets.

For most asset managers, one of the root causes of the problem is disconnected systems. More concretely, it’s the dependence on closed systems like spreadsheets. Spreadsheets and CRMs are powerful tools that can begin to tackle the huge job of tracking and storing engagement data. But while they are good solutions for storing data, they also conceal and disconnect information — from users and other systems.

Aside from that, funds talk about the manual data input required to keep the spreadsheets updated. It doesn’t scale well from a resource or productivity perspective — and it can be error prone.

Not only should individual datasets be visible in automated ways, but separate datasets need to be joinable with equal levels of automation.For example, joining portfolios, internal ratings, and third-party datasets with different ticker nomenclatures and formats — all in one view.

To run meaningful reports, engagement data should be married to client portfolios. Third-party data needs to be actionable to be useful. The lifecycle of an engagement needs to be trackable granularly – and all this can be automated.

Without Metadata, the Story Is Hard to Find

We’ve walked through why automation is beneficial to engagement tracking and ESG — for fund and client alike. But let’s discuss the more fundamental step to any engagement: data capture.

If you want a complete narrative, you need to capture data early and often. Tracking this data is paramount to meaningful client reporting. Too often, the means of capture are manual at best, archaic at worst.

Who at your firm touches the engagement process? If engagement is part of the investment story, probably quite a few. If we look at an average-sized asset manager, an engagement objective is often:

- Started by a member of the ESG team or varying members of the investment team.

- Further matured by some combination of ESG teams, the analyst(s) and fund managers.

- Fed down to client reporting.

When you consider varying personal processes, the number of overall engagements across funds and the wider firm, and the required datapoints therein, that’s a lot of opportunity for data leakage! As ESG and impact becomes further engrained in investment teams and processes, this will only multiply.

Data capture needs to be as seamless for ESG teams as it is for equity and credit analysts – integrating with their existing processes where possible (full-functionality Microsoft integration is a great example). The more that ESG is perceived a burden, the more difficult data capture will be.

Achieve Small Wins From Simple Workflows

Suppress your urge to build a complex workflow. You may end up scrapping it. For instance, a large global fund manager (one I’d argue is a leader in impact investing) approached us a couple years ago to integrate their engagement workflow into VerityRMS.

They had been using spreadsheets and CRM for years, and it just wasn’t working anymore. Portfolio reporting and story building was nearly impossible. So we recommended a simple starter workflow, which could be added to thereafter. To their credit, the senior team wanted an extremely robust and thorough workflow, sometimes taking the form of large templates and new steps for the investment teams (which deviates from new workflow best practices).

On paper and in demo, it was amazing end-to-end workflow. In practice, it struggled with adoption because of how complex it was. It struggled to add value.

Six months later the workflow was streamlined and simplified, with some amazing results. Simpler is almost always better, and it’s much easier to layer on steps in a process, rather than irritate ESG and investment teams from the start.

Rigid Systems Break, Stay Agile

ESG and engagement processes look different now than they did two years ago, and two years from now we’ll say the same thing.

Make sure your processes and systems reflect that uncertainty and are flexible enough to adapt. Whether it be additional metadata surrounding engagement, adding new datasets, or new reporting requirements, when clients are considering solutions to modernize engagement workflow, we advise that configurability is key.

Appreciate that investment and ESG teams are not all the same, and therefore ensure your ESG engagement solution is not one-size-fits-all either. Generally speaking, the leading fund managers, analysts, and firms have unique, differentiated processes, the solutions they implement should adequately reflect that — and fit their process.

Bottom Line

Disparate systems, lack of data, and haphazard workflows are putting up a lot of resistance for fund managers and ESG teams. They aren’t going anywhere. So start addressing these problems soon with a guiding principle is that ESG should work for you, not the other way around.

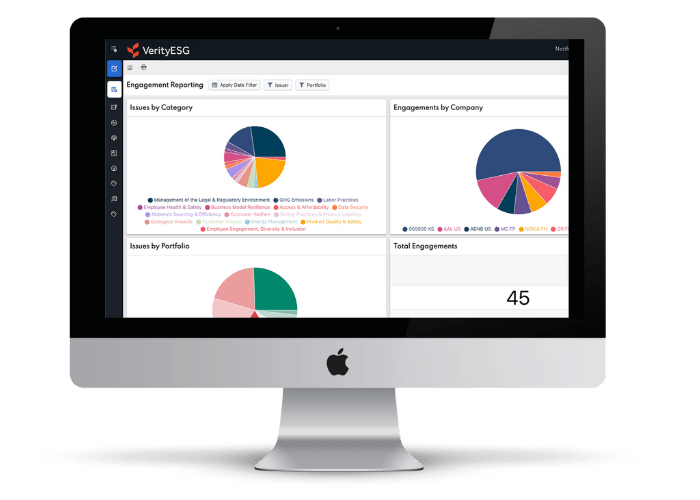

See the New Fundamentals in Action

At Verity, we offer integrated, automated ESG and engagement tracking solutions to leading asset managers and alternative investors globally. See how VerityESG can help streamline your workflow.

Outperformance Starts Here

See how Verity accelerates winning investment decisions for the world's leading asset managers.

Request a Demo