Lockup Tracker & Database: A Shortcut Through SPAC & IPO Complexity

Investors tracking lockups — now or in the future — don’t have to puzzle over legalese, release dates, blackout periods, price thresholds, and other moving targets.

2021-level hype around new issues paused for a good part of 2022, but the challenge of tracking lockups — in particular, conditional lockups and early release provisions — didn’t go anywhere.

In a few fast years, the staying up to date on lockups went from simple addition (add 90, 180 days to IPO) to sophisticated: tracking earnings dates, blackout periods undetermined at IPO, and release dates dependent on share price hitting a certain percentage over IPO for a given length of time.

Even if you knew what details you were looking for, finding it was difficult and buried in legalese.

It’s with these struggles in mind that we’ve made it much easier to track and screen new issues with our lockup tracker and database, the latest in a string of VerityData | inFilings updates that includes SPAC & IPOs.

The New Lockup Database

What exciting about this database, compared to any others available to institutional investors, is 1. the breadth, you’re able to get a big picture view quickly and 2. the clarity of detail, what was once buried is now surfaced quickly.

You can quickly answer critical, alpha-influencing questions like:

- Were any shares released early? Is my investment protected?

- How much pressure is going to be on the stock once lockups are released?

- Are any circumstances where the shares can be released early (ERPs)?

- Are there multiple release dates, what are they?

The before and after examples below show just how much easier lockup details are to digest.

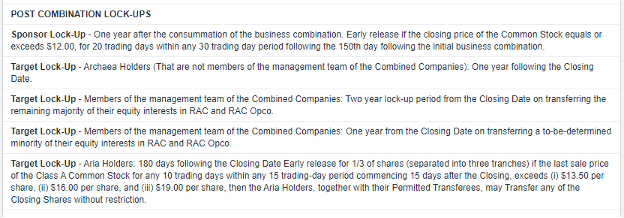

TYPICAL LOCKUP BEFORE

The SPAC information is there, but it’s not easy to parse.

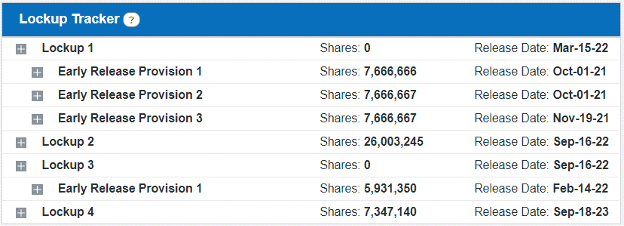

TYPICAL LOCKUPS NOW

All the dates, provisions, and share counts are right there.

We’ve made quite a few other updates to our platform as well, including a standardization across SPACs and IPOs, so you can screen both in one place.

Bottom Line

At Verity, we believe data can be the difference between a little early and too late, between a good decision and a great one. We’re excited about this new lockups database and what it means for institutional investors.

See VerityData | inFilings in Action

Outperformance Starts Here

See how Verity accelerates winning investment decisions for the world's leading asset managers.

Request a Demo