When Insiders Stop Selling: What Cessation of Selling Events Reveal to Investors

Learn how pauses in routine insider selling can reveal undervaluation or signal M&A activity.

At a recent customer visit, a portfolio manager introduced VerityData to another 15-analyst team. “Pay attention to what VerityData has. I’ve been a big fan of their Cessation of Selling event coverage.”

Across all the data available through VerityData | InsiderScore, Cessation of Selling events — a proprietary VerityData signal tracking pauses in insider selling — have become a particularly effective demonstration of our expertise in analyzing insider behavior. It’s a nuanced signal that’s hard to replicate. One that highlights how deeply our team understands the motivations, mechanics, context, and patterns behind insider transactions.

In Differentiated Episode 18, VerityData Director of Research Ben Silverman and Senior Analyst Max Magee dove into the Cessation of Selling phenomenon, including real-world examples from Microsoft (MSFT), Expedia Group (EXPE), and Tableau Software summarized below, showing how the absence of activity can sometimes be the most telling data point of all.

Listen to the Podcast Episode →

Microsoft (MSFT): Valuation-Oriented Pause

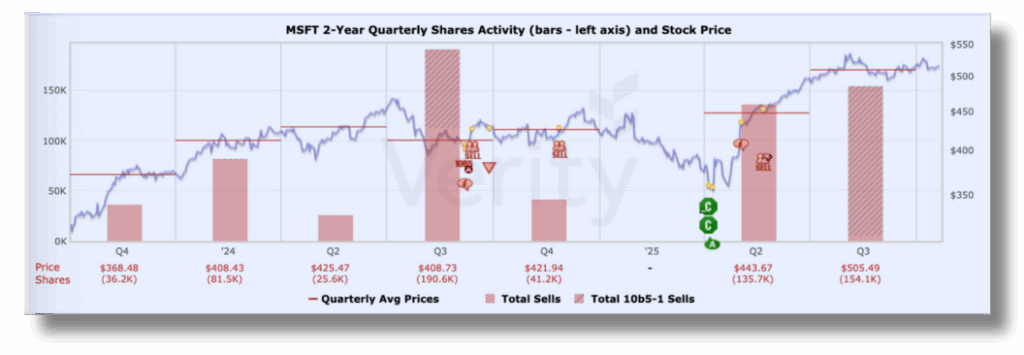

Microsoft provides a textbook case of valuation-driven Cessation of Selling. The company had insider sales in every quarter since Q2 2012 and, looking back, a nearly unbroken pattern for more than 15 years. That consistency made the Q1 2025 pause stand out.

After years of consistent insider sales (every quarter since 2012), MSFT insiders paused in early April 2025 — shown by the Green “C” Cessation of Selling marker.

Microsoft insiders typically sell not through preset 10b5-1 plans but during open trading windows following earnings. In this quarter, the stock drifted lower after results, yet none of the usual sellers participated — a collective decision to sit it out. The Cessation of Selling event was recorded in early April, and within weeks shares rose sharply. By the time insiders resumed selling in the next window, the stock was 15–20% higher and eventually more than 40% above the event point.

“At a lot of companies when insiders who regularly sold, stopped selling, it was an identifier that insiders thought that the stock was undervalued and they were making good calls.”

Ben Silverman

VerityData Director of Research

Expedia Group (EXPE): Five Years of Selling, Then Silence

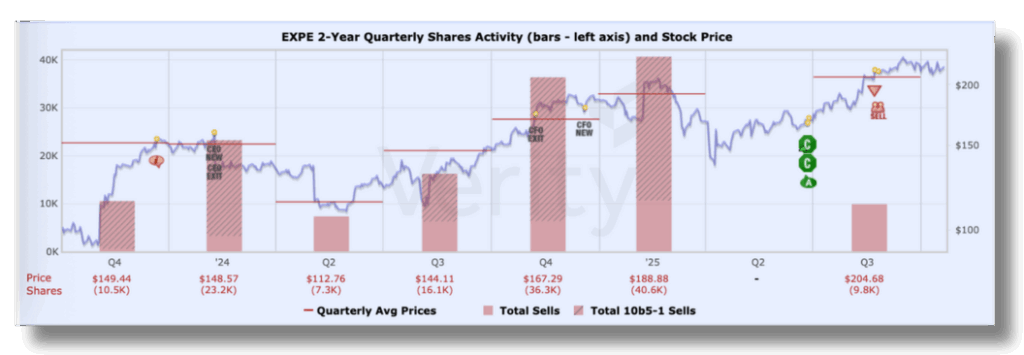

Expedia showed a different but equally clear pattern. The company experienced continuous insider selling for five years, from Q2 2020 through Q1 2025. When the stock fell below roughly $150, both automated and discretionary sales paused.

Insider selling halted for the first time in five years when EXPE dropped below $150 — the Green “C” marks the Cessation of Selling event.

Former CEO Dara Khosrowshahi’s 10b5-1 plan included a minimum sale price threshold at $150, and that limit was reached when shares dropped during March and April 2025. Other insiders who sold opportunistically during open windows also refrained from trading, marking the first pause in five years. The stock soon recovered. By the time sales resumed, shares had risen to around $225, suggesting the insiders’ implicit price floor had been well calibrated.

Tableau Software: Silence Before a Sale

While Microsoft and Expedia highlight valuation dynamics, Tableau’s pause suggested material non-public information.

Before Salesforce’s (CRM) 2019 acquisition of Tableau, the two co-founders — both heavy, routine 10b5-1 sellers — abruptly stopped selling even as the CEO continued smaller, regular trades. Their typical transactions involved hundreds of thousands of shares, often worth $35 to $50 million. The Cessation of Selling came months before Salesforce announced the deal at a premium.

Executives can legally cancel existing 10b5-1 plans, and such cancellations often coincide with pending strategic activity. The behavioral change — large holders stopping sales while smaller ones continued — became a clear M&A signal in hindsight.

“If you think a company might be an acquisition target, if the CEO was selling two weeks ago, it’s very unlikely that company is in talks to be acquired.” — Ben Silverman

Bottom Line

Max summarized the concept simply: “It’s really an exercise in pattern recognition. It’s just noting that we have this culture of selling and then noting that it has changed.”

Across these examples, Cessation of Selling emerges as a nuanced insider-behavior metric. Sometimes it highlights valuation inflection points. Other times it hints at information asymmetry or strategic activity. Either way, it reminds investors that when insiders stop doing what they normally do, the silence itself can be the signal.

See VerityData in Action

Discover how VerityData accelerates idea generation and risk management. Get access to 15+ years of the most accurate and complete data of its kind — includes insider activity, stock buyback initiations & quarterly repurchases, lockups, at-the-market offerings, 13F/D/Gs, management changes, and more — along with 2,500 annual research briefs from VerityData experts.

Outperformance Starts Here

See how Verity accelerates winning investment decisions for the world's leading asset managers.

Request a Demo