Ready Day 1: Why Startup Funds Began Prioritizing Research Management

A decade ago, funds didn't consider front-office tech outside of a data portal & Microsoft Office. That's changed. What's happening?

One of the biggest changes I’ve seen over the past few years is that a research management system (RMS) is now a day 1 tool for many new fund managers.

Most of the recent billion-dollar-plus fund launches have implemented RMS or are in the process of doing so. (We’re proud to be working with several of the firms referenced in the linked Bloomberg article.)

Since the beginning of 2021, roughly 25% of new VerityRMS clients are putting investment research best practices in place from day 1. This is a marked difference from years ago.

What’s changed?

With an RMS in place, startups can get answers to important questions. Are we working through new ideas quickly enough? Are we learning from ideas we passed on?

Time-to-Value Has Shortened: Implementing RMS Is Easier

It’s become significantly easier and quicker to get going with RMS than it was a decade ago and prior. When I started selling RMS back in 2015, fund managers were still debating the big questions of the 2010s — “build vs. buy?” and “on-premise vs. cloud?” — both of which are now largely settled.

Most firms have embraced the reality that developing in-house tools for their investment teams is outside the scope of their core competencies, from start-up funds with five investment professionals to global asset managers with 500+. Building software from scratch is an expensive CapEx proposition that can take years of effort and doesn’t always yield user-friendly results, not to mention ongoing technical support costs. Firms have also embraced the enterprise-grade security and ease of deployment offered by hosting platforms such as AWS.

Buying a vendor solution hosted on a dedicated single-tenant installation of AWS, for example, greatly cuts down on the time and effort to get an RMS in place — without sacrificing information security.

When funds launched a decade ago, the front-office technology stack typically consisted of a market data portal and Microsoft Office (and not much else). When I used to speak with fund managers who might buy RMS, I would reference a now-dated Citi “Hedge Fund Maturity Model” report. That report made it clear that, other than outsourced trading platform execution support via primes, new hedge fund tech consisted of spreadsheets and shared drives.

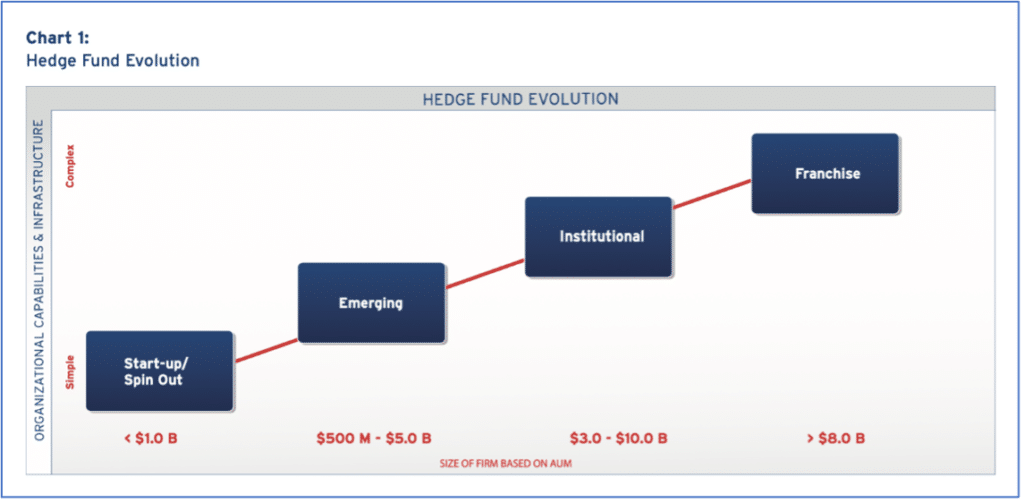

A decade ago, firms waited for RMS until they reached the Institutional phase. Today, start-ups are often considering RMS before launching. Graphic from Planning for Change: Understanding the Hedge Fund Maturity Model, Citi Prime Finance, 2010

Funds waited largely because legacy on-premise RMS offerings were such a burden to implement. The industry hadn’t yet caught up to the technology of the day. Most firms didn’t consider buying purpose-built front-office tools beyond a data portal until they reached the Institutional phase of maturity (i.e., $3-10b AUM), and often not until they reached the Franchise phase (i.e., $10B+ AUM). That’s all changed now.

Improvements to vendor platform features — such as VerityRMS’s no-code toolkit, which lets clients configure the software quickly without waiting for development — have also greatly shortened the time-to-value. New firms can consider RMS earlier, since they won’t get bogged down with many months of setup.

The cost of building in-house tools, the ease of deployment afforded by modern hosting platforms, and RMS feature improvements have combined to provide opportunities to the Startup segment of the hedge fund market, allowing them to leverage sophisticated investment research management tools from day 1.

RMS Has Matured: Leaders Are Familiar With It

Another contributing factor to firms using RMS earlier in their evolution is that founding PMs are mostly familiar with the RMS product category (or at least understand that front-office tech can be used to differentiate their investment process).

Most of those PMs at funds that made that Bloomberg list of billion-dollar-plus startups are coming from large, established shops with an RMS in place — several of which are also VerityRMS clients. These PMs and/or their teams reach out to us to discuss implementing RMS at their soon-to-launch funds. It’s an opportunity for them to bring over workflows that worked and update those that need improvement.

Startups also create the opportunity to improve their processes as they mature. By tracking coverage companies’ KPIs and their investment teams’ diligence, price targets, and recommendations early in the firm’s lifecycle, startup managers now can analyze and report on a wide range of target company metrics, as well as their own team’s efficacy of process.

With an RMS in place, firms can get answers to important questions:

- Are we working through new ideas quickly enough?

- Are we appropriately monitoring those ideas we passed on, to learn from prior efforts and decisions more deeply?

- Are we keeping an eye on the research team’s capacity and productivity?

- Can we quickly and easily report on all these metrics?

Gone are the days of tracking new ideas and company metrics in siloed Excel spreadsheets. RMS is broadly accessible to any firm ready to trade. In fact, the Verity customer success team does most of the work on a client’s behalf.

Bottom Line

We expect this day 1 trend to continue, particularly as we look at the new firms we’re speaking with each week. These firms recognize the benefits of a centralized research system where structured data, long-form research, and investment workflows (pre- and post-trade) all seamlessly coexist in one environment.

Thinking About Starting a Fund?

At Verity, we offer the modern research management system trusted by global asset managers. Request your custom demo to explore the possibilities VerityRMS can bring to your fund’s performance from day 1.