Why & How Investors Should Track Equity Gifts By Insiders

With new disclosure changes effected by the SEC on April 1, 2023, tracking insider equity gift transactions will become more important for investors. New VerityData capabilities make it easy.

As of April 1, 2023 (as part of the SEC’s amendment to Rule 16A-3), corporate insiders will be required to report gifts on Form 4s within two business days of the gift. This is a significant change from the previous requirement of reporting gifts no more than 45 days after the end of the fiscal year.

In this article, I’ll cover why gifts are important transactions, share an example at Coinbase, and introduce you to how we’re making these transactions easy to understand in VerityData.

With the new disclosure changes, tracking gift transactions will be important for investors.

Why Gift Giving Matters

In making the decision to amend reporting requirements, the SEC concluded insiders engage in “problematic practices” when gifting shares of their own companies, which included opportunistic behavior. They specifically cited two academic studies.

A 2021 academic study in March 2021 co-authored by Cindy Schipani and Nejat Seyhun, both of University of Michigan, found that donations by large shareholders “are suspiciously well-timed.”

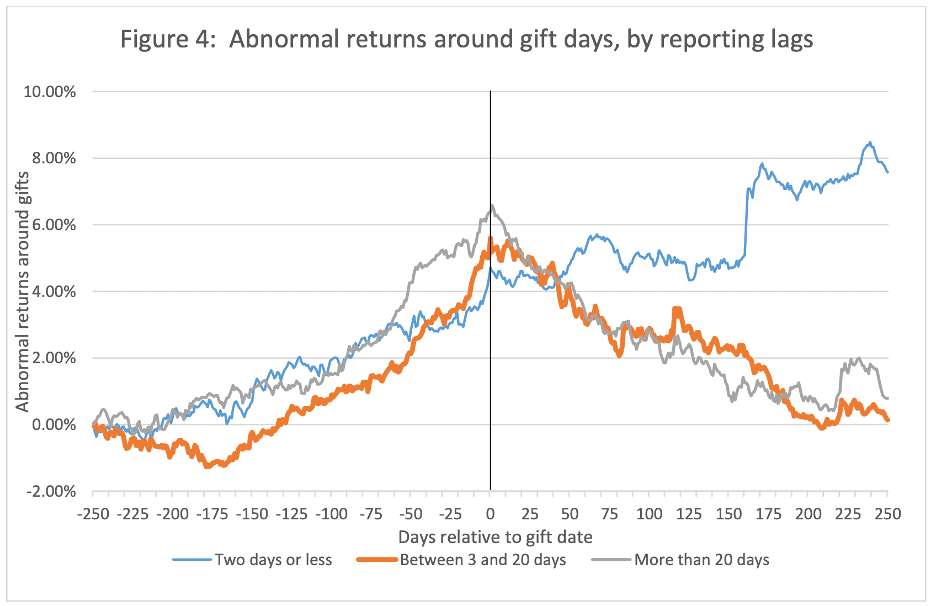

Giving away stock creates a tax deduction for the donor, and there’s an additional benefit of gifting at relatively high stock prices. The higher the value of the stock, the better off the donor is. The authors of study found that “stock prices rise abnormally about 6% during the one-year period before the gift date and they fall abnormally by about 4% during the one year after the gift date, meaning that large shareholders tend to find the perfect day on which to give.”

The noted 2021 academic study added to earlier research on the topic of insiders being unusually timely when gifting shares, including a 2009 paper by David Yermack that looked at Chairman and CEOs specifically.

An Example of Well-Timed Gifts

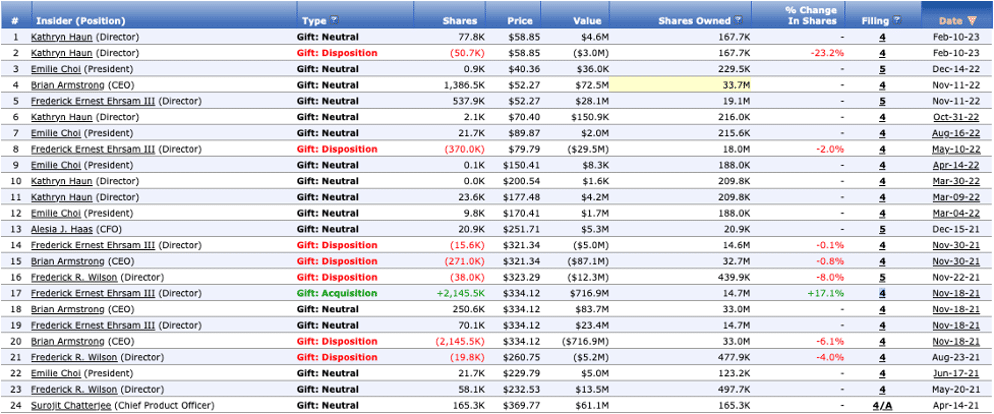

Insiders at Coinbase (COIN), the cryptocurrency exchange platform, have been timely at gifting shares. That includes CEO Brian Armstrong and Director Frederick Wilson, who is a partner at Union Square Ventures.

Coinbase debuted in an April 2021 direct listing in which Armstrong participated in by selling. He gifted shares twice in November ahead of an average return of –77.5% in the following six-month period, well below technology peers. Wilson never sold shares (his firm did sell in the direct listing).

However, Armstrong did dispose of his personal shares by gifting stock in August and November 2021 — ahead of significant underperformance. Below is a snapshot of all gifts at COIN. VerityData separates gifts as dispositions, neutral, and acquisitions. Dispositions are shares disappearing from ownership. Neutral gifts are insiders moving stock from into or out of a trust, for example, where ownership is unchanged.

Getting Granular on the Change in SEC Rule

The December 2022 amendment requires insiders to report bona fide gifts of equity securities on form 5s, rather than the old rule that allowed insiders to report gifts on form 4s. Note that form 4s disclosures are required to be within two business days of a transaction, compared to form 5s which allowed gifts to be reported more than a year after the gift.

In the final ruling, the SEC wrote:

“Because the donor is in a position to benefit from the asset’s value at the time of donation and sale, the donor may be motivated to give at a time when donor is aware of material nonpublic information and may expect the donee to sell prior to the disclosure of such information. Investors cognizant of this dynamic may be more reluctant to trade.”

What It Means for VerityData Clients

VerityData clients can now see gifts alongside buys and sales when looking at companies they care about — as well as histories by specific insiders — to provide better context. You can also find gifts in the market-wide transaction pages so users can see who gave the largest gifts in the past day or week.

VerityData previously didn’t clean and show gifts on the platform due to the long lags that made the information stale.

As of March 24, our data team has processed and cleaned all gift filings data back to April 2021. We will continue to scrub and clean filings for all gifts dating back to 2004.

Bottom Line

It’s unclear how the new SEC changes will impact gifts predicting negative equity returns. The timelier filings, however, will certainly make the disclosure more valuable.

Interested in Taking Advantage of Equity Grant Transactions?

Request access to VerityData >>

Clients: Please reach out to your customer success team.

Outperformance Starts Here

See how Verity accelerates winning investment decisions for the world's leading asset managers.

Request a Demo