-

10-K/10-Qs

-

Proxies

-

Transcripts. Boosted by AI.

-

Press Releases

VerityData | inFilings

The Fastest Way to Find What Matters in SEC Filings

Spot red flags and see the signal sooner — without digging through filings. With VerityData | inFilings, you can quickly generate ideas and monitor SEC disclosures at scale with pristine, structured data. Trusted by 300+ firms.

Take quick action on the most meaningful events across a wide range of disclosures with clean, structured, and exclusive data.

-

*NEW* Incentive Compensation

-

SPACs & IPOs & Lockups

-

Peer Groups

-

Critical Audit Matters

-

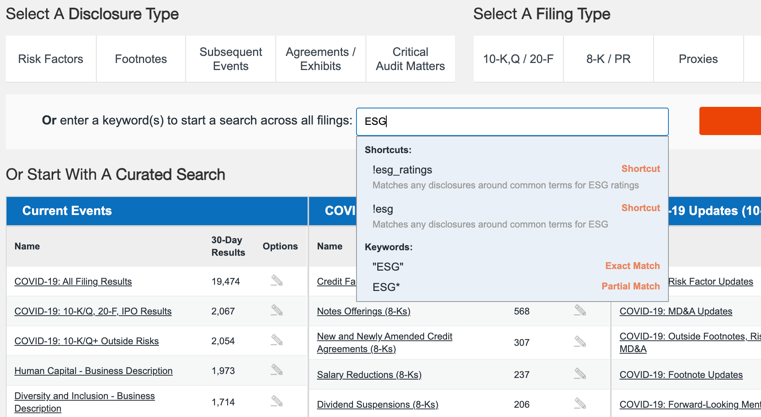

Risk Factors

Frequently Asked Questions

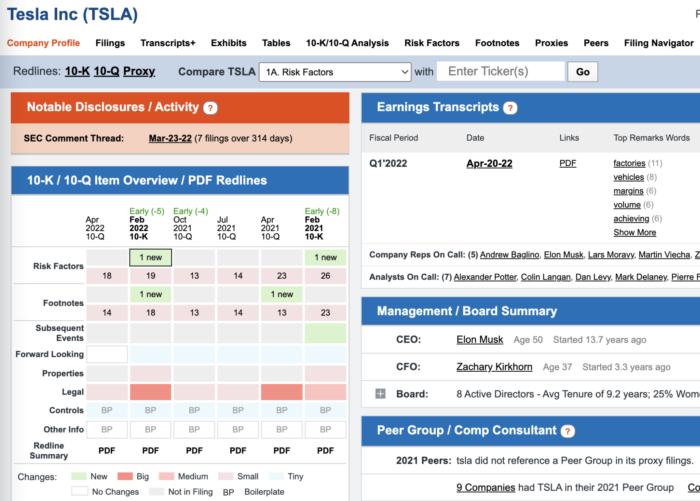

inFilings is VerityData’s tool for analyzing SEC filings at scale. It transforms disclosures into clean, structured data—letting you spot red flags and important developments quickly without manually digging through documents. The platform includes alerts, redlines, and summaries so investment teams can see what changed, why it matters, and where to focus first.

The platform covers a broad set of SEC filings and related disclosures, including:

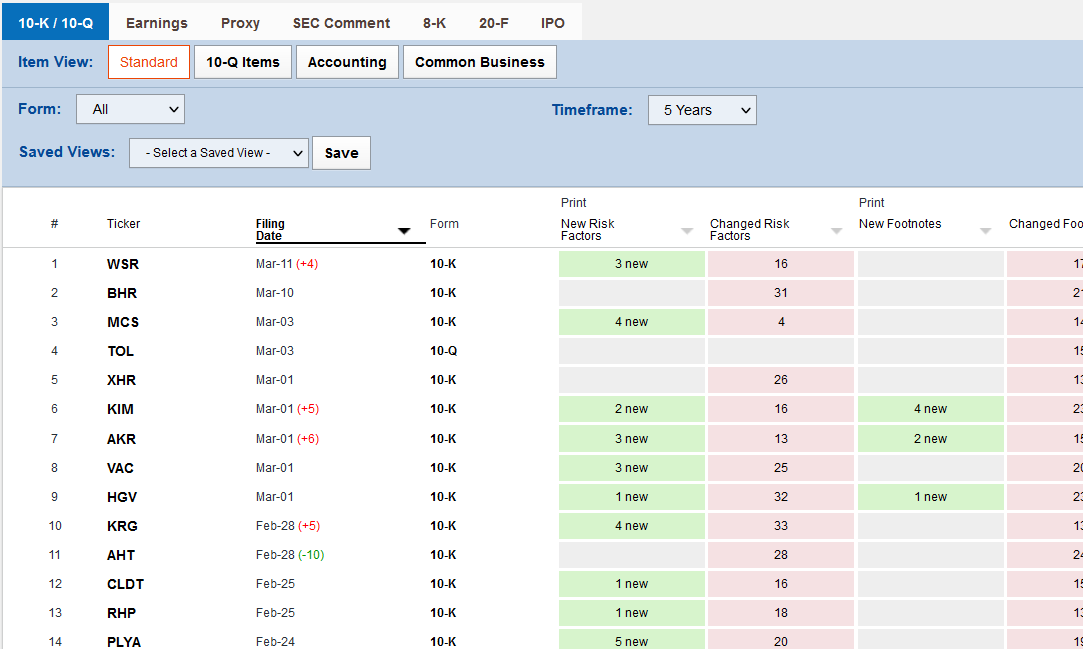

- 10-Ks and 10-Qs

- Proxies

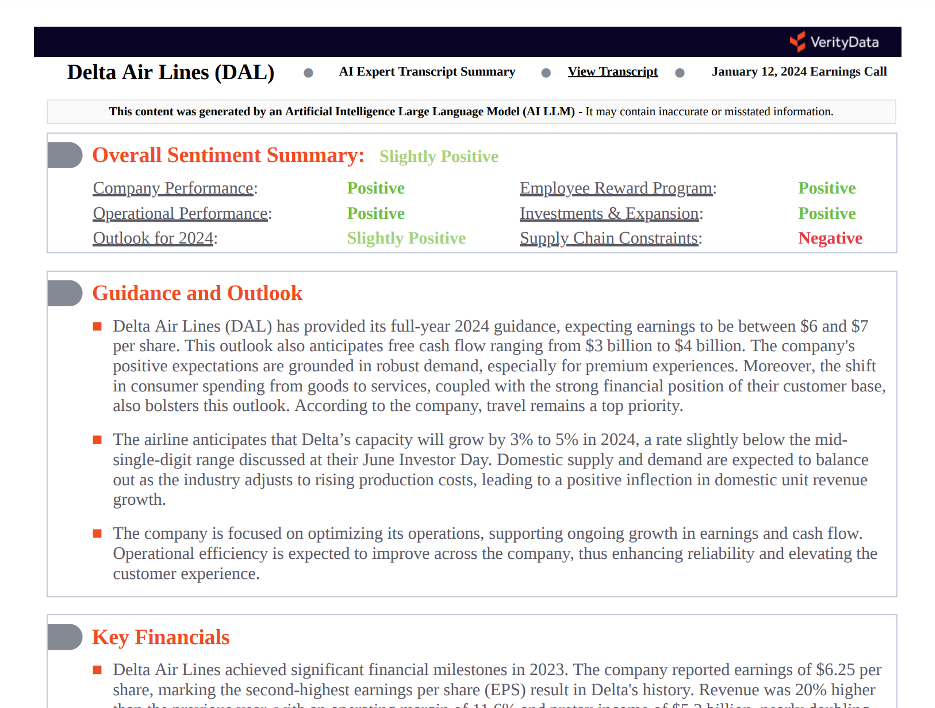

- Transcripts (enhanced with AI summaries)

- SPAC and IPO filings, including lockups

- Incentive compensation and executive pay data

- Peer group changes, risk factors, and critical audit matters.

inFilings turns dense, unstructured disclosures into actionable insights by:

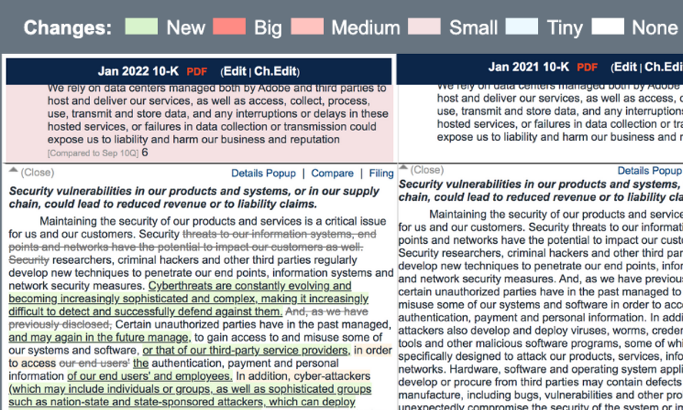

- Running side-by-side redline comparisons across up to five years of filings

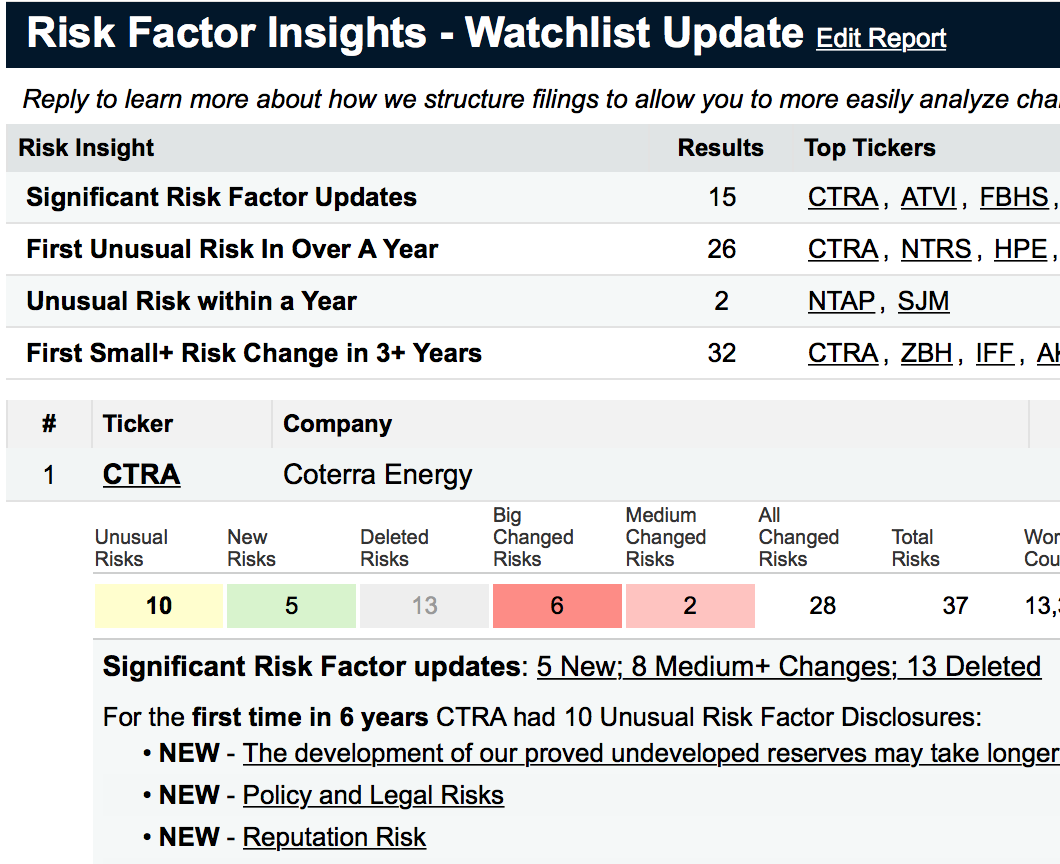

- Offering alerts and visual heatmaps that surface material changes like new legal issues or governance updates

- Delivering AI-powered summaries of earnings transcripts and MD&A sections

- Pulling out and structuring details from proxies and 10-Ks, such as executive incentive compensation plans, peer group changes, and evolving risk factors

Beyond structured and accurate filings, inFilings highlights differentiated data such as executive compensation structures, SPAC/IPO events, lockups, peer benchmark shifts, risk factor changes, and critical audit matters—so you see high-value insights within minutes.

Unlike raw filings on EDGAR, inFilings filters and structures documents, highlights key changes, and layers in analytics like redlines, summaries, and alerts so you don’t waste time sifting through dense disclosures.

Yes. Most firms pair inFilings’ structured textual filing insights with InsiderScore’s signals on insider trading and buybacks to get both disclosure context and corporate insider dynamics in one workflow.

Verity offers a powerful inFilings API delivering high-integrity, structured SEC filings data that fuel NLP, sentiment models, and disclosure comparisons.

100s of firms — including hedge funds, asset managers, and quant teams — use inFilings to streamline their workflows and spot actionable filing signals faster.

Yes. You can request a demo or trial to experience features like alerts, redlines, incentive compensation analysis, and summaries firsthand. Click here to request a demo.

Outperformance Starts Here

See how Verity accelerates winning investment decisions for the world's leading asset managers.

Request a Demo