What to Expect From the 1% Buyback Tax

Will the new 1% buyback tax impact buyback spending? Unlikely. Here's what we expect to see for the remainder of the year.

Among the components of the Inflation Reduction Act of 2022 signed into law on August 16 by President Joe Biden is a 1% excise tax on buybacks. Unwelcomed on Wall Street and by most investors, we don’t believe this “buyback tax” will cause a significant shift in buyback spending across the market. Its impact on corporations and shareholders will be nuanced; companies will find ways to mitigate the issue.

Here’s what we have seen and expect to see for the remainder of the year.

Execs Not Flinching at Buyback Tax

Will management scoff at a 1% tax, when they believe stock is undervalued? We don’t think so. Yes, they will factor the tax into the equation, but it’s just another cost of doing business. Recent executive statements substantiate this view.

‘A Drop in the Ocean’

Alan Haughie, chief financial officer of building-products maker Louisiana-Pacific Corporation (LPX), told analysts on an August 9 earnings call that the buyback excise tax is not impacting management’s capital allocation thinking.

No, not at all. That 1%, I’ll call it, tax is so small compared to the gap we believe exists between our intrinsic value and our current share price as of even right now, not that I’ve looked in the last half hour, that 1% is a drop in the ocean. That’s of no consequence to our capital allocation strategy.

Transcript Source: inFilings

‘Doesn’t Change Our Mind’

Roger Krone, chairman and CEO of defense contractor Leidos Holdings (LDOS), expressed a similar opinion at the Jefferies Industrials Conference.

And we’ve been pretty clear, we expect to be in the market on a regular basis as part of our capital deployment. And I got a question earlier today, a 1% excise tax probably doesn’t change our mind, we are not hyperscalar. We’re in for billions of dollars in buyback. Our ASR, 1% would have cost us what, $5 million on the $500 million. And it’s money we wish we didn’t have to spend but I’d rather pay the 1% then see the corporate rate go up.

So I guess it’s our choice of evils. 1% excise on buybacks is probably better than what we could have seen, because at one time, we were thinking the corporate might go to 28. And so keeping the corporate rate where it is, it works for us. But we’re committed to give back our great cash flow to our owners and our shareholders, and buyback has been and will be a significant part of that deployment strategy.

Transcript Source: inFilings

Companies May Shift to Dividends

We can expect some companies will shift capital allocation from buybacks to dividends. The Urban-Brookings Tax Policy Center recently estimated that the 1% buyback excise tax could result in a 1.5% increase in dividend payments. Note that there is a danger in raising dividends.

Dividends are closely tracked by investors and dividend-related information is required to be disclosed in 8-Ks. Cutting a dividend is a big, negative news event. So, when a company raises its dividends, management needs to be confident that it can sustain the dividend and continue to raise it at the cadence investors expect.

Related Content: 2022 Buyback Report

The Signal Still Lies in Buyback Executions

Whereas dividends are closely watched and easier to read, buybacks are different — and will continue to be. Oddly, the announcement of a buyback authorization generates more news and commentary than the actual execution of buybacks. An authorization is just that — it doesn’t mean a company will execute a buyback or do so within a certain period.

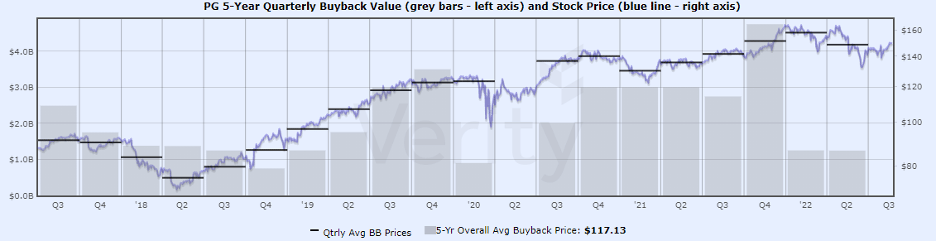

5-Year Buyback History at Procter & Gamble

Companies reduce and increase quarterly buyback spends regularly but these changes often go unnoticed. Consider the case of Procter & Gamble (PG).

Full Size | Source: InsiderScore

Note that the dollar value of buybacks fell in 2018 as the stock suffered but ramped into strength the following year. Like many companies, PG reduced its buyback spend significantly during the first quarters of the COVID-19 Pandemic, then kickstarted buybacks following the stock’s recovery. More recently, the company reduced buybacks during the first half of 2022, even as the stock came in off its all-time high.

Expect Some Lumpiness Throughout 2022

While we don’t believe buyback spending will be impacted by the new tax, there may be some “lumpiness” in the second half of the year as some companies front-load buybacks to beat the tax before it rolls out on January 1, 2023.

Start Seeing Buybacks More Clearly

VerityData | InsiderScore has delivered data and analysis on buybacks — as well as other insider activity — to leading asset managers for nearly two decades.

Outperformance Starts Here

See how Verity accelerates winning investment decisions for the world's leading asset managers.

Request a Demo