The Escalation of ESG Transparency (And What Fund Managers Can Do)

After years of greenwashing and a shock delivered in the context of the Russian invasion of Ukraine, the SEC is set to enforce more truth in advertising around ESG. Head of Solutions Consulting offers starting points.

When Upton Sinclair published The Jungle in 1906, he intended to shed light on the inhumane living and working conditions of industrial workers. The legacy of the book, though, is the public outcry over descriptions of stomach-turning health violations in the late 19th and early 20th century meat industry. These revelations led to the Meat Inspection Act of 1906.

The Jungle and the inspection act that followed account for just one of the landmark cases of regulatory intervention to protect and educate consumers on what’s inside the goods they’re buying. America swiftly agreed people should know what they’re eating.

History proves a shock is often necessary to ignite change. We see this play out again and again in financial sector.

- The stock market crash of 1929 brought the Securities Act of 1933.

- Enron prompted the Sarbanes-Oxley Act of 2002.

- The financial crisis of 2007-2009 yielded the Dodd-Frank Wall Street Reform Act of 2010.

A Shock for ESG Investing

Now, we’re faced with a new shock to the system, Russia’s invasion of Ukraine. This attack has very serious and grave implications at local, national, and international levels. One of the headlines for the crisis, as it relates to the financial sector: a surprising number of ESG funds had exposure to Russia and have suffered significant losses because of it. According to Bloomberg:

Fund managers touting environmental, social and governance standards held at least $8.3 billion in Russian assets right before President Vladimir Putin launched a war on Ukraine. The figure is based on an analysis by Bloomberg of roughly 4,800 ESG funds representing more than $2.3 trillion in total assets. Of those, about 300 were directly exposed to Russia, though the figure may be higher.

Oil and gas companies, fast food chains, and more shut down Russian operations as governments and the public demand harsh economic sanctions. And likely, there’s soon to be growing outcry that many ESG funds in the market had meaningful exposure to Russia leading up to the invasion.

The SEC & ESG Skepticism

In recent years, the question of marketing (supposedly) ESG-friendly funds to the public has been regularly discussed and debated. Not much has been done.

Today, those with intimate knowledge of stock market mechanics understand not all ESG funds are as advertised. Many fund managers are thought to be greenwashing their products sold to the public.

Gensler and the SEC are already on the hunt to better inform consumers of what they’re investing in.

If it’s easy to tell if milk is fat-free by just looking at the nutrition label, it might be time to make it easier to tell if “green” or “sustainable” funds are really what they say they are. pic.twitter.com/RbabGQmUXQ

— Gary Gensler (@GaryGensler) March 1, 2022

As Bloomberg puts it, Gensler “is making it clear he’s skeptical the hundreds of investment funds that tout ESG credentials are as green or socially conscious as advertised.” In response, the SEC is working to implement new disclosure requirements regarding investment adviser vehicles that market ESG benefits, so called impact investing.

In fact, ESG has been made one of the top exam priorities by the SEC. The SEC says that their examinations division will also review whether fund proxy votes are in alignment with its ESG-related disclosures and mandates in addition whether there are misrepresentations of ESG factors.

Starting Points for Fund Managers

After years of little activity, new ESG rules and regulations are coming swiftly and comprehensively. Here are three things that fund managers can do.

1. Start preparing for new disclosure and reporting requirements as well as examination requirements. What are you doing currently, if anything, and how do you bridge that gap? Managers who deploy a strategic, thoughtful approach to ESG investment are more likely to navigate the changes with less disruption.

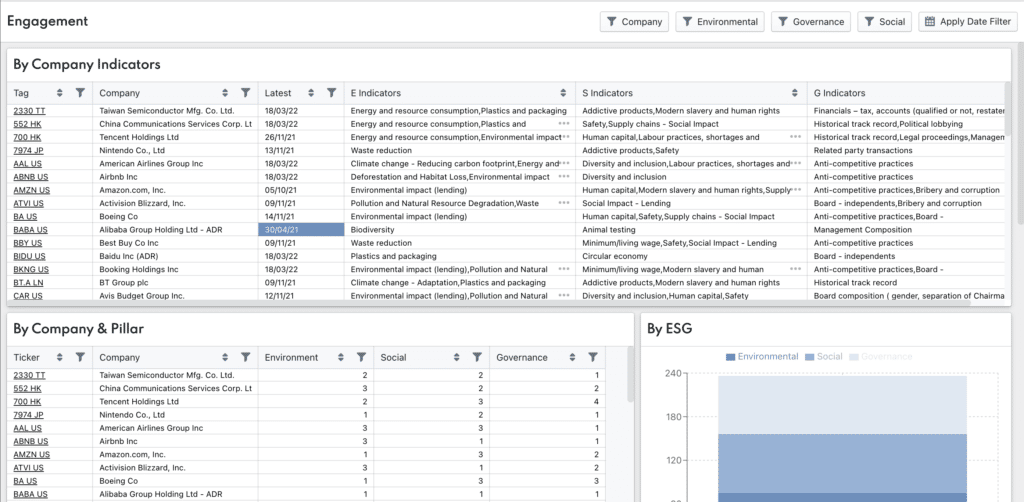

2. Start tracking ESG engagements & analysis. If not already, put in place policies and systems to track ESG-related engagements and analysis. Many funds that we work with use VerityRMS to track engagements using our intuitive, in-app notetaking capabilities and a dedicated dashboard (pictured below).

One of many ways funds use VerityRMS to streamline ESG-related activities.

3. Start thinking about transparency. Demonstrate to institutional LPs, retail investors, and the SEC that your organization takes these risks seriously and has the means to manage them effectively.

Bottom Line

There is appetite and momentum for more truth in ESG investing. Funds can make it easier on themselves by getting ahead of the changes ahead.

Get Ahead of ESG With VerityRMS

Request your custom demo to talk to us about how VerityRMS can be used to improve ESG workflows and much more.

Outperformance Starts Here

See how Verity accelerates winning investment decisions for the world's leading asset managers.

Request a Demo