Is It Time for Fixed Income Investors to Get Onboard With Modern Research Management?

Most research management systems have failed to account for an essential requirement of fundamental credit: issuer hierarchies. Find out how we've solved this problem and more with VerityRMS.

Research management systems have become a front-office staple for equity investors. With information overload, hybrid workplaces, analyst turnover, and evolving compliance directives, an RMS offers research workflow efficiency and investment team productivity.

Unfortunately for fixed income investors, traditional RMS have largely been designed for equity investors, with credit very much an afterthought.

Why has RMS fallen short of demand? Simple. Most RMS take for granted the meaningful nuances between fundamental equity and fundamental credit.

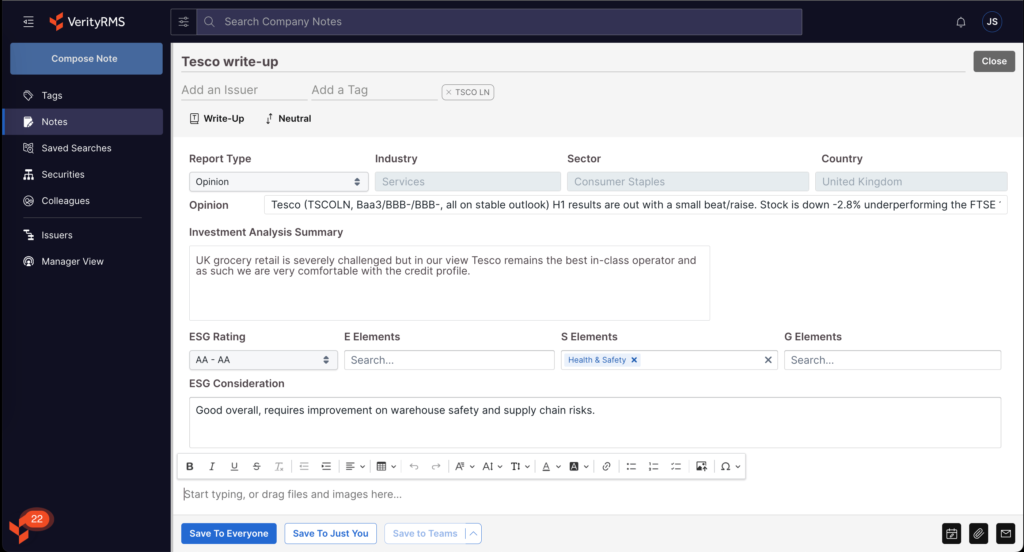

The truth is fundamental credit has unique workflows and requirements like:

- Issuer pipelines

- Corporate hierarchies

- Model integrations

- New issue flow

- ESG considerations

In this blog, I’ll give an overview of how we’ve designed VerityRMS to address challenges unique to fixed income research teams, opening up new possibilities around how they manage research. First, why most research management systems have failed so far: issuer hierarchies.

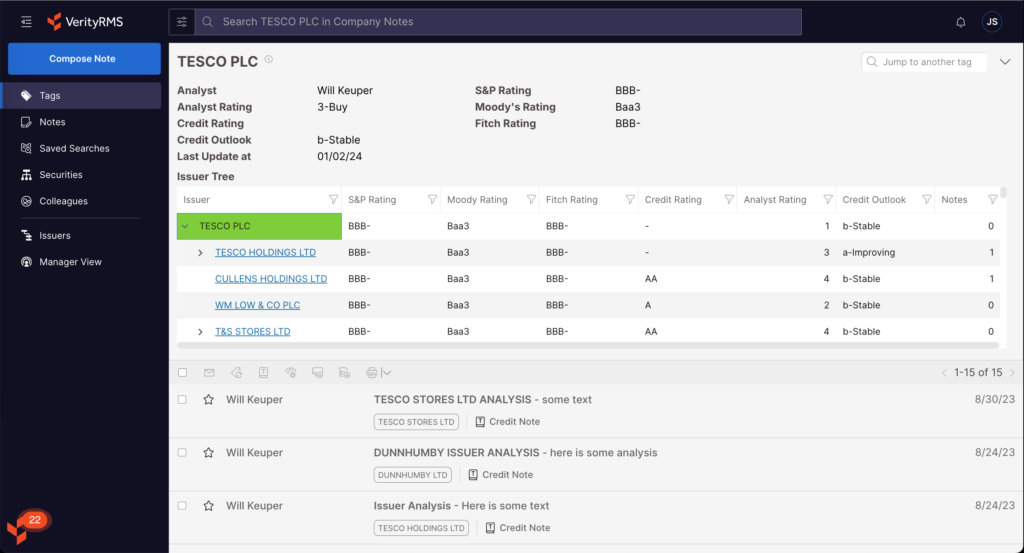

Issuer Hierarchies & The Problem of Granularity

As a credit analyst, you don’t just care about Verizon, or ultimate parents, you care about the entirety of the capital structure. However, most research management systems do not have an appreciation or product support for issuer hierarchies.

Not being able to author, search, and visualize this corporate hierarchy will severely limit a corporate credit analyst — and has been a hugely limiting factor of many RMS to date.

That’s why, at Verity we offer full, out-of-the-box issuer hierarchy support as standard. Whether you want to feed us their data or leverage VerityRMS to bring that data in.

Authoring Research on Issuers

Authoring research and tagging takes mere seconds. All research is organized within issuer hierarchies.

With VerityRMS, credit analysts can quickly author research across the issuer hierarchy for effective collaboration and workflow integrity. Analysts can save substantial amounts of time through notching, which avoids the tedious, error-prone manual labor of updating each rating individually.

Reporting on Issuers

With the granularity available in VerityRMS, fixed income teams can also expedite issuer reporting. Tearsheets (pictured below) automatically collect the latest, most necessary data on any specific issuer. Available third-party data integrations let you pipe in the content you need. But you can also bring in internal research as needed. Once again, everything is customizable.

Monitoring the Pipeline & Portfolio

An RMS brings a lot of efficiency to portfolio monitoring workflows as well. A portfolio manager can get everything they want to see organized onto one or two screens — with one-click access into the latest progress and developments.

The examples below show a few possibilities. One dashboard view gathers various Tesco PLC securities, their prices, maturity, and more. Another shows pipeline progress. Charting capabilities are also available.

Custom dashboards offer at-a-glance monitoring. These are fully configurable to your team’s process.

With VerityRMS, we offer dashboard templates based on best practices but there’s unlimited customization available to make sure your processes stay intact.

Expediting Audits & Compliance

Of course, a firm’s analysts and PMs aren’t the only ones who regularly need information on portfolio holdings. With an RMS, teams can quickly respond to any information requests from internal teams.

“Compliance, legal, and auditing are all things we use our RMS for. The biggest change from before we had an RMS is we now can easily track who audits and changes our documents, which allows that information to be more easily pulled and given to legal, compliance, or audit rather quickly.” – Fixed Income Analyst

What would normally be painful and time-consuming process becomes far less intrusive to analyst workflows.

Bottom Line

I’ve covered here how VerityRMS uniquely solves for issuer hierarchy issues, which opens the door to a very broad list of practical benefits available with a modern RMS: productivity, collaboration, compliance, IP protection, and so on.

With VerityRMS, you get a fully integrated solution for your fixed income team. Beyond issuer hierarchies and in-app workflows, third-party ESG data, portfolio data, model data, etc., can all be easily imported via API, in-app flat file importer, Office add-ins, etc.

Could VerityRMS Add Value to Your Fixed Income Workflows?

Designed by analysts. Built for high-achieving funds. VerityRMS is the research management system that gives analysts, compliance teams, and portfolio managers more of what they need.

Outperformance Starts Here

See how Verity accelerates winning investment decisions for the world's leading asset managers.

Request a Demo